What are supply-side policies? Definition and meaning

Supply-side policies are government economic policies aimed at making industries and markets operate better and more efficiently so that they contribute to greater underlying rate of GDP (gross domestic product) growth. Lawmakers who pursue supply-side policies believe in supply-side economics. Any policy that improves a country’s economy’s productive potential and its ability to produce, is within the umbrella of supply-side policies.

During the 1980s, US President Ronald Reagan and British Prime Minister Margaret Thatcher were great believers in supply-side policies, as opposed to Keynesian policies, which boosted demand. Reagan and Thatcher insisted that real wealth was created by finding ways to boost supply, unlike Keynes’ policies which pushed up inflation.

People who support supply-side policies say that economic growth is more effective when there is more investment in capital, and when barriers on the production of goods and services are lowered.

The concept of supply-side economics was promoted strongly by Robert Mundell, a Nobel-Prize winning Canadian economist, during the Reagan administration.

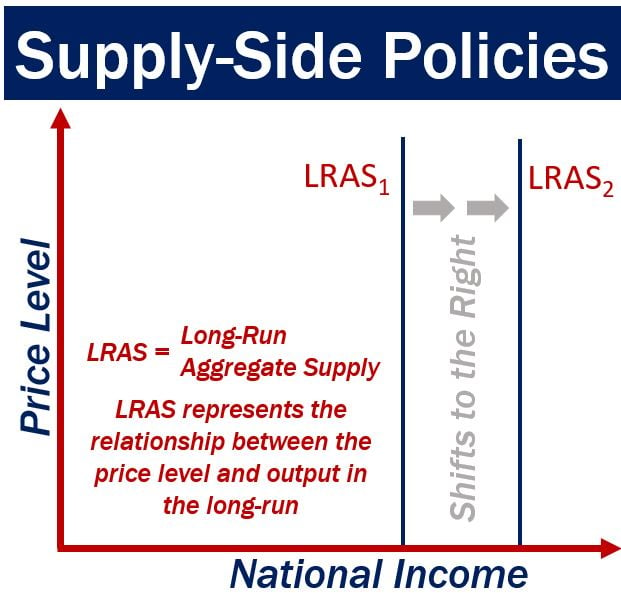

Revision Guru says: “Supply side policies are those policies that aim to shift the long run aggregate supply curve to the right. The policies will also shift the short run aggregate supply curve; however this won’t affect the level of long-term growth within an economy.”

Revision Guru says: “Supply side policies are those policies that aim to shift the long run aggregate supply curve to the right. The policies will also shift the short run aggregate supply curve; however this won’t affect the level of long-term growth within an economy.”

According to Mundell, with supply-side policies, consumers benefit from a greater supply of products and services at lower prices. The investment and growth of businesses will also increase the demand for workers, and therefore create jobs.

Typically, the policies pursued include lowering marginal tax rates and reducing government regulation.

Regarding supply-side policies, the Intelligent Economist writes:

“In economics, supply-side policies are policies aimed at increasing aggregate supply, a shift from left to right. Successful policies lower the natural rate of unemployment. They enhance the productive capacities of an economy while improving the quality and quantity of the four **factors of production. However, supply side policies are difficult to implement and take time to take effect.”

** The factors of production are an economy’s building blocks; the inputs that are used to produce goods and services in order to make an economic profit – they include land, labor, capital and entrepreneurship (enterprise).

The best-known supply-side policies implemented in the 20th century were those of US President Ronald Reagan and British Prime Minister Margaret Thatcher.

The best-known supply-side policies implemented in the 20th century were those of US President Ronald Reagan and British Prime Minister Margaret Thatcher.

Supply-side policies- examples

Policies focus on three factors of production:

– Labor Market: this is freed up by lowering wages. Policymakers say this makes a lower paid job more attractive. In order to lower wages, parliament needs to abolish minimum wage legislation, reduce unemployment benefits, decentralize trade union power, bring down income tax rates, and make it easier for companies to hire and fire workers.

In practice, however, implementing some of these policies could be political suicide for any government that is in power – they are extremely unpopular.

– Capital Markets: savings need to be made more attractive, competition between banks must increase, and governments should make more funds available for banks to use for investment.

– Entrepreneurship: this can be enhanced by encouraging share ownership among company workers, and lowering marginal tax rates.

Supply-side policies also focus on:

– Competition and Efficiency: monopolies must be removed, state-owned companies privatized, trade needs to be freed up, and the government has to implement inward investment policies.

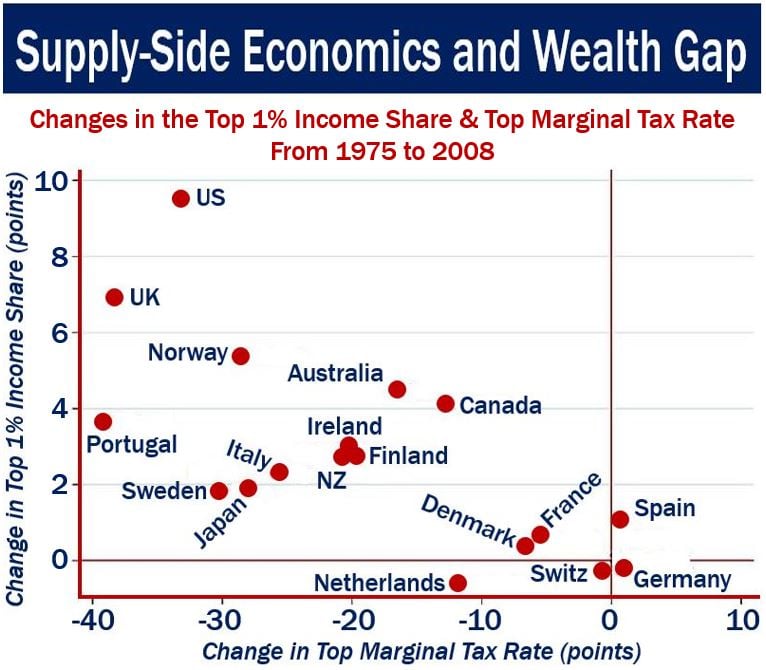

Many economists say that a downside to supply-side economics is that it benefits high-income people at the expense of (or considerably more than) lower earners. This graph shows the change in the top one percent share against the change in the top income tax rate in the OECD countries over 33 years. There is a strong correlation between income inequality and declining top tax rates. (Image: Adapted from Wikipedia)

Many economists say that a downside to supply-side economics is that it benefits high-income people at the expense of (or considerably more than) lower earners. This graph shows the change in the top one percent share against the change in the top income tax rate in the OECD countries over 33 years. There is a strong correlation between income inequality and declining top tax rates. (Image: Adapted from Wikipedia)

– Education labor productivity improves if the workforce is better educated and trained.

In theory, if supply-side policies are carried out properly and successfully, there is a positive effect on the country’s balance of payments. If the productive capacity in an economy increases, the resulting lower prices will boost the competitiveness of the nation’s exports, which should in turn lead to an improvement in the country’s current account position.

Supply-side policies may have an adverse impact on income and wealth distribution, resulting in a wider wealth gap – the difference between the wealthiest and poorest people in a country gets larger.

In their quest for sustainable economic growth, most governments today use a combination of supply-side and demand-side economic policies

Video – Supply-side policies

In this video, the speaker talks about what supply-side policies are, and how they affect the economy.