What is the random walk theory? Definition and meaning

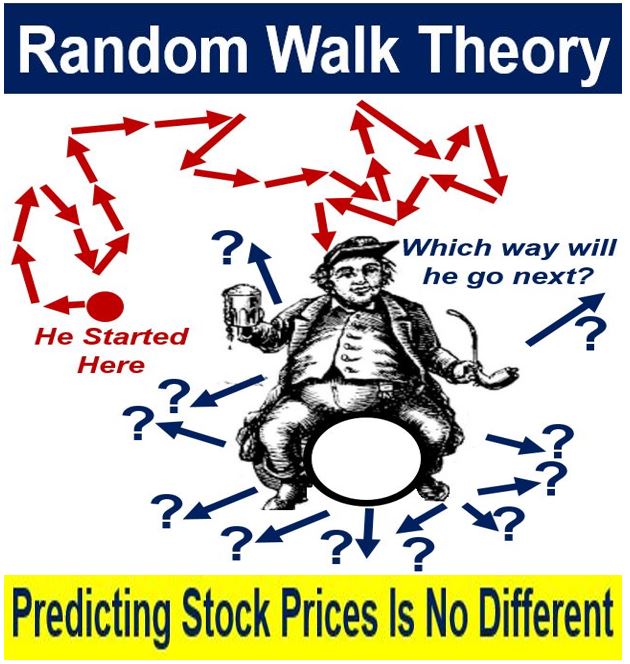

Random walk theory claims that it is impossible to predict which way prices will go in the world of investments. Shares and some other financial assets follow a **random walk. In other words, it is not possible to know whether the next price movement will be up or down, or how steeply that increase or decline might be. We also use the term ‘random walk hypothesis‘ with the same meaning.

** A random walk is a mathematical process that describes a path that consists of a succession of random steps.

Outperforming the market consistently?

According to many economists, this unpredictability means that investors will never be able to outperform the market consistently.

Some economists, however, disagree and claim that asset prices do follow a non-random walk, i.e., they can be predictable. In other words, they insist that it is possible to outperform the markets consistently.

According to the random walk theory, stock price changes have the same distribution and are completely independent of one another.

Therefore, it is not possible to use the past trends to predict where a market will go.

Put simply; random walk theory is the idea that stocks and shares take a random, haphazard, and totally unpredictable path.

According to the Corporate Finance Institute:

“The Random Walk Theory, or the Random Walk Hypothesis, is a mathematical model of the stock market. Proponents of the theory believe that the prices of securities in the stock market evolve according to a random walk.”

Random walk theory – history

The concept of the random walk hypothesis dates back to a book published by Jules Regnault (1834-1894). Regnault was a French stock broker’s assistant. He was one of the first authors who attempted to create a ‘stock exchange science‘ based on probabilistic and statistical analysis.

Louis Bachelier (1870-1946), a French mathematician, included some remarkable insights and commentary in his 1900 Ph.D. dissertation – The Theory of Speculation.

Paul Cootner (1930-1978) developed Bachelier’s ideas in his 1964 book – The Random Character of Stock Market Prices. Crootner was an American financial economist who taught at the MIT Sloan School of Management.

Maurice Kendall (1907-1983) wrote about prices in a 1953 paper – The Analysis of Economic Time Series, Part 1: Prices. Kendall, a British statistician, suggested that share prices moved randomly. In other words, he believed that there was no pattern or trend.

The term ‘random walk hypothesis’ was popularized by Princeton University Economics Professor Burton Malkiel in his 1973 book – A Random Walk Down Wall Street.

Non-random walk theory supporters believe we can make predictions regarding stock prices after observing past trends.

As random as flipping a coin

Prof. Malkiel carried out a test in which his students were given hypothetical stocks worth $50. In the corporate world, the word ‘stocks’ means the same as ‘shares.’

A coin flip determined the closing stock price for each day. Heads meant that the price closed half-a-point up. Tails, on the other hand, meant it closed half-a-point down.

Therefore, there was a 50-50 chance that each day would end higher than the previous day’s close. Prof. Malkiel and his team members tried to determine trends or cycles from the tests.

Prof. Malkiel then went with the results of his tests in a chart and graph form to a chartist. A chartist is somebody who tries to predict future movements. They do this by attempting to interpret past patterns. They assume that history has a tendency to repeat itself.

Malkiel was told by the chartist to buy the stock immediately. As the coin flips were random, the fictitious stock they used in the test had no overall trend.

Prof. Malkiel argued that this indicated that the stocks and the markets could be as random as flipping a coin.

Non-random walk theory

Many investors and economists believe that the market is to some degree predictable. So do several academics.

They believe that prices may follow certain trends. Therefore, by studying previous prices we can predict which way stock values will go, they say.

Some economic studies have had findings that support this view. Andrew Wen-Chuan Lo, the Charles E. and Susan T. Harris Professor of Finance at the MIT Sloan School of Management, and A. Craig MacKinlay, Joseph P. Wargrove Professor of Finance at the Wharton School at the University of Pennsylvania wrote a book – A Non-Random Walk Down Wall Street – that attempts to prove that the random walk theory is wrong.

Princeton University Press wrote the following comment regarding Mackinlay’s and Lo’s book:

“Lo and MacKinlay find that markets are not completely random after all, and that predictable components do exist in recent stock and bond returns.”

“Their book provides a state-of-the-art account of the techniques for detecting predictabilities and evaluating their statistical and economic significance, and offers a tantalizing glimpse into the financial technologies of the future.”

Prof. Martin Weber has carried out several studies to identify trends in stock prices and the stock market. Weber is a leading researcher in behavioral finance, who works at the University of Mannheim in Germany.

In one study, Prof. Weber observed the stock market for a whole decade. Throughout those ten years, he looked at market prices for detectable trends.

Prof. Weber eventually noticed a trend with stocks that experienced a significant price increase in their first five years. They also tended to under-perform during the second-half of the decade.

Prof. Weber and colleagues often cite this observation, especially when they are challenging the random walk theory.

Video What’s Random Walk Theory?

Watch this video on our sister channel, Marketing Business Network, on YouTube.