What is a vulture investor? Definition and meaning

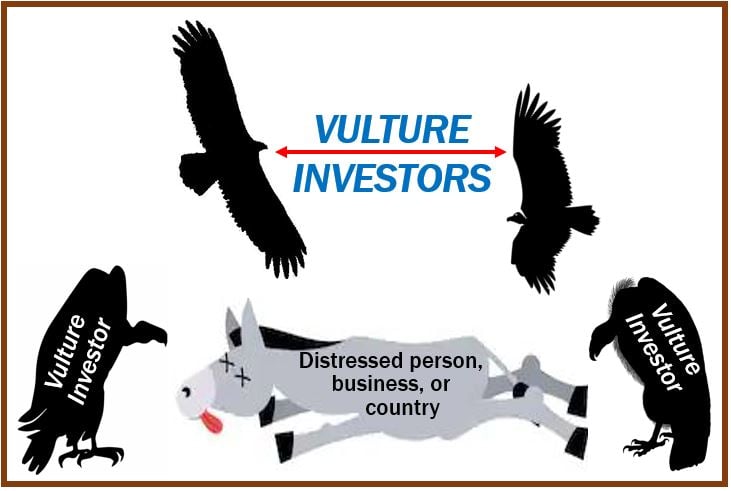

A vulture investor purchases financial instruments and assets at knock down prices from distressed people, companies and entitites, i.e. they are in desperate need of money.

The vulture investor may buy property, held assets, debts, or securities.

Companies in trouble are often the target of such investors, who buy a controlling stake in order to liquidate and make a profit.

Borrowers who are no longer able to make payments on their mortgage and need to sell their property are often sought after by vulture investors.

The vulture investor plays a vital role

Just as vultures play an important part in nature’s ecosystem, they also do in business and finance. In times of crisis, vulture investors swoop in and purchase the most troubled assets at super-low prices, thus giving desperate sellers an opportunity to get out.

In some cases, they may also be partly responsible for the resurrection of businesses that everybody thought would die.

Put simply, they profit from other people’s and companies’ disasters, but also help clear up the mess and recycle money and assets that would otherwise remain either dead or in a zombie state.

Example of a vulture investor in action

Imagine John Doe Inc. has lost more than 80% of its customers following a food-poisoning scandal. John Doe’s stocks have plunged by over 90%, and analysts say the company will be unable to recover.

However, John Doe owns a valuable food processing technique patent that could be licensed off to other companies.

John Smith, a vulture investor, hears about this and purchases John Doe high-yield bonds, expecting that the patent’s value may either help the company recover or at least make sure he recovers his investment plus a healthy profit if the patent is sold off during bankruptcy.

Recently, there has been growing concern at how these predatory scavengers hound desperate governments and disrupt economies. They buy sovereign debts (that have not been paid) and then chase governments for payment. For years hedge funds have battled over Argentina’s debt.

According to Cambridge Dictionaries Online, a vulture investor is:

“A person or organization that buys shares cheaply in companies that are failing in order to take control, improve their performance, and so make money,” or “A person or organization that buys a company’s or country’s debt that has not been paid and takes legal action to get them to pay it.”

Funds that purchase securities in distressed companies and other entities are known as vulture funds.

Video – The art of vulture investing

In this video, George Schultze, author of “The Art of Vulture Investing”, who says he is a vulture investor, talks about his job.