What is operating ratio? Definition and meaning

Operating ratio has several possible meanings – it usually refers to a company’s operating expenses divided by its operating revenues (net sales). It can also be any type of business or financial ratio that measures a business’ efficiency, including its sales to cost of goods sold ratio, net profit to net worth ratio, and net profit to gross income ratio.

The operating ratio is calculated to determine how efficient a company’s management is by comparing the company’s operating expenses to net sales. A small ratio suggests the business is better able to generate profits if revenues decline.

However, if you are an investor, bear in mind when you use this ratio that it does not take into account debt repayment or expansion.

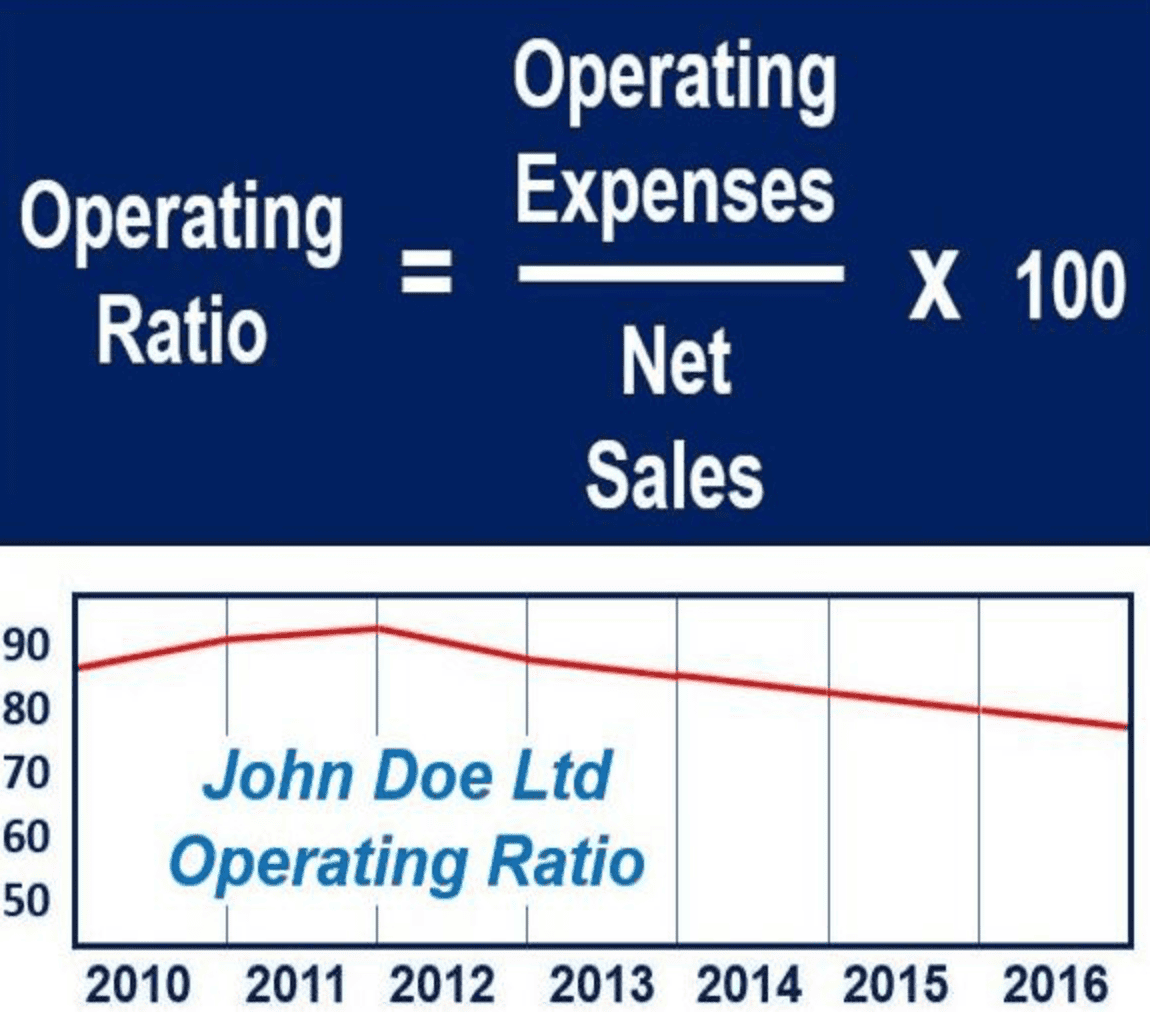

A low operating ratio number is better than a high one – the more efficient a company is (the greater its margin) the lower the number is. In this image, John Doe Limited’s ratio has improved since the beginning of 2012, before which it was deteriorating.

There are several ways to analyze performance trends. For analysts, one of the most popular is operating ratio, because it focuses on core business activities.

