Trough – definition and meaning

A trough, in economics, is the point in the business cycle between the end of a recession and the transition to accelerating GDP (gross domestic product) growth.

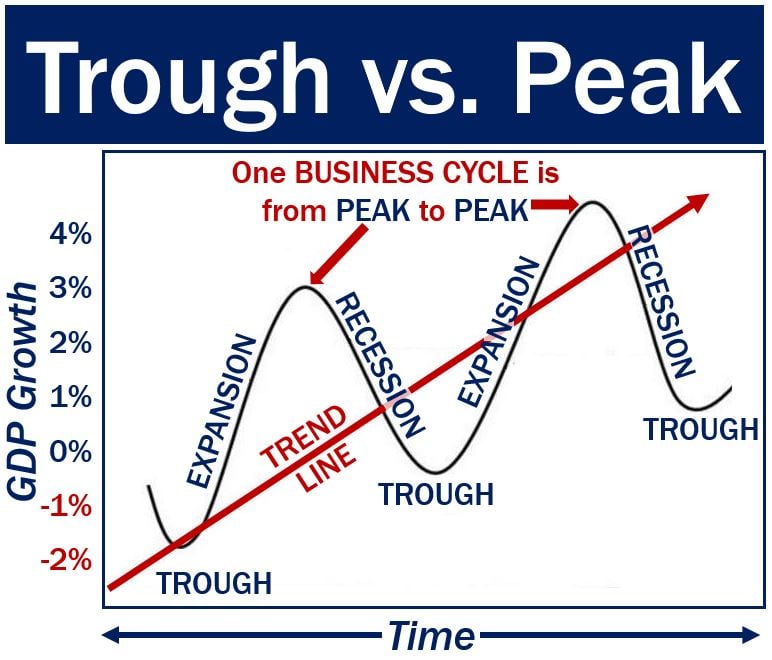

Economists say that the business cycle goes through four main stages: 1. Expansion. 2. Peak. 3. Contraction. 4. Trough.

In non-business English, a trough can mean:

1. A long, narrow open container that farm animals or working animals drink or eat out of.

2. A long, narrow open container used for growing plants.

3. A channel that a liquid flows through.

4. A long hollow in the Earth’s surface.

5. The lowest part between two waves in the sea.

6. The opposite of peak in a graph – the lowest part of the line on a graph, between where it falls and rises.

7. In medicine, it is the lowest concentration of a drug in the patient’s bloodstream, while the peak is the highest concentration.

A business cycle is one V-shaped wave – from peak to peak. The trough is the bottom of the wave, the point between recession and expansion – the point between the falling line and the rising line.

A business cycle is one V-shaped wave – from peak to peak. The trough is the bottom of the wave, the point between recession and expansion – the point between the falling line and the rising line.

This article will focus on the term when it is used in business, economics, finance and statistics.

Lexicon.ft.com, the Financial Times’ glossary of terms, defines the term ‘peak-to-trough’ as follows:

“The stage of the business or market cycle from the end of a period of growth (peak) into declining activity and contraction until it hits its ultimate cyclical bottom (trough).”

“This is the change in a data measure – e.g., an asset price or economic statistic – from its highest point to its lowest point. The term is often used to refer to declines during a cyclical downturn.”

The GPD’s peak-to-trough decline during a recession is the total output shrinkage from the point where the recession started to when the economy begins expanding again.

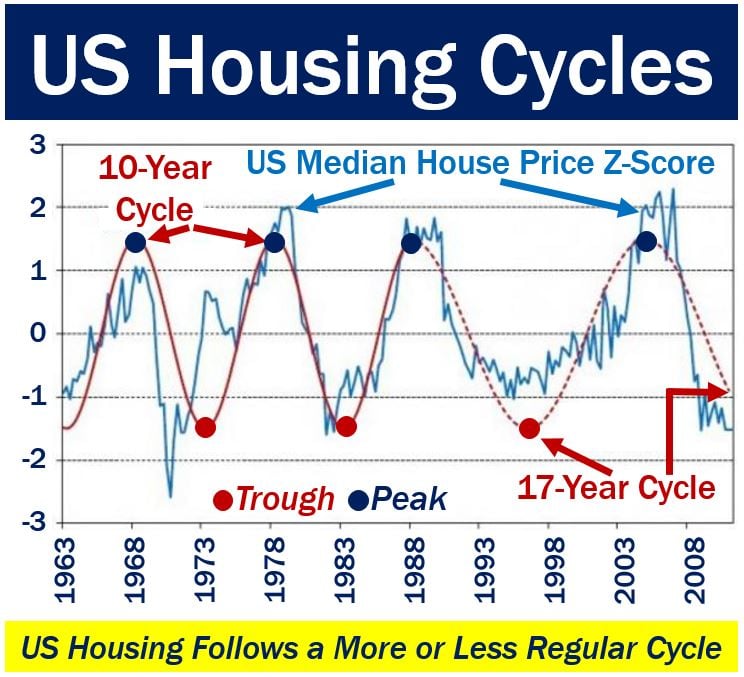

The term ‘peak-to-trough’ is sometimes used for house prices, industrial output, commercial property, and other sectors of the economy.

In an article in ‘Business Insider’ in 2011, Sam Ro wrote: “property is the most cyclical of assets. Housing booms crater, while depressed real estate markets eventually recover.” (Image: adapted from static3.businessinsider.com)

In an article in ‘Business Insider’ in 2011, Sam Ro wrote: “property is the most cyclical of assets. Housing booms crater, while depressed real estate markets eventually recover.” (Image: adapted from static3.businessinsider.com)

Trough in the business cycle

The business cycle is the natural expansion and contraction of a country’s GDP that occurs over time. Each business cycle has four stages:

– Expansion: this occurs between the trough and the peak; it is when GDP is growing, unemployment reaches its natural rate, and inflation nears the central banks’ 2% target. During the expansion phase the stock market is bullish – investors buy.

– Peak: this occurs just before GDP growth starts to decline. The peak is the top of the economic growth mountain – the moment when GDP growth transitions into the contraction phase.

– Contraction: this phase begins at the peak and ends at the trough. GDP growth weakens, and may even turn negative.

Two consecutive quarters of shrinking GDP suggest that a country is in a recession. The stock market is in a bear market – investors sell.

– Trough: this phase occurs when the economy transitions from the shrinking phase to the expansion phase. When the economy reaches this point, it has literally hit ‘rock bottom’ – it is uphill after that.

Typical cycles in the world’s advanced economies look like the surface of the sea with long and gentle waves. The wave, usually illustrated in a graph, shows how GDP rises and falls over time.

Assuming a successful economy is achieving GDP growth over the long-term, business cycles tend to have waves that rise and fall gradually – not steeply – over a period of years.

Occasionally, the waves are much steeper, as occurred during the period of rapid growth leading up to 2007, followed by the global financial crisis of 2007/8, and the Great Recession that it triggered.