What are toxic assets? Definition and meaning

Toxic assets are financial assets that are now worth considerably less than they used to be, will likely continue falling in value, and for which the market has frozen, i.e. there is no longer a functioning market for them.

The holder of a toxic asset finds that it is no longer possible to sell it at a satisfactory price.

Toxic assets featured as major problems among many banks and financial institutions during the 2007/8 global financial crisis, including securitizations of subprime mortgages where the creators of the securities did not take into account the true rate of mortgage default, and how contagious this would become across securities.

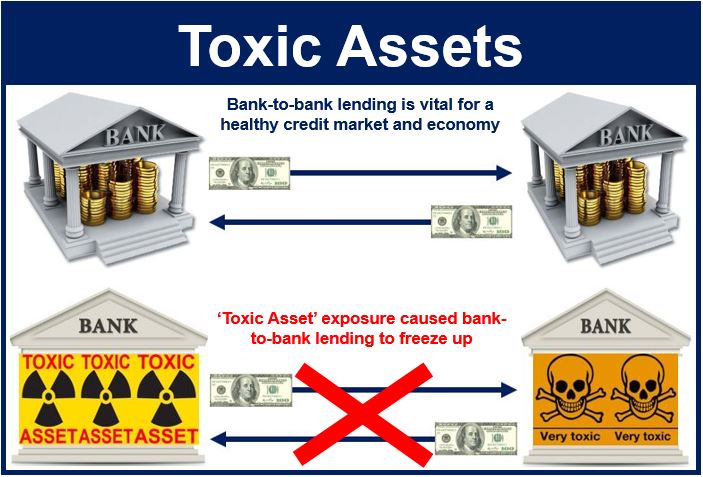

Markets for several toxic assets froze during the last financial crisis. The problem started in 2007 and gradually got worse, so that by mid-2008 the world was facing a devastating financial meltdown.

Toxic assets pushed the global economy to the edge of an abyss 2008.

Toxic assets pushed the global economy to the edge of an abyss 2008.

Assets with a AAA rating were suddenly no better than junks bonds – within a matter of months their value plummeted.

The term is believed to have been coined in 2006 by Countrywide Financial’s founder Angelo Mozilo, who wrote in SEC filings “[The 100% loan-to-value subprime loan is] the most dangerous product in existence and there can be nothing more toxic…”

Holders fear selling toxic assets

The freezing of toxic asset markets occurred because of several factors. The assets’ values were extremely sensitive to economic conditions, and growing uncertainty and pessimism in these conditions made it hard to estimate their value.

Financial institutions did not want to sell the assets at super knock-down prices – if they did, they would be forced to considerably reduce their stated assets, which would make them (on paper) insolvent.

Example of a toxic asset

Imagine Fred Smith purchases a house with a $500,000 mortgage loan through XYZ Bank, which charges a 5% interest rate. XYZ now has a mortgage-backed security – this is an asset.

ABC Bank buys the asset from XYZ and receives the 5% interest paid by Mr. Smith. As long as Mr. Smith keeps up with his installments, it is a good asset.

If Mr. Smith defaults on the loan, the owner of the mortgage-backed security (ABC Bank) will stop receiving the payments. The bank will take possession of the house and sell it. However, if house prices have declined, it will only recover a fraction of the money.

Nobody is going to want to buy that asset, because it is a money-looser. It has become a toxic asset.

The Nasdaq Business Glossary says the following about toxic assets:

“In the context of the 2007-2009 recession, the term refers to assets like mortgage backed securities and collateralized debt obligations that are illiquid and difficult to value. If the value of the underlying assets falls significantly, these securities could lose value rapidly (aggravated by the lack of liquidity and transparency in price) which could lead to significant write-downs (and hence losses) for holders of these toxic assets.”