Market Failure occurs when a market does not operate efficiently – in this ‘inefficient’ market, prices do not reflect all publicly available information and could be influenced by several factors, including government regulations or monopolistic practices.

When a market – left to itself – does not allocate resources efficiently, you have a market failure. Most interventionist lawmakers typically allege market failure to justify the reason for their interventions.

Market failure may occur when each consumer makes a correct decision for themselves, but these are found to be the wrong decisions for the group. The term refers to any situation where the individual incentives for rational behavior do not result in rational outcomes for the whole group.

The Oxford Reference Dictionary says the following about the definition of ‘Market Failure’:

“A situation in which a market does not operate efficiently. Factors that may cause market failure include the possession of market power by transactors, externalities, or information problems.”

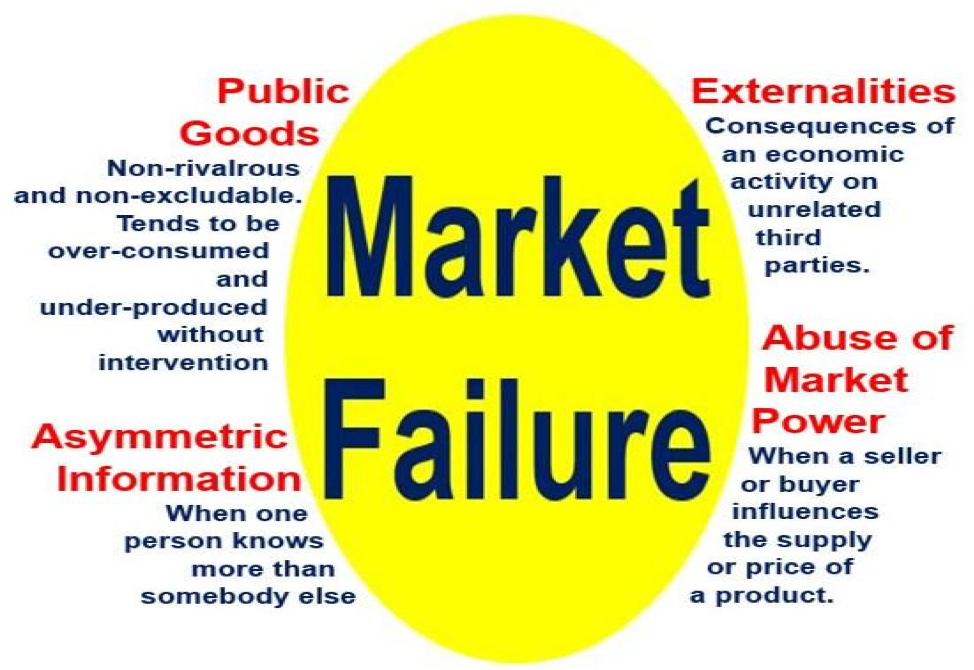

This is demonstrated – in traditional microeconomics – as a steady state of imbalance (disequilibrium) in which supply does not match demand.There are many possible reasons for market failure. The four in this image are the main ones.

Market failure is a situation in which there is another conceivable outcome where an individual could be made better off without making another individual worse off.

It can be viewed as a scenario in which an individual’s pursuit of self-interest results in outcomes that are not efficient – they could be improved upon from the group’s (society’s) point of view.

According to BusinessDictionary.com, market failure is:

“A situation where resources cannot be efficiently allocated due to the breakdown of price mechanism caused by factors such as establishment of monopolies.

Market failure – four main causes

Economists tell us that market failures have four main causes:

– Market Power Abuse: this may happen when a single supplier or buyer is able to exert significant influence over prices or supply.

When just a single seller exists, there is a monopoly. When the market has just one buyer, or a buyer that dominates purchases, there is a monopsony.

According to Facts and Details: “China’s three great rivers – the Yangtze, Pearl and Yellow River – are so filthy that it is dangerous to swim or eat fish caught in them.The Yangtze River is polluted with 40 million tons of industrial and sewage waste. Half of China’s 20,000 petrochemical factories lie on its banks. About 40% of all waste water produced in China – about 25 billion tons – flows into the Yangtze, of which only about 20% is treated beforehand.” (Image: factsanddetails.com)

– Externalities: when the negative impact of an economic activity on outsiders is not taken into account by the market.

For example, a company may be polluting the environment, affecting the health and well-being of a large number of people – and the market ignores the costs this imposes on the outsiders.

– Public Goods: these are things that we all consume, such as clean air, national defense, the judiciary, public parks, etc.. If it were left to the market, national defense would not be fit for purpose.

– Information Asymmetry: sometimes called information failure, occurs when one party has better or more information than another – when one person knows more than somebody else. This can make it difficult for two parties to do business together.

If a lender does not know what the chances are that the borrower will repay, or a used-car salesman or saleswoman knows more about the car’s quality than do potential purchasers, the market does not work efficiently.

Media outlets, for example, due to their political influences or ownership structure, may not properly disseminate certain viewpoints, or might engage in propaganda campaigns.

These types of asymmetries can distort our incentives and result in considerable inefficiencies.

Market failure – addressing the causes

Most countries today have antitrust (anti-monopoly) legislation and government agencies to tackle abuse of power.

Introducing regulations, imposing certain taxes, or paying subsidies can all contribute to reducing externalities. Property rights can force the market to take the welfare of those who are negatively affected by an economic activity into account.

Making sure that the provision of public education or national defense – public goods – is guaranteed can be achieved by funding them directly through the tax system.

Since the advent of the Internet, information has become much more abundant and easy to access. As more people globally have online access, the prevalence of asymmetric information will decline.

The provision and quality of public goods, if left entirely to the market, usually ends as market failure. That is why the government has to intervene – otherwise we would not have adequate national defense and proper infrastructure.

Alex Tabarrok and Tyler Cowen make the following comment in an article – ‘The End of Asymmetric Information’ – published by CATO Unbound:

“Might the age of asymmetric information – for better or worse – be over? Market institutions are rapidly evolving to a situation where very often the buyer and the seller have roughly equal knowledge.”

“Technological developments are giving everyone who wants it access to the very best information when it comes to product quality, worker performance, matches to friends and partners, and the nature of financial transactions, among many other areas.”

Origin of the term ‘Market Failure’

The origins of the concept of the term can be traced back to Adam Smith (1723-1790), a Scottish economist and philosopher, and other economists at that time.

English economist Arthur Pigou (1877-1959), and some other economists in the early 20th century, were the first to formally write about market inefficiencies and the need for government intervention.

The term ‘Market Failure’ started to become widespread in the English language after World War II. Francis Bator’s 1958 article ‘The Anatomy of Market Failure’ is often credited with bringing the term into common usage among economists. Francis Bator (1925-2018) was a Hungarian-American economist and educator.

Video – What is market failure?

This video, from our sister channel on YouTube – Marketing Business Network, explains what ‘Market Failure’ is using simple and easy-to-understand language and examples.