What is the neutrality of money? Definition and meaning

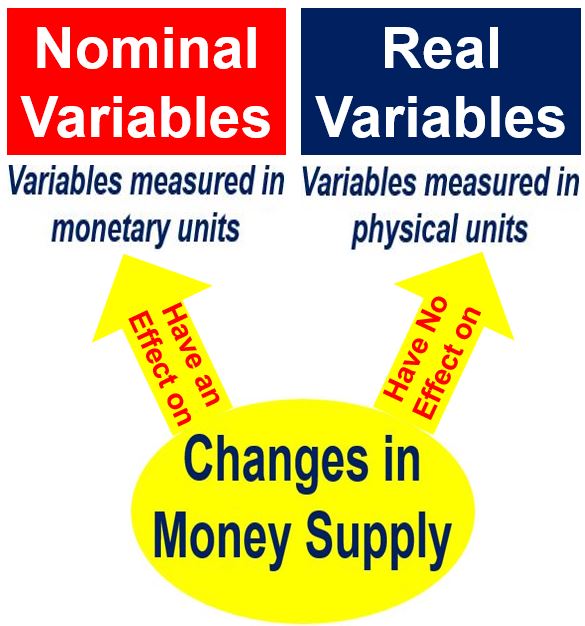

The Neutrality of Money, Monetary Neutrality, or Neutral Money is the idea that any change in the money supply makes no difference to real economic variables.

Real interest rates, employment, real consumption, or GDP (gross domestic product), for example, are real economic variables.

Only nominal variables within the economy, such as wages, prices, and exchange rates alter when the money supply changes.

Monetary policy can influence nominal variables but, according to the neutrality of money, it does not have lasting effects on real variables such as employment or real GDP growth.

If a country’s central bank doubles the money supply, prices will increase by the same amount. In other words, if you double the money supply, each currency unit is worth 50% less.

One cancels out the other

Everything cancels each other out. They all increase equally. Therefore, there is no real economic change.

Price levels might change as a result of increasing the money supply, but not output or the basic structure of the country’s economy.

Neutrality of money – classical economics

The neutrality of money theory is a core belief of classical economics. It was first proposed by David Hume (1711-1776), a Scottish historian, economist, philosopher and essayist, best known today for his highly influential system of radical empiricism, naturalism and skepticism.

Hume set out the classical dichotomy that there are two types of economic variables – nominal and real. He explained that whatever influences nominal variables may not necessarily have an impact on the real variables, i.e. the real economy.

-

Nominal and real variables

Examples of nominal variables in the economy are exchange rates, wages and prices. Examples of real variables are output (GDP), the amount of real investment, and employment.

While Hume thought up the concept of monetary neutrality, the term ‘The Neutrality of Money’ was first used by continental economists at the beginning of the twentieth century.

-

Friedrich Hayek

When Friedrich Hayek (1899-1992), an Austrian-British economist and philosopher, best known for his defense of classical liberalism, introduced the term in 1931, it exploded as a special topic in economic literature, especially those written in the English language.

Monetarism and the neutrality of money

Current economists who support monetarism believe that pure monetary neutrality does not exist in the real world, specifically in the short term.

In the short run, altering the money supply may affect real variables, such as employment.

However, in the long run, after the money circulates throughout the economy, the neutrality of money establishes itself once again. In other words, the real economy does not change, say monetarist economists.

Superneutrality of Money

The Superneutrality of Money, an even stronger property than neutrality of money, holds that not only do changes in the money supply not affect the real economy at all, but also that the rate of money supply growth has absolutely no effect on real variables.

In this case, nominal prices and wages remain proportional to the nominal money supply not only in response to one-off permanent changes in the nominal money supply, but also in response to permanent changes in the rate at which the nominal money supply grows.

‘Helicopter Drop’ story

Milton Friedman (1912-2006), an American economist who was awarded the 1976 Nobel for Economics, gave the example of the ‘helicopter drop’ to explain the neutrality of money.

Imagine a community in perfect economic equilibrium, when suddenly the following occurs:

“Let us suppose, then, that one day a helicopter flies over our hypothetical long-stationary community and drops additional money from the sky equal to the amount already in circulation-say, $2,000 per representative individual who earns $20,000 a year in income.”

”The money will, of course, be hastily collected by members of the community. Let us suppose further that everyone is convinced this event is unique and will never be repeated….”

“…People’s attempts to spend more than they receive will be frustrated, but in the process these attempts will bid up the nominal value of goods and services. The additional pieces of paper do not alter the basic conditions of the community. They make no additional productive capacity available.”

”They alter no tastes….the final equilibrium will be a nominal income of $40,000 per representative individual instead of $20,000, with precisely the same flow of real goods and services as before.”

Economic equilibrium is an economic state in which demand equals supply.

-

Helicopter drop

We use the term helicopter drop when referring to the printing of huge sums of money. The authorities distribute the money to people, hoping that the measure will boost the economy. We also call it helicopter money.

It is largely a metaphor for unusual measures to kick-start the economy. Central banks and governments may adopt such measures during recessions and deflationary periods.

In the 21st century, the term gained popularity again when Ben Bernanke referred to it in a 2002 speech. He had just become a new Fed governor. In fact, some people started calling him ‘Helicopter Ben.’

Video – What is the Neutrality of Money?

This video is from our sister channel on YouTube – Marketing Business Network (MBN). It explains that the “Neutrality of Money” is using straightforward examples and easy-to-understand language.