What is risk-seeking? Definition and meaning

Risk-Seeking or Risk-Loving describes a person who cannot get enough risk. He or she prefers an investment with an uncertain outcome rather than one with the same expected returns and certainty that they will be delivered.

If you offer either $100 guaranteed or a 50% chance of either $200 or $0, a risk-seeking individual will prefer the $200 or nothing option, even though both options have the same **expected value.

** The ‘expected value’ of something – when you have at least two options – is the sum of what is offered divided by the number of possibilities. For example, if you have a 50% chance of winning either $200 or $0, the expected value is: $200 plus $0 divided by two possibilities, which equals $100.

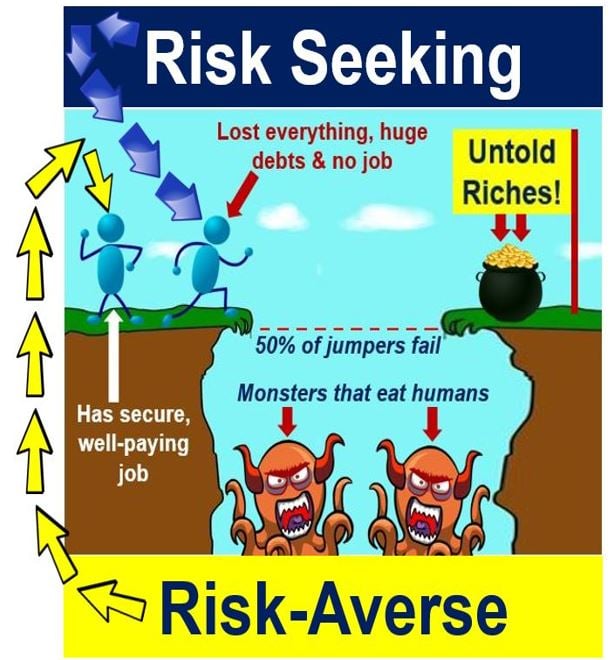

Risk-seeking traits are more commonly found in people who have nothing to lose, compared to those in secure and well-paying jobs – they are more likely to be risk-averse. However, risk-seekers who are financially secure do exist.

Risk-seeking traits are more commonly found in people who have nothing to lose, compared to those in secure and well-paying jobs – they are more likely to be risk-averse. However, risk-seekers who are financially secure do exist.

Risk-seeking, risk-averse & risk-tolerant

The opposite of a risk-seeking person is a risk-averse individual. Risk-averse people prefer certainty – they don’t like betting on uncertain outcomes. Risk-averse people live by the idiom: “A bird in the hand is worth two in the bush.”

A risk-tolerant investor, on the other hand, will seek more of a balance between stability and risk, and will include more fixed income and value stocks in his or her portfolio.

A risk-neutral person is completely insensitive to risk. He or she is only interested in the potential return, and ignores the potential losses or risks completely.

What type of investor are you? Investment experts say that one of the most valuable things we can do is to inventory our personality and get to know ourselves as investors.

Most decisions we make are not random ones – they are driven by a range of factors that make up who we are, what we desire, what we need, how we anticipate things, and what we fear.

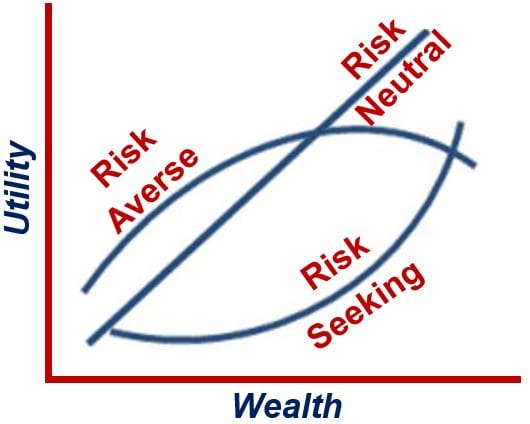

The curvature of the utility function of the 3 investors in this image tells us whether they are risk-seeking, hazard-neutral or risk-averse. The convex-shaped line corresponds to the risk-seeker, the straight line to the risk-neutral individual, and the concave shape to the risk averse investor. (Image: adapted from math.stackexchange.com)

The curvature of the utility function of the 3 investors in this image tells us whether they are risk-seeking, hazard-neutral or risk-averse. The convex-shaped line corresponds to the risk-seeker, the straight line to the risk-neutral individual, and the concave shape to the risk averse investor. (Image: adapted from math.stackexchange.com)

This article has explained what risk-averse, risk-seeking and risk-neutral investors are like. That does not mean there are three distinct categories.

