What are mortgage-backed securities?

Mortgage-backed securities, often referred to by their acronym MBS, are bonds that are secured by a mortgage or pools of mortgage loans. This type of security is also known as a ‘mortgage-related security’ or a ‘mortgage pass through’.

In their most basic form, the mortgagor’s (borrower’s) monthly payments are passed on to the bondholder, i.e. the bondholders get payments that include both principal and interest.

This is the main difference between MBS and Treasuries, as well as other types of bonds which pay out interest twice a year and return the full principal at the end of the term (maturity).

MBS allow smaller banks to have more funds so they can lend out more money and expand their business.

MBS allow smaller banks to have more funds so they can lend out more money and expand their business.

How is a mortgage-backed security created?

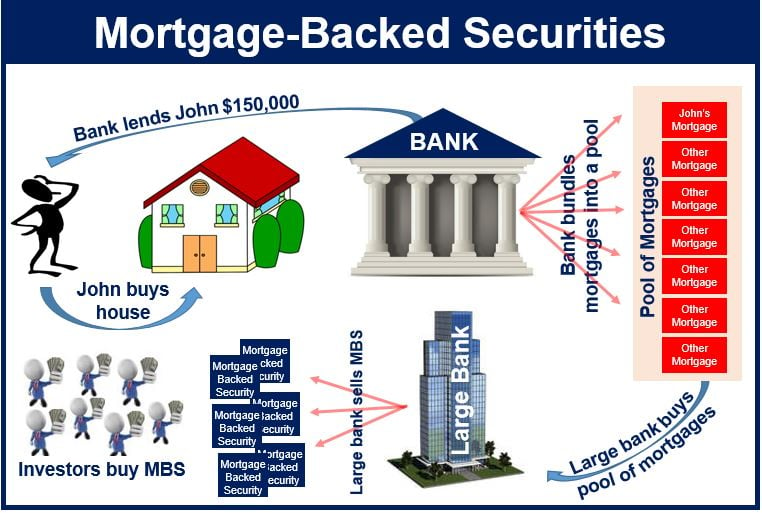

- The mortgagee (lender) awards a loan to a borrower.

- The mortgagee sells the mortgage to a bank, GSE (government-sponsored enterprise) such as Freddie Mac or Fannie Mae, or another financial institution. The mortgage may still be serviced by the lender.

- The lender may also package them together into a ‘pool’ of several mortgages. The pool can vary in size, from very few to thousands of loans. As mortgagors (borrowers) pay their monthly installments, the mortgage pool generates a regular cash flow.

- The financial institution sells claims on that cash flow in the form of bonds. The MBS are then traded on the open market.

- Mortgagor payments, which include interest and principal, pass through the chain, from the original lender all the way to the bondholder.

For this process to occur, the mortgage must have come from an authorized and regulated lender.

When investors buy a mortgage-backed security, they are essentially lending funds to a homebuyer or business.

Smaller banks use MBS to grant home loans to their customers without having to worry about whether the borrower has the assets to cover the loan. The smaller banks acts as mediators between the mortgagor and the investment markets.

The US Securities and Exchange Commission says the following regarding mortgage-backed securities:

“Mortgage-backed securities (MBS) are debt obligations that represent claims to the cash flows from pools of mortgage loans, most commonly on residential property. Mortgage loans are purchased from banks, mortgage companies, and other originators and then assembled into pools by a governmental, quasi-governmental, or private entity. The entity then issues securities that represent claims on the principal and interest payments made by borrowers on the loans in the pool, a process known as securitization.”