Operating ratio measures efficiency

A corporation’s operating ratio is perceived as a measure of its operational efficiency. When measuring a business’ efficient use of managerial resources and capital, it is frequently used together with return on equity and return on assets.

Operating ratio is commonly monitored over a period of several months or years in order to determine whether a business is operating more or less efficiently.

If over time a company’s operating ratio is rising, it suggests that it is gradually operating less efficiently and may need to implement cost controls in order to improve margins – rising operating ratios mean its margins are shrinking.

On the other hand, if its operating ratio is declining – that’s great – it means that operating expenses are contracting as a proportion of sales.

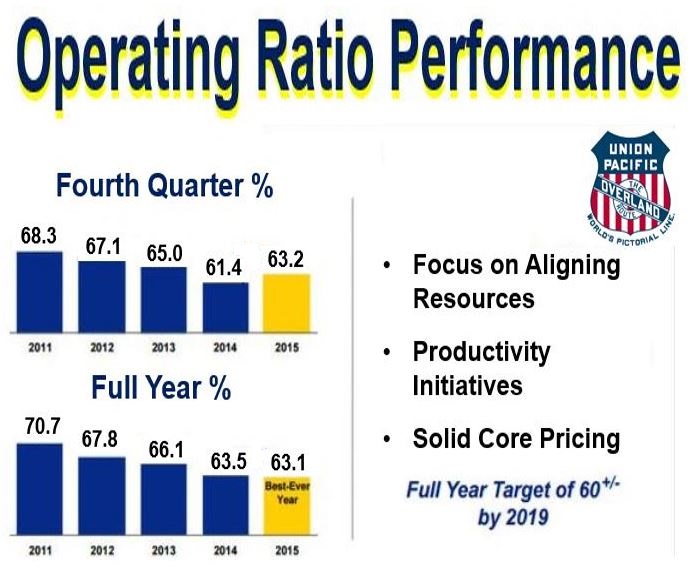

In February 2016, Luke Neely reported in The Motley Fool: “Despite the horrible conditions brought on by the drop in commodity prices, Union Pacific was able to increase its operating ratio to 63.2% for 2015.” Union Pacific is a freight hauling railroad that operates 8,500 locomotives over 32,100 route-miles in the United States. (Image: Motley Fool)

In February 2016, Luke Neely reported in The Motley Fool: “Despite the horrible conditions brought on by the drop in commodity prices, Union Pacific was able to increase its operating ratio to 63.2% for 2015.” Union Pacific is a freight hauling railroad that operates 8,500 locomotives over 32,100 route-miles in the United States. (Image: Motley Fool)

Operating ratio formula

A company’s operating ratio is computed by dividing operating expenses by net sales and expressing the result as a percentage. The calculation is done as follows:

Operating Ratio = (Operating Cost ÷ Net Sales) x 100

The formula’s basic components are operating cost and net sales. Operating cost is the cost of goods sold plus operating expenses. The computation excludes taxes, interest charges, i.e. non-operating expenses.

The example below may help you understand the computation of operating ratio:

Imagine you are analyzing a company called John Doe Limited – below are some of the company’s financial data:

– Net Sales: $300,000

– Cost of Goods Sold: $150,000

– Administrative Expenses: $25,000

– Selling Expenses: $25,000

– Interest Charges: $10,000 (not an operating expense)

You calculate John Doe Limited’s operating ratio with the above data as follows (N.B. interest charges are excluded from the formula because they are not an operating expense):

Operating Cost = (cost of goods sold) 150,000 + (admin expenses) 25,000 + (selling expenses) 25,000 = 200,000.

Operating Ratio = (200,000 ÷ 300,000) x 100 = 66.66%

John Doe Limited’s operating ratio, specifically its operating profit ratio, is 66.66%. In other words, 66.66% of its sales revenue are used to cover the cost of goods sold and operating expenses.

This ratio on its own, without comparing it to other companies in the same industry, or the same company over a period of time, is not that useful.

Imagine you measure the top running speed of an animal at 15 mph. Is that fast? Nobody knows – you need to determine what type of animal it is, how fast other animals of the same species can run, and how fast it has run in the past. If it were a tortoise the speed would be incredible, but if it were a cheetah it would be extremely slow.

A company’s operating ratio should be compared with other companies making the same product or offering the same service, and/or its previous ratios.

According to BusinessDictionary.com, operating ratios are:

“Ratios used in expense control, and in measuring the profitability and financial soundness of a firm, by expressing each income statement item as a percentage of sales revenue.”

“They also show the essential connections between income statement and balance sheet items. Operating ratios include operating cash flow to sales ratio, operating expenses to gross margin ratio, operating expenses to sales ratio, operating performance ratio, and hundreds such others.”

Video – What is Operating Ratio?

This Alternate Learning video explains what operating ratio is, its formula and components.