What is share capital? Definition and meaning

Share Capital or Issued Share Capital is the proportion of a company’s equity that came from the sale of its shares to the shareholders for cash. If a company sells 10,000 shares at $30 dollars each, its share capital is $300,000.

Share capital can consist of both common and preferred shares.

Share capital may change

A company’s share capital can change. It may decide at some point to issue additional shares.

Issuing new shares can be a strategic move to raise additional funds for company growth and investment without incurring debt.

Share capital only looks at the nominal value of the shares, i.e. how much they were sold for (the amount printed on the share certificates), regardless of how much each share may be worth now.

For example, if a company sold 5,000 shares at $20 dollars each five years ago, and today each share is worth $70, its share capital is 5,000 x $20 (not 5,000 x $70), or $100,000.

Sometimes shares are exchanged for non-cash, as may occur when one company acquires another. In this case the share capital is increased to the par value of the new shares.

Share capital also serves as an important indicator of a company’s financial foundation for investors, reflecting the initial commitment of equity by the shareholders.

Company’s share structure

The term ‘share capital’ is sometimes used to describe the number and types of shares that make up a company’s share structure.

For example, Company A may have an ‘outstanding share capital’ of 500,000 shares, it has received them for a total of $1 million, which in its balance sheet is the ‘share capital’. In that sentence the first usage of the term refers to its ‘share structure’, while the second use refers to ‘the proportion of equity coming from the sale of shares’.

The Collins English Dictionary says the following about share capital:

“A company’s share capital is the money that shareholders invest in order to start or expand the business.”

Example of share capital

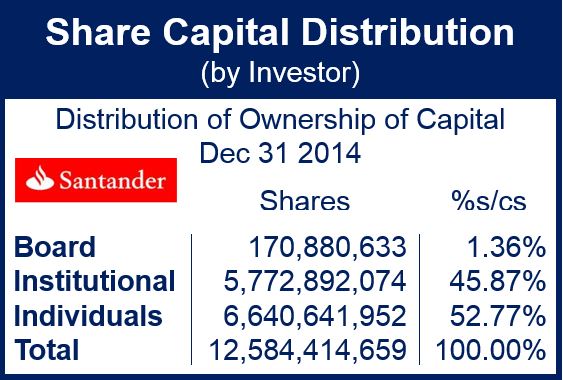

Let’s look at an increase of share capital carried out in February 2015. Banco Santander S.A. announced that the number of shares into which the corporate capital is divided was 14,060,585,886, with a nominal value of 0.50 euros each.

(Source: Banco Santander S.A.)

(Source: Banco Santander S.A.)

According to Santander “All shares incorporate identical political and economic rights. Each ordinary Banco Santander share corresponds to one vote.”

In the business world, the word ‘capital’ (used on its own) refers to money invested in setting up or expanding a business, plus machinery, buildings, vehicles, etc.

Video – What is Share Capital?

This video, from our YouTube partner channel – Marketing Business Network, explains what ‘Share Capital’ means using simple and easy-to-understand language and examples.