What are fixed costs? Definition and meaning

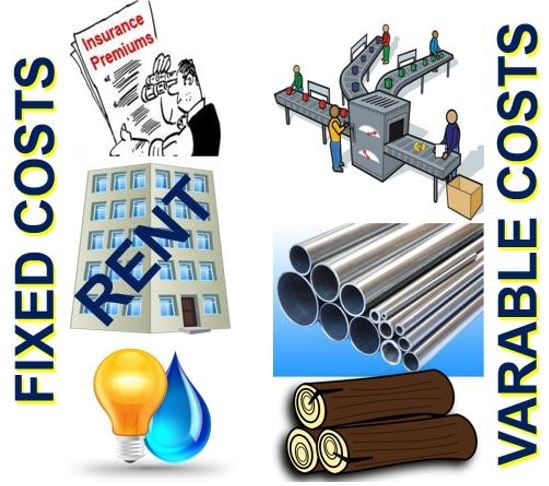

Fixed Costs are costs that do not change in relation to levels of production, unlike variable costs, which do. If you have a business, your fixed costs are those that don’t change (or don’t change much) from month to month, regardless of how busy things are.

Fixed costs remain relatively constant on a month-to-month basis. They do change slightly over the long term, but compared to variable costs they remain pretty much the same.

More significantly, business activity does not affect them.

Fixed costs are expenses that a business has to pay, regardless of business activity. For example, rent is a fixed cost, i.e., it does not go up when sales or production increase. Other examples of fixed costs are insurance premiums, depreciation on equipment, property taxes, salaries of permanent employees, and loan interest payments.

Variable vs. fixed costs

Total costs are made up of two components: 1. Fixed costs. 2. Variable costs.

In management accounting, as mentioned above, we define fixed costs as business expenses that do not fluctuate. Specifically, they do not fluctuate according to levels of activity within a relevant period.

In marketing, it is vital to know how costs divide between fixed and variable. This distinction is important in forecasting the earnings generated by unit-sales changes, and thus the financial impact of suggested marketing campaigns.

In financial analysis, the concept is used to find a business’ break-even point, as well as determining product pricing. A financial analysis involves assessing something’s stability, solvency, profitability, and viability.

Fixed costs – periodic costs

We have to pay fixed costs on a regular basis. Therefore, we see them as periodic costs. The amount charged to expense generally changes very little from period to period.

Fixed cost breakdown

Let’s suppose that John Doe Inc. manufactures door-handles. It has a lease on a building which costs $15,000 per month.

If during one month, the company has no production, it still has to pay the month’s lease in full, i.e., $15,000.

-

Economies of scale

Businesses can achieve economies of scale when they produce enough goods to spread fixed costs.

For example, John Doe’s $180,000 annual lease spread over 1.8 million door-handles produced in one year means that each unit carries with it $0.10 or ten cents in fixed cost.

If production jumps to 3.6 million units, the fixed cost per unit goes down to five cents per unit. Understanding this relationship between production volume and fixed cost distribution is crucial for strategic planning, as it can inform decisions on scaling operations and capital investments.

This example just looked at the lease cost. Fixed costs also include utilities, some office supplies, and other items.

As production increases, fixed cost per unit goes down. The variable cost per unit, on the other hand, remains about the same.

The variable cost per unit may decline slightly if the company can get discounts from suppliers.

Firms with high fixed costs

Companies with a large fixed cost component have to generate a considerable amount of sales volume. The high sales volume must have sufficient contribution margin to offset the fixed cost.

However, as soon as they reach those sales levels, they typically have relatively low variable costs per unit. Therefore, they can generate exceptional profits above the break-even level.

-

Oil refineries – massive fixed costs

Let’s look at an oil refinery. Fixed costs are huge in relation to its refining capacity. If the cost of a barrel of oil falls below a certain price, the refinery runs at a loss.

However, when prices rise beyond a certain level, it can be incredibly profitable.

Generally, the higher the fixed cost, the easier it is to increase production rapidly. Effectively, all you have to do is turn the tap onto full.

On the other hand, if a business has low fixed costs, its break-even point is much lower. Therefore, it is easier to reach. However, it has a high variable cost per unit.

Low vs. high fixed cost companies

Low fixed cost companies can earn a profit with much lower sales volume levels than high fixed cost businesses. However, their profits are not so huge when sales increase.

Consulting businesses, for example, have extremely low fixed costs. In fact, most of their costs are variable.

-

All costs are ultimately variable

Economists say that ultimately, all costs eventually are variable. Take, for example, management salaries, which typically do not vary according to the number of units produced.

However, if the company falls on very hard times and layoffs occur, those expenses will change significantly.

The Financial Times ft.com/lexicon defines a fixed cost as follows:

“Cost that does not change even if output or sales volume changes. The opposite of variable cost.”

Video – What are Fixed Costs?

This video, from our sister channel on YouTube – Marketing Business Network, explains what ‘Fixed Costs’ are using simple and easy-to-understand language and examples.