Google advertising prices – cost per click – are down 9% compared to one year ago, but the company’s Q1 2014 profits rose 3% to $3.45 billion. News on Google’s sliding advertising prices and lower margins on its non-core businesses sent shares down 5% in early trading on Thursday.

Despite a drop in cost per click, the number of “paid clicks” increased by 26% year-on-year.

Investors were also discouraged at the low price Google sold Motorola Mobility to Lenovo. Two years ago the company paid $12.5 billion for the smartphone maker, and agreed to sell it in January 2014 for just $3 billion to Lenovo.

Despite the two pieces of bad news that sent investors running for cover, Larry Page, Google’s CEO, said in a statement:

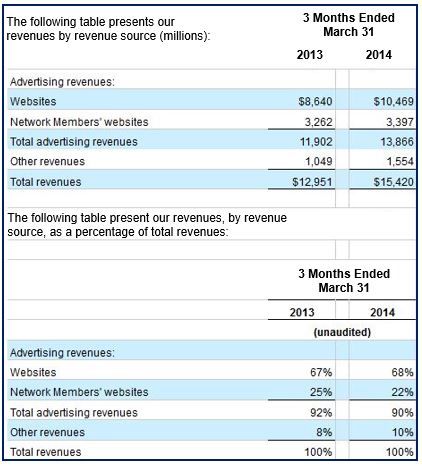

“We completed another great quarter. Google’s revenue was $15.4 billion, up 19% year on year. We got lots of product improvements done, especially on mobile. I’m also excited with progress on our emerging businesses.”

Although Google advertising prices dropped, advertising income rose.

Google is the largest online advertising vehicle in the world.

Google advertising prices down because of mobile screen ads

Google does not appear to be able to command higher prices for its mobile adverts, a worrying development given that a growing number of consumers are accessing its browser via their smartphones.

Advertisers have not shown the same enthusiasm to pay good money for adverts on mobile screens as they do for desktop ads. Mobile screen ads are up to 50% cheaper than desktop ones.

Nikesh Arora, Google’s Chief Business Officer, believes that mobile screen ads will rise as it becomes easier for users to buy products on their smartphones. He acknowledged that mobile screen ad income is being undermined partly because businesses have not spent enough time developing their mobile screen sites – most still assume that purchases are made via desktop screens.

Arora said:

“The journey is just beginning for advertisers on the mobile side. Right now we can lead the horse to water, but we can’t make it drink.”

Google expenses up

Google’s Q1 2014 profits were eroded by rapidly-rising expenses. Revenue increased 19% to $15.4 billion compared to $13 billion in Q1 2013, excluding the planned sale of Motorola Moblity to Lenovo. This was less than analysts’ forecast of $15.5 billion.

Expenses rose 23%, hence the lower 3% rise net income of $3.65 billion or $5.33 per share, compared to $3.53 billion or $5.24 per share a year earlier. Excluding stock-based compensation and some other items, earnings were $6.27 per share (analysts predicted $6.41).

In an interview with The Wall Street Journal, Brian Wieser, a Pivotal Research Group analyst, said “The top line was pretty good, but the margin compression probably disappointed the market. The margin erosion trend seems to be well in place.”

Diversification hitting Google margins

As Google diversifies into more businesses, it is finding that profit margins are lower. Its -online-video service YouTube, as well as display advertising yield lower profit margins compared to its original search-advertising business, Wieser explained.

On Monday, Google said it had purchased Titan Aerospace, a solar-powered drone maker for an undisclosed amount. The acquisition should help it deliver wireless Internet to millions of people across the world. Rival Facebook recently announced plans to build solar-powered drones in order to provide Internet access to people in remote locations.

On April 15th, 2014, wearable computer device Google Glass went on sale in the US for just one day. Stocks were sold out, the company informed. The company recently filed a patent that describes a camera-enabled contact lens.

While encouraged by Google’s moves to invest in new products, there is concern that the company’s profit margins could be affected.

Google is the most visited website worldwide.

Video – Google profits up but share price down

Written by [google_authorship]