What is a risk-free rate? Definition and meaning

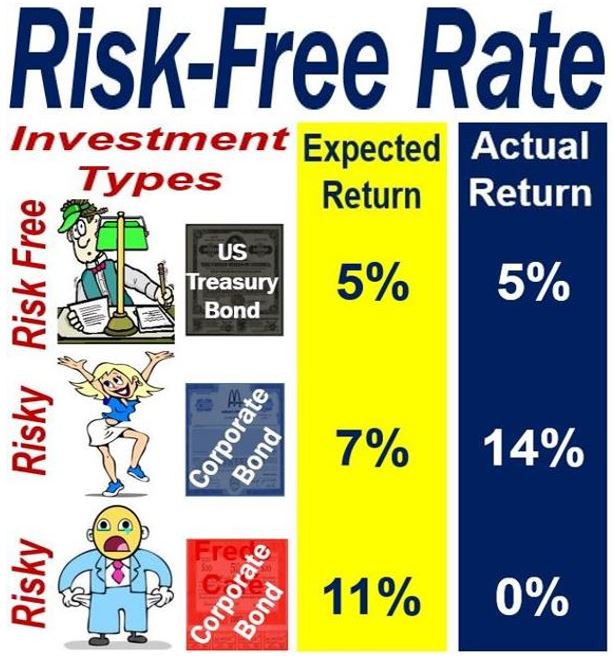

Risk-free rate refers to the yield on top-quality government stocks. It is often called the risk-free interest rate. The risk-free benchmark, for the majority of investors, is the US Treasury yield – other assets are measured against it. When an investment is risk-free, it means that the actual return that an investor obtains equals the expected return.

When investors purchase assets, they have returns that they expect to make over a year, six-months, or other time horizons.

The actual returns they get during that time may not be the same as their expected returns – there is a ‘risk’ that they might not do as well as they expected.

In the world of finance and investments, risk is viewed in terms of how different actual returns are from expected returns. US Treasury bonds’ expected returns are always the same as their actual returns, hence they have a risk-free rate.

A risk-free rate appeals to the risk-averse investor – one who does not like taking risks and prefers guarantees and certainties. A risk-seeking investor is more likely to go for a risky investment, where the outcome is not certain – he or she could either come out of it with a hefty profit or none at all.

A risk-free rate appeals to the risk-averse investor – one who does not like taking risks and prefers guarantees and certainties. A risk-seeking investor is more likely to go for a risky investment, where the outcome is not certain – he or she could either come out of it with a hefty profit or none at all.

Risk-free investments have a guaranteed return

Imagine you have a one-year time horizon and you purchase a one-year Treasury bond with a 4% expected return.

When the one-year holding period is over, the actual return that you will have on this investment will be 4% – with all default-free government one-year bonds, the actual return will never vary from the expected return. They are risk-free investments with a risk-free rate.

Put simply, an investment with a risk-free rate has a guaranteed return.

The Financial Times’ dictionary of terms – ft.com/lexicon – says the following regarding the risk-free rate:

“The risk-free rate, or as it is sometimes known, the risk-free interest rate, is the yield on high quality government bonds. For most investors the US Treasury yield is the risk-free benchmark against which other assets can be measured.”

“Pension funds use the the risk-free rate to to discount their liabilities to present value, so they can compare them with assets and get a funding ratio.”

From 1999 to 2007, the risk-free premium (risk-free interest rate) represented more than half the total value of each bar in the image above. From 2008 to 2011, the equity risk premium represented over half the total value of each bar. The make up of the cost of equity changed in 2008. (Image: aswathdamodaran.blogspot.mx)

From 1999 to 2007, the risk-free premium (risk-free interest rate) represented more than half the total value of each bar in the image above. From 2008 to 2011, the equity risk premium represented over half the total value of each bar. The make up of the cost of equity changed in 2008. (Image: aswathdamodaran.blogspot.mx)

Risk-free rate vs. other rates

When comparing risk-free with other types of investments (risky investments), you will see that they behave differently – their returns do not correlate in the market.

If we all accept that the first definition of a risk-free rate is that the investment has a guaranteed return, and a risky investment does not, this lack of correlation between the two types of investments will always exist.

In an article titled – What is the Risk-free Rate? A Search for the Basic Building Block – Aswath Damodaran, Professor of Finance at the Stern School of Business, New York University, wrote:

“An investment that delivers the same return, no matter what the scenario, should be uncorrelated with risky investments with returns that vary across scenarios.”

How the risk-free rate helps us

Some people may ask: “Why does the risk-free rate matter?” It matters because it is the building block both of capital and the cost of equity.

Since a risk-free interest rate can be obtained with absolutely no risk, all other investments which carry some risk must have a higher rate of return in order to attract investors.

We calculate the cost of equity by adding a risk **premium to the risk-free rate. How big the **premium is depends on how risky the investment is.

** Risk premium is the difference between a risky investment’s expected return and a risk-free one. For example, if a government bond (risk-free) yields 5% per year, while a corporate bond yields 7%, the risk premium is 7 minus 5, which equals 2%.

For example, a blue-chip company’s corporate bond will have a smaller premium than a less established company that has not made good profits for many years.

We estimate the cost of debt by adding a default spread to the risk-free rate – again, how big the spread is depends on the credit risk in the commercial enterprise.

Therefore, when risk-free rates go up, and everything else remains constant, discount rates will increase while present value in a discounted cash flow valuation will shrink.

Regarding whether the risk-free rate matters, Prof. Damodaran added:

“The level of the risk-free rate matters for other reasons as well. As the risk-free rate rises, and the discount rates rise with it, the breakdown of a firm’s value into growth assets and assets in place will also shift.”

“Since growth assets deliver cash flows further into the future, the value of growth assets will decrease more than the value of assets in place, as risk-free rates rise.”

Video – Risk-Free Rate – Definition and Meaning

In this video, Prof. Damodara explains what a risk-free rate is. He uses simple terms and easy-to-understand examples and concepts. He explains that establishing what the risk-free rate is is no easy matter. Government’s across the world have different currencies – some hard and others soft – and credit histories – some with frequent defaults and others not.