What is overhead?

In business and finance, Overhead refers to all ongoing business expenses. We also call it the ‘operating expense.’ It is an expense that the owner must pay even when the business does not earn any revenue.

We use the term both in its plural and singular forms, i.e., overhead or overheads. The plural form is more common in the United Kingdom and Commonwealth countries. The singular form is popular in North America.

According to the Business Development Bank of Canada:

“Overhead is a general term describing indirect costs — i.e., all costs not directly related to manufacturing a product (cost of goods sold) or acquiring a product for resale (cost of sales).”

We use the term for budgeting purposes. We also use it to find out how much a company should charge for its products. If it does not charge the right amount, it cannot make a profit.

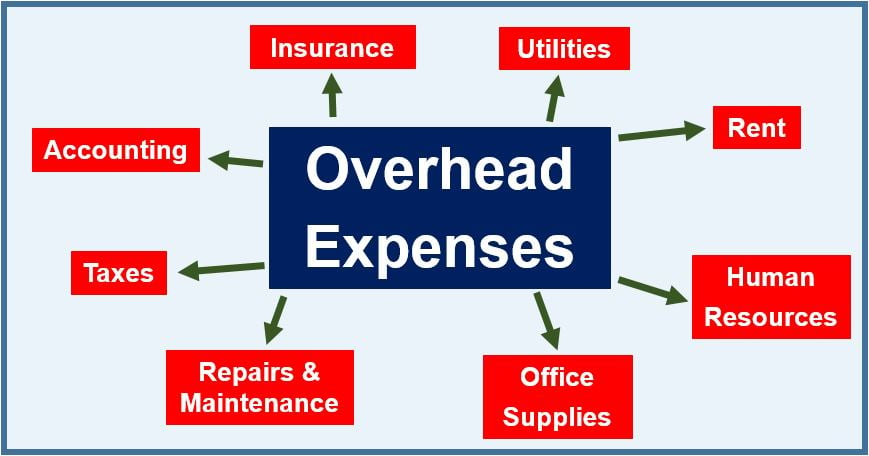

Expenses that form part of the overhead include rent, utilities, travel expenditures, repairs, legal fees, insurance, and advertising fees. We also include telephone bills, electricity, labor burden, and direct materials.

The term refers to all these expenses that keep a business operating.

Manufacturing overhead

Manufacturing overhead represents the costs that support manufacturing. However, they are not linked to specific products or services.

These expenses can either be fixed or variable. In other words, some remain the same on a consistent basis, while others fluctuate.

According to Nasdaq.com has the following definition of the term:

“The expenses of a business that are not attributable directly to the production or sale of goods.”

Fixed overhead costs

These costs remain the same, regardless of the number of units the company produces or sells.

Fixed overhead costs include rental costs, retail sales floor space, etc.

Variable overhead costs

Variable costs are those that do change. In other words, when production rises they go up, and when production falls they subsequently decline too.

Examples include manufacturing machinery electricity, equipment utilities, materials handling wages, and production supplies.

Home business

If you want to set up a company with low overhead costs, a home business is a good option. Startups have a considerably greater chance of success if the entrepreneur begins operating from home.

Bill Gates and Steve Jobs both began with home businesses. In fact, during their first few years, they worked in their garage.

Overhead – vocabulary and concepts

There are many compound nouns that contain the word “overhead.” Let’s take a look at some of them, their meanings, and how we can use them in a sentence:

-

Overhead Allocation

The process of distributing overhead costs across different departments or products.

Example: “The company’s overhead allocation method evenly distributes utilities expenses across all departments.”

-

Overhead Analysis

The examination of overhead costs to assess efficiency and cost-effectiveness.

Example: “An overhead analysis revealed that we could reduce electricity costs by switching to energy-efficient lighting.”

-

Overhead Budget

A financial plan that estimates the overhead costs for a specific period.

Example: “The CFO prepared an overhead budget for the next fiscal year to better manage the company’s expenses.”

-

Overhead Control

The process of monitoring and managing overhead expenses to maintain profitability.

Example: “Effective overhead control has helped the firm remain profitable despite market fluctuations.”

-

Overhead Rate

A measure used to calculate how much overhead to allocate to each unit of production.

Example: “The new project’s overhead rate was calculated to ensure pricing covers all production costs.”

-

Overhead Reduction

The act of decreasing overhead costs to improve profitability.

Example: “The company implemented an overhead reduction plan that included downsizing office space.”

-

Overhead Variance

The difference between the estimated overhead costs and the actual overhead incurred.

Example: “This month’s financial report shows a significant overhead variance due to unexpected legal fees.”

Video – What is Overhead?

In this educational video, presented by our affiliate channel Marketing Business Network on YouTube, we explain what “Overhead” is using straightforward language and easy-to-understand examples.