An Overdraft occurs when a person’s bank account goes below zero, the balance is a negative number – the customer, who is Overdrawn, owes the money to the bank. The negative balance may be accidental, when the customer draws more money than was available in the account, or an Arranged Overdraft, which is a prior agreement with the account provider – usually a bank – with interest charged at an agreed rate.

Even with an agreed overdraft, if the customer exceeds the agreed limit (credit limit), additional fees may be charged and the interest rates may be higher.

Experts remind people that when they go into overdraft they are getting into debt. It should be used for short-term borrowing or emergencies only, they add. However, many customers end up treating their arranged overdraft as their spending limit instead of a last resort.

If a customer wishes to borrow more than his or her overdraft allows, or over a longer period, they might be better off with a different kind of credit.

Know Your Money has the following definition of an overdraft:

“An overdraft is a specified amount of money that a bank customer is allowed to owe his or her bank. In most cases, these arrangements are temporary.”

Fees and interest rates

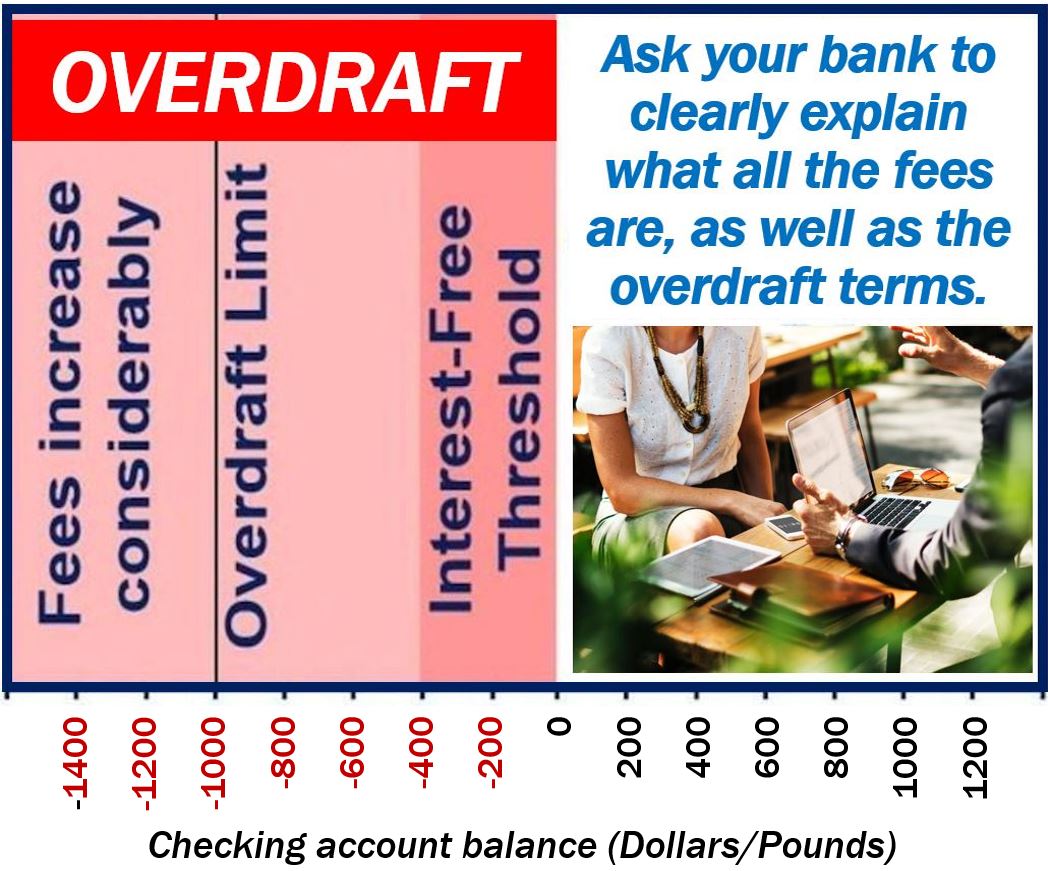

It is vital that customers ask their bank to explain what all the costs of an overdraft are, and to read the lender’s terms and conditions for overdrafts.

Some lenders have complicated rules regarding how much they charge, which even a rocket scientist would find hard to understand fully. It is important that you are clear about the costs of being overdrawn – ask a bank employee to explain the terms to you.

Some banks advertise an ‘interest-free overdraft’ – bear in mind that they nearly always apply to the first part of the overdraft, perhaps the first few hundred dollars or pounds, or overdrafts on just student accounts.

Unauthorized overdrafts

An unauthorized or unplanned overdraft occurs when you exceed your authorized overdraft limit, or have no authorized limit and go into the red.

This should be avoided at all costs, because it can be very costly.

If you have an unauthorized overdraft the bank may charge a monthly fee, a daily fee, and also transaction fees. They all add up to quite a substantial amount.

In order to avoid accumulating extra costs, stay within your overdraft limit. If you think you may exceed it, talk to your lender and either ask for an extension or higher limit. You could save yourself a lot of money.

Overdraft protection

Overdraft protection is an arrangement the customer has with the lender, in which he or she is not penalized with additional charges, checks (UK: cheques) are not bounced or debit cards declined.

In an overdraft protection arrangement, the bank typically links up the customer’s checking and savings accounts – the latter is used as backup money if the checking account slips into negative numbers or beyond the existing overdraft limit.

However, if your savings account does not have enough funds to cover the shortfall in your checking account, the bank will add charges and higher interest rates.

Avoid an eternal debt spiral

If you are not careful you may find yourself falling into the vicious circle of spiraling overdraft fees which push you further into debt, which in turn triggers even more unauthorized overdraft fees…, etc.

According to HelpWithMyBank.gov, part of the US Department of the Treasury, your bank may charge an overdraft fee even while there is a deposit pending. Many transactions are processed overnight, and may not be reflected in an available balance.

HelpWithMyBank writes on its website:

“On checking accounts, banks generally post deposits before withdrawals. However, the law does not require this. In addition, banks may establish a cutoff time for deposits made at a branch or through an ATM. Deposits made after that time may be treated as having been made on the following business day.”

“For example, a deposit made after the Friday afternoon cutoff time would be treated as if it were made on the following Monday. So any items with next-day availability would then be available the next day (Tuesday).”

Many banks have an overdraft interest-free threshold. If you stay within this threshold you will not pay any interest. UK bank NatWest says: “However, if the amount you overdraw under an arranged facility exceeds these thresholds, interest on the overdrawn balance will be added.”

Difference between ‘current balance’ and ‘available balance’

On your online, printed and ATM bank statements you will often see the two terms – current or available balance. They do not mean the same.

Santander Bank makes the following comment:

“The best way to understand the difference is to think of your available balance as the amount of money you have available to spend. This is because sometimes it won’t show money that has been paid into your account until it has cleared, and it will usually show you the money you’ve paid out of your account straightaway, so you don’t spend it twice.”

“It will also include any Arranged Overdraft facility you may have. Your current balance may show money that has been paid into your account before it has cleared and won’t normally show you the money you’ve paid out of your account until it has cleared.”

Etymology (origin) of the term ‘Overdraft’

Etymology is the study of the origin of words and how their meanings evolved over time.

According to www.etymonline.com, the term OVERDRAFT entered the English language in 1841 with the meaning “action of overdrawing an account.” By 1891, it also meant “amount by which a draft exceeds the sum against which it is drawn.”

Video – What is an Overdraft?

Watch this video from Marketing Business Network, our YouTube Channel.