What is the stock market? Definition and meaning

The stock market or equity market is where buyers and sellers trade equity (stocks, shares) either through a stock exchange or over the counter. Investors trade listed shares through a stock exchange and unlisted shares over the counter (privately). You can also learn more here at https://www.thestockdork.

Dark pools – trades that occur in the dark, i.e., away from the public eye – also form part of the stock market. Experts say dark pools make up about one-eighth of America’s total trading of stocks.

Stock exchange vs. stock market. A stock exchange is the physical facility where investors trade shares. The New York Stock Exchange and the London Stock Exchange, for example, are stock exchanges.

The stock market is a general term that refers to a loose network of economic transactions. It has an abstract meaning, i.e., the mechanism for buying and selling shares.

It is like the difference between the oil market and a gas station (UK: petrol station). One is a general term for a specific market. The other term, on the other hand, refers to a physical place.

Almost 24% of world’s financial asset value is wrapped up in stocks. (Data Source: marketwatch.com)

Almost 24% of world’s financial asset value is wrapped up in stocks. (Data Source: marketwatch.com)

In the media, writers common use the terms ‘stock market’ and ‘stock exchange’ interchangeably.

The FT Lexicon defines stock market as:

“Organised stock trading either through a stock exchange or over the counter.”

Categorizing shares

In the stock market, we categorize shares several different ways. One common way is according to where a company’s headquarters are.

For example, GlaxoSmithKline and HSBC have their headquarters in the UK. Therefore, we consider them as part of the London Stock Exchange.

However, we can also trade their shares at exchanges across the world.

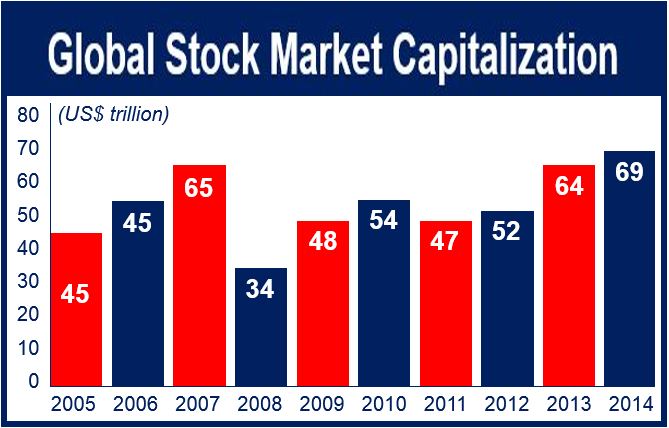

At the end of 2014, the size of the global stock market (total market capitalization) was approximately $69 trillion, according to MarketWatch.

The largest market in the world is in the United States (34% of world total), followed by Japan (approx. 6%), and then the UK (approx. 6%).

Stock markets emerged soon after first stocks

The first joint-stock company (as we know it today) was the Dutch East India Co. It issued the first paper shares, which traders could conveniently buy, sell and trade with other shareholders and investors.

A joint-stock company is one that belongs to its shareholders. However, joint-stock companies in the US and UK are not the same.

The buying and selling of shares began to grow rapidly, especially as trade with the New World increased.

The expansion of what was effectively a nascent stock market increased the need for a properly-organized marketplace to exchange these shares.

Stock traders started meeting at a London coffeehouse, which at the time was a marketplace. Stock traders took over the coffeehouse. In 1773, they called it the ‘Stock Exchange.’ They founded the London Stock Exchange. It was the world’s first.

In 1790, the first stock exchange in the New World opened in Philadelphia.

The term ‘stock market’ may also refer to the value of shares investors are trading in a geographical area. For example, look at this phrase: “The Japanese stock market declined sharply this morning.”

Market jitters

Bad news, such as rising inflation, lower GDP growth, or political instability can make investors nervous.

When investors are nervous or apprehensive, they tend to sell stocks and bonds. This pushes down prices.

We refer to a general feeling of fear and apprehension among investors and traders ‘market jitters.’

Today, with rapid communications and everybody having online access to data, market jitters rapidly spreads beyond borders.

An Active Market – this is a market with many buyers and traders. Trading volume is heavy and liquidity is high. Share prices in an active market do not fluctuate wildly when massive transactions occur.