What is a Portfolio?

In finance, a Portfolio is a spread of investment products held by an individual, hedge fund, corporation, or financial institution.

The value of each asset in a portfolio determines its risk/reward ratio, which we call their asset allocation.

With proper asset allocation, the long-term goal is to maximize expected returns and minimize risk.

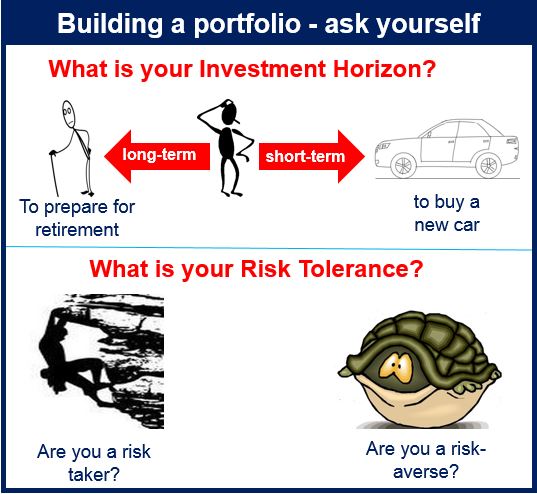

We create our spread of investments according to our levels of risk tolerance. We also take into account our investment objectives and time frames.

People’s portfolios form part of their personal finances.

Managing a portfolio

There are numerous ways of managing investment portfolios. Notable approaches include arbitrage pricing theory, price-weighting, risk parity, and the capital asset pricing model. There’s also the value at risk model, the Jensen Index, equal weighting, and capitalization-weighting.

We calculate returns and performances that portfolios achieve by using quarterly or monthly money-weighted returns.

Another way is by using the true time-weighted method, i.e., it compensates for external flows.

A mix of stock types

All portfolios should have a good spread of investments. When purchasing shares, you should have a mix of defensive stocks and cyclical stocks.

Defensive stocks are those that belong to companies that withstand recessions and economic fluctuations. Utility companies, for example, do well regardless of the economic climate.

In this context, the term ‘economic climate‘ means the same as ‘economic conditions.’

Cyclical shares do well when the economy is booming, but suffer during hard times. Car companies, vacation providers, and producers of luxury goods, for example, issue cyclical shares.

Not all investments spread over a wide area. Mutual funds, for example, have focused funds and diversified funds. Focused funds invest in no more than thirty companies and a maximum of three sectors. They contrast with diversified funds.

Portfolio manager

A person in charge of clients’ portfolios is a portfolio manager. This person works alongside researchers and investment analysts.

To have portfolios with more successful outcomes, individuals may get together and form investment clubs. In these clubs, investors pool their money together before purchasing financial products.

Compound phrases with ‘portfolio’

A compound phrase is a term which consists of two words, such as ‘portfolio manager.’ In the English language, there are many compound phrases containing the word ‘portfolio.’ Let’s have a look at some of them:

-

Portfolio diversification

Spreading investments to reduce risk.

For example: “He focused on ‘portfolio diversification’ to mitigate potential financial losses.”

-

Portfolio rebalancing

Adjusting the proportions of different assets in a portfolio.

For example: “Annual ‘portfolio rebalancing’ helps maintain her desired level of risk.”

-

Portfolio allocation

Distribution of assets across various investment categories.

For example: “His ‘portfolio allocation’ favored technology stocks this quarter.”

-

Portfolio optimization

Strategic configuration for maximum performance.

For example: “They used advanced algorithms for ‘portfolio optimization’.”

-

Portfolio analysis

Examination and evaluation of investment portfolios.

For example: “The firm offered a detailed ‘portfolio analysis’ to their clients.”

-

Portfolio construction

Building an investment portfolio from scratch.

For example: “Careful ‘portfolio construction’ is key to achieving long-term financial goals.”

Other meanings

-

Range of products

The term may also refer to the range of products a company has.

For example, GlaxoSmithKline, the UK’s largest pharmaceutical company, has a wide portfolio of drugs, covering cardiovascular, diabetes, and antibiotics. It also makes and sells painkillers and drugs for rare diseases.

Many different businesses use the word portfolio with this meaning, which could be seen as a synonym of ‘offering.’ For example, Company A is buying Company B to expand its offering, i.e., expand its range of products to sell.

-

Flat bags

Portfolios are also flat bags for carrying documents, i.e., briefcases. The Oxford Living Dictionaries has the following definition:

“A large, thin, flat case for loose sheets of paper such as drawings or maps.”

-

Government minister

A ‘minister without portfolio’ can mean: 1. A government minister with no specific responsibility. 2. A government minister who is not head of any ministry.

-

Collection of sketches or photos

A portfolio can also mean a collection of drawings or photographs, typically bound in book form, or in a folder.

Etymology of portfolio

Etymology is the study of words, specifically where they come from and how their meanings have evolved.

The English word originates from the Italian word portafoglio, which comes from the Latin word portare (to carry).

The Latin word foglio means related to a ‘sheet’ or ‘leaf.’

3 Videos

These three interesting educational videos, from our sister YouTube channel – Marketing Business Network, explain what ‘Portfolio,’ ‘Portfolio Manager,’ and ‘Active Portfolio Strategy’ are using simple, straightforward, and easy-to-understand language and examples..

-

What is a Portfolio?

-

What is a Portfolio Manager?

-

What is an Active Portfolio Strategy?