Wide economic moat – definition and meaning

A wide economic moat is an edge that a commercial enterprise has over its rivals, which can be taken advantage of to boost profits and consolidate its position in the market. If a company has new breakthrough products, secure patents, state-of-the-art technology, and a good brand identity, it has a wide economic moat that will keep the rivals at bay for a number of years.

A wide economic moat is a kind of competitive advantage that a company has that makes it harder for competitors to grab its market share.

In fact, the problem is often the other way round; the company with the wide economic moat is the one that is in a position to gain greater market share and hurt rivals’ profits.

Protecting companies and castles

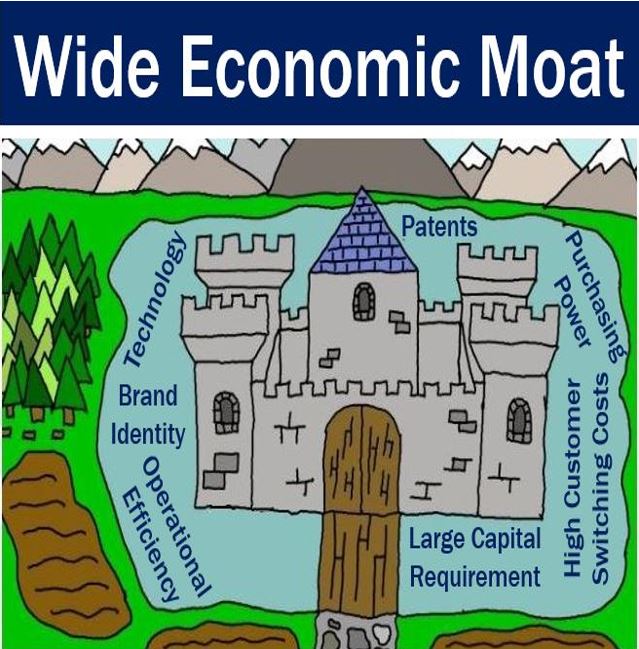

Medieval castles used to have a circular canal filled with water surrounding them – a moat – which made it harder for enemies to invade. The notion of protection in business comes from a castle’s moat.

A company with an extremely profitable business is similar to a rich castle that is constantly under attack by rivals and enemies.

If there is no strong defense – no moat – it would not be long before the competitors copied what the company was doing, charged lower prices, grabbed market share, and undermined profit margins.

The following components help create a wide economic moat for companies:

– Patents: a patent is a certificate that protects an inventor from the illegal sales, copying and other uses of his or her invention without permission.

– Brand Identity: a company’s brand is its image and personality. Quality branding helps a company sell its products or services more successfully.

– Technology: in an article that appears on PinnacleofIndiana.com, the website of an advanced imaging solutions company, Butch Whitmire writes: “When I think of a business’ technology and how it relates to supporting competitive advantage, I think of the layers of a pyramid. The higher you move on the pyramid, the more likely it is that technology increases your competitive advantage.”

– Purchasing Power

– Operational efficiency

– Large Capital Requirement

– High Customer Switching Costs

Commercial entities with a wide economic moat operate business models that are extremely hard – often impossible – for rivals to imitate, compete with, or attack.

Investing Answers makes the following comment regarding Wal-Mart’s competitive advantage:

“Wal-Mart (WMT) is a perfect example of a company that has a wide moat. The company controls so much retail space that it’s able to demand the lowest possible prices from suppliers.”

“Because it would take decades of successful expansion for any firm to match Wal-Mart’s tremendous size and scale, the company enjoys a sustainable advantage over its competition.”

Wide economic moat – investors’ focus

A wide economic moat tells us that a company is able to remain profitable for many years to come. Most investors, and people who represent investors, examine the size of companies’ economic moats when deciding where to invest.

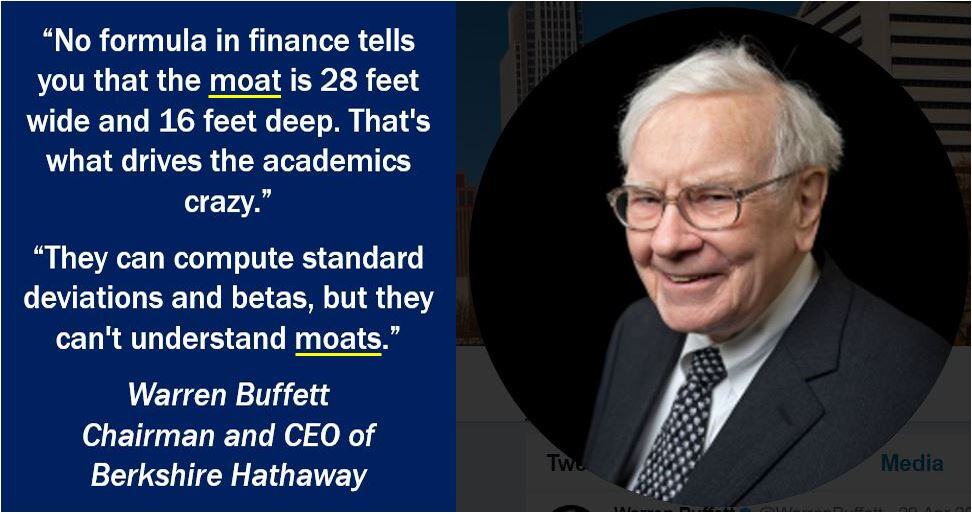

The wider the moat the better, is the motto of virtually every investor. Determining how wide an economic moat is is not easy – it is not something we can do mathematically.

A term coined by Warren Buffett

Warren Buffett, an American business magnet, philanthropist, and probably the world’s most successful investor, coined the term wide economic moat. Mr. Buffett co-leads the company Berkshire Hathaway with Charlie Munger.

At Berkshire Hathaway’s 2000 Annual Meeting, Mr. Buffett said:

“So we think in terms of that moat and the ability to keep its width and its impossibility of being crossed as the primary criterion of a great business. And we tell our managers we want the moat widened every year.”

“That doesn’t necessarily mean the profit will be more this year than it was last year because it won’t be sometimes. However, if the moat is widened every year, the business will do very well. When we see a moat that’s tenuous in any way – it’s just too risky. We don’t know how to evaluate that.”

“And, therefore, we leave it alone. We think that all of our businesses — or virtually all of our businesses — have pretty darned good moats.”

Video – Buffet’s wide economic moat

This Donxs M video talks about Warren Buffett and his friend and business partner Charlie Munger. When asked what he looks for when deciding where to invest, Mr. Buffett answers: “I look for a company that has a moat around it.”