What is the time value of money? Definition and examples

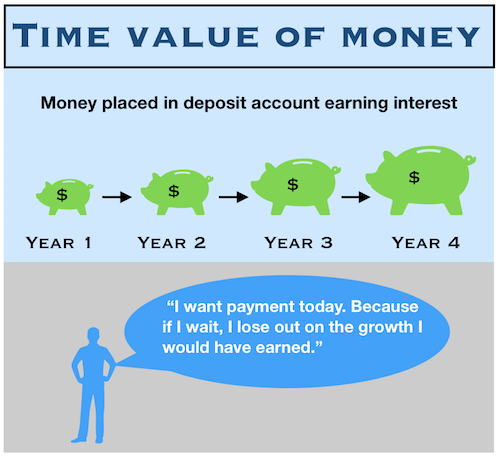

The Time Value of Money (TVM), also known as Present Discounted Value, refers to the notion that money available now is worth more than the same amount in the future, because of its ability to grow.

The term is similar to the concept of ‘time is money’, in the sense of the money itself, rather than one’s own time that is invested. As long as money can earn interest (which it can), it is worth more the sooner you get it.

This principle underpins many financial decisions, from personal savings to corporate investments, emphasizing the potential gains from immediate monetary utilization.

We all know that if we deposit money in a savings account, it will earn interest. That is why we prefer receiving money now than the same amount at a future date.

The Time Value of Money is important in financial management. TVM can be used to compare different investment options and to solve problems involving mortgages, leases, loans, savings, and annuities.

Example of Time Value of Money

Imagine you lent a friend $1,000 and he paid you back today. You immediately deposit that money into an account that earns 7% annually. It will be worth $1,070 in exactly one year’s time.

If, on the other hand, you received the $1,000 in one year’s time, it would only be worth $934.58 ($1,000 ÷ 1.07), assuming a 7% annual interest rate.

If you asked people whether they would prefer to receive $1,000 now or that amount in one year’s time, they would probably all say they wanted it now, for several reasons:

- They want to be sure they get the money. Waiting a year increases the risk of not getting the money.

- They may want to go out shopping or go on vacation soon, and that money would be useful.

- If they invested that money today in a deposit account, the $1,000 would be worth more in one year’s time. They are aware of the Time Value of Money.

A key concept of TVM is that a series of equally, evenly-spaced instalment payments or a single lump sum, or receipts of future pledged payments can be converted to an equivalent value now.

One may also determine the whole thing the other way round, the value to which one single sum or a series of future payments will have appreciated at a future date.

Conversely, understanding TVM is crucial for retirement planning, allowing individuals to estimate the future value of their current savings.

“Time value of money” in context

Here are several sentences that illustrate how the concept of “time value of money” is applied in various scenarios:

- “Understanding the time value of money is essential when deciding whether to take a lump sum from a lottery win or opt for annual payments.”

- “Financial advisors often stress the time value of money when advising clients on the benefits of starting their retirement savings early.”

- “The time value of money concept helps investors evaluate the potential returns on investment properties versus putting money into a savings account.”

- “In our accounting class, we used the time value of money to calculate the current worth of future cash flows from a proposed business project.”

- “When considering a new job offer, it’s important to factor in the time value of money if the salary includes deferred bonuses or stock options.”

- “The time value of money plays a crucial role in the realm of bonds and stocks, as it affects discount rates and investment risk assessments.”

- “Companies often use the time value of money to determine whether the long-term benefits of expensive new technology will outweigh the immediate costs.”

Video – What is Time Value of Money?

This video presentation, from our sister channel on YouTube – Marketing Business Network, explains what the meaning of ‘Time Value of Money’ is using simple and easy-to-understand language and examples.