The three categories represent part of a spectrum with infinite points in between. I might be a moderate or extreme risk-seeker, you may be a moderate or extreme risk-averse type of person. Very few individuals are completely risk neutral. However, we all have a tendency towards one of the types described above.

Risk-seeking investments

In the world of investing, risk-seeking individuals typically seek out investments such as international stocks and **small-cap stocks – they prefer growth investments to value investments.

** Small-cap refers to companies with a relatively small market capitalization.

Experts say that the risk seeker needs to carry out even greater due diligence than other types of investors, given that what he or she is about to purchase carries greater risk.

Furthermore, risk-seeking investors often contribute to technological advancement by providing capital to high-risk, high-reward ventures that may lead to breakthroughs in science and industry.

Risk-seeking entrepreneur

The term risk-seeking may also refer to a person who is willing to give up a secure job with a regular salary in order to start his or her own commercial enterprise.

Most self-made business people, at some point in their lives, had to make a choice between security and uncertainty, but with a chance of a greater financial and emotional payoff.

In the realm of entrepreneurship, risk-seeking behavior is often synonymous with innovation, as entrepreneurs must embrace uncertainty to introduce new products or services that can disrupt markets and create new demand.

David Cummings, an entrepreneur who co-founded Pardot, a Saas-based marketing automation application that enables marketers to create and deploy promotion campaigns, wrote the following in his website regarding risk and whether he is risk-seeking:

“When people tell me I must love risk because I’m an entrepreneur I always respond that it feels less risky to me to be an entrepreneur. Why? I have a strong locus of control and want to own my destiny. As an entrepreneur, I’m ultimately responsible if we win or lose. That’s how I like it.”

“The next time someone says ‘that’s so risky’, ask them if there’s an irreversible component to the potential negative outcome. If the outcome is reversible, and has a reasonable chance of success, it’s likely less risky than perceived. If fact, most decisions and the resulting outcomes are reversible.”

A risk-pursuing negotiator

The term is also used in negotiations. A risk-seeking negotiator adopts a high level or approach in the amount of risk that he or she is prepared to accept in a negotiation.

The negotiator who chooses not to accept a ‘sure thing’ and goes for the long gamble, and who expects more may be gained in a negotiation that most other people (in the same situation), is said to be ‘risk-seeking’.

Exploring vocabulary with ‘risk’

There are many terms in the English language that describe people’s attitude towards risk, apart from risk-seeking. Let’s have a look at some of them:

-

Risk Taker

A person who is willing to take risks, especially in business or financial contexts.

For example: “Mark Zuckerberg, a well-known ‘risk taker’, turned a college project into a global social media platform.”

-

Risk Avoider

An individual who tends to steer clear of situations involving risk or uncertainty.

For example: “As a ‘risk avoider’, Jane always opts for the safest investment options.”

-

Risk Adverse

This is an alternative form of ‘risk averse’, referring to a person who dislikes risk.

For example: “Despite the potential for higher returns, ‘risk adverse’ individuals tend to avoid the stock market.”

-

Risk Analyst

A professional who assesses and makes recommendations to mitigate risks.

For example: “The ‘risk analyst’ at the bank has a significant role in deciding loan approvals.”

-

Risk Manager

Someone who identifies, assesses, and prioritizes risks in an organization or project.

For example: “The firm’s ‘risk manager’ developed a comprehensive plan to deal with potential data breaches.”

-

Risk Seeker

This phrase describes a person who actively seeks out high-risk situations or opportunities.

For example: “Elon Musk is often seen as a ‘risk seeker’, pushing the boundaries of technology and space travel.”

-

Risk Lover

Similar to ‘risk seeker’, this term describes someone who enjoys engaging in risky behavior.

For example: “In the world of finance, a ‘risk lover’ might be drawn to volatile trading markets.”

-

Risk Carrier

A person or entity that assumes the financial risk in a venture.

For example: “Insurance companies are essentially ‘risk carriers’ for their policyholders.”

-

Risk Professional

An individual with expertise in risk assessment and management.

For example: “Hiring a ‘risk professional’ helped the company navigate complex compliance regulations.”

-

Risk Entrepreneur

A person who starts ventures with a higher than average chance of failure.

For example: “Many of today’s most successful tech giants were initially considered ‘risk entrepreneurs’.”

Video – What is Risk-Seeking?

This interesting video presentation, from our sister channel in YouTube – Marketing Business Network, explains what ‘Risk-Seeking’ is using simple and easy-to-understand language and examples.