What is the shadow banking system? Definition and meaning

The shadow banking system refers to different types of non-regulated financial intermediaries that provide traditional banking-like services. However, they do so outside the traditional system of regulated depository financial institutions.

They are institutions that look like banks, act like banks, but are not mainstream banks.

The shadow banking system consists of securitization vehicles, money market mutual funds, mortgage companies, investment banks, asset-backed commercial paper (ABCP) conduits, hedge funds, monoline insurance firms (that provide guarantees to issuers), and markets for repurchase agreements (repos).

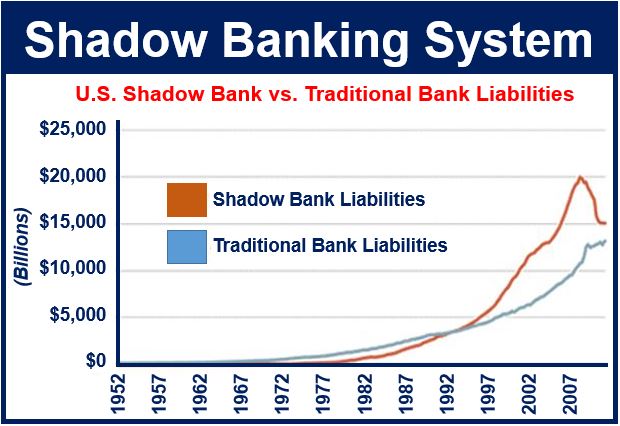

According to these figures, shadow banking liabilities outgrew those of traditional banks. (Source: stlouisfed.org)

According to these figures, shadow banking liabilities outgrew those of traditional banks. (Source: stlouisfed.org)

These non-financial intermediaries grew up complementing the regulated banking system during the property boom from 2001 to 2008, especially in the United Sates. They were moved off balance sheets and distributed to a large number of investors.

Shadow banking system fueled property prices

The shadow banking system propelled the residential mortgage lending boom that pushed up property prices until the middle of 2007, when the sub-prime crisis emerged and the subsequent global financial meltdown of 2007/2008.

Shadow banking components escaped regulation mainly because they did not accept bank deposits. Without close supervision, they were able to take much greater credit and liquidity risks, and did not have capital requirements proportionate to those risks.

Since the global financial crisis, the shadow banking system has come under growing scrutiny by regulatory authorities.

The term was coined by Paul McCulley, an American economist and former managing director at PIMCO, in a speech in 2007 at the annual financial symposium hosted by the Kansas City Federal Reserve Bank in Jackson Hole, Wyoming. He was referring mainly to non-bank financial institutions that engaged in maturity transformation (obtaining short-term funds to invest in longer-term assets).

Shadow banking is huge

According to the International Monetary Fund (IMF):

“Estimating the size of the shadow banking system is particularly difficult because many of its entities do not report to government regulators. The shadow banking system appears to be largest in the United States, but nonbank credit intermediation is present in other countries—and growing.”

Bryan Noeth and Rajdeep Sengupta, of the Federal Reserve Bank of St. Louis, wrote that the size of the shadow banking sector in the US reached nearly $20 trillion in 2007, and shrank to about $15 trillion in 2007, making it “at least as big as, if not bigger than, the traditional banking system.”

Shadow banks are active in many parts of the world. Particularly notable today is the expansion rate in China. Analysts are concerned that many types of shadow banking entities in China – the types of lending going on there outside of mainstream banking – are expanding at a breakneck speed. Some people wonder how this is going to end.

Forty percent of the increase in total debt in China from 2008 to 2014 came from shadow bank lending.

The term ‘shadow banking’ may also refer to the unregulated activities of regulated financial institutions such as credit default swaps.

Video – Five facts about shadow banking

The FT’s financial editor Patrick Jenkins offers five key facts to remember about shadow banking.