Savings refers to any income that we do not spend and put aside – we put the money away. It is the portion of our disposable income that we do not spend on consumer goods, but accumulate or invest.

According to Keynesian economics, the term refers to the amount of money left over when the cost of an individual’s consumer expenditure is subtracted from his or her total disposable income earned over a specified period. Put simply, total disposable income minus how much of that disposable income is spent.

Savings does not mean the absence of spending – a definition that many people will give you if you ask them what the term means. Instead, it is the result of the intentional act of setting money aside, building it up, usually for a specific purpose or goal.

If savings are invested in different investment vehicles, they can be turned into additional income. For example, if you buy US **Treasury bills, you will earn interest – that is income.

** Treasury bills are short-term promissory notes, with time-to-maturity periods ranging from a few days to 52 weeks.

If you leave your savings lying around, without earning interest, they will gradually lose value. Idle funds get eaten away by inflation. For example, one million dollars in 1918 had the purchasing power of 15.5 million dollars today.

Example of savings

Mary Smith gets a monthly paycheck, paid into her bank account, of $7,000.

Her expenses include:

- – $1,600 rent

- – $100 utilities

- – $700 auto loan payment

- – $500 credit card payment

- – $500 groceries

- – $600 student loan payment

- – $80 for her smartphone

- – $140 for gas (UK: petrol)

- – TOTAL: $4,120

Her disposable income is her monthly paycheck of $7,000 minus $4,120, which equals $2,880.

If Mary puts all her disposable income into savings, she will be better able to confront an emergency compared to Arnold, her work colleague, who lives from paycheck-to-paycheck, i.e. he spends all his disposable income. Arnold has no savings.

What are savings for?

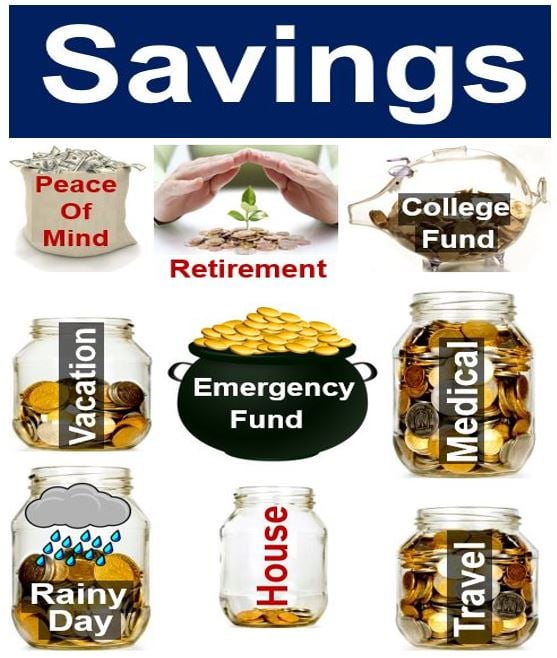

People accumulate savings for many different purposes. Below are some common reasons why people save:

- To have an emergency fund. You never know what might happen in the future. Even if you live in a country with free, universal healthcare, somebody in your family might come down with something for which treatment only exists abroad.

- To have an income when you retire. Most people who prepare for retirement save a percentage of their monthly income for that purpose.

- So that you have funds for home maintenance and repairs.

- To have funds available for future car repairs.

- In order to build up a college fund for your children.

- To have enough money to pay for all your insurance deductibles.

- So that you are ready for your son’s or daughter’s wedding expenses.

- You like the feeling of being that little bit wealthier each month.

- Peace of mind: there is nothing more soul-destroying than lying awake at night wondering how to pay certain bills, cover ever-growing debt repayments, or simply getting by from one day to the next.

- To become financially independent. We all have a different idea of what being rich means. However, we all agree that people with personal wealth have financial independence – they call their own shots, financially speaking. With decent savings, you have the freedom to make choices in your life beyond what your monthly paycheck or a bank loan may allow.

Some advice

In an article in the myMoneyCoach website, the author has the following savings advice:

“Start today by setting aside a little money each pay check until you have an emergency savings fund of $500 to $1,000. If you receive a bonus from work or an income tax refund, use that to get you started or to add to what you’ve already got set aside.”

‘As life happens and you need to dip into your fund, build it back up. It takes a bit of work, but it’s a habit worth getting in to.”

Savings rates vary

How much people save varies considerably depending on their age, income and nationalities. Throughout all the age groups, however, people save more as their incomes rise. When interest rates rise, the supply of savings also increases.

Regarding savings, the Economist’s glossary of terms makes the following comment:

“How much individuals save varies significantly among different age groups and nationalities. Everywhere, people of all ages save more as their income rises.”

“The supply of savings rises when interest rates rise; a rise in interest rates causes demand for funds to invest to fall; a rise in demand for investment funds may cause interest rates, and thus the cost of capital, to rise. The level of savings is also influenced by changes in wealth and by taxation policies.”

Savings can also mean to economize. For example, if you shop around before buying a new television, car, or any expensive item, you can make tremendous savings.

Etymology of ‘saving’ and ‘save’

Etymology is the study of the origin of words. We call a person who specializes in the origin of words an etymologist.

According to the Online Etymology Dictionary, in the English language, the word Savings, the plural of Saving, as the verbal noun from Save (v.), dates back to 1737.

The term Savings Bank first appeared in 1817, Savings Account in 1882, and S&L for Savings and Loan in 1951.

The verb Save, with the meaning ‘reserve for future use’, first appeared in 13th century England. In the 12th century, Save meant to “bring to safety, rescue from peril,” as well as “deliver from sin or its consequences, admit to eternal life”.