Is the Greek recovery here for the long haul?

Has the worst of the Greek crisis been overcome and is the government delivering in terms of reforms and savings?

IfW economists Claus-Friedrich Laaser, David Benček and Klaus Schrader are not as optimistic as Greek and European leaders are.

In their study – Kiel Policy Brief 68 – the authors see Greece as an economy that is still shrinking and shows “some precarious structural weak points.”

The Greek government is still very far from carrying out the necessary reforms, and the country’s debt problem continues to stifle the economy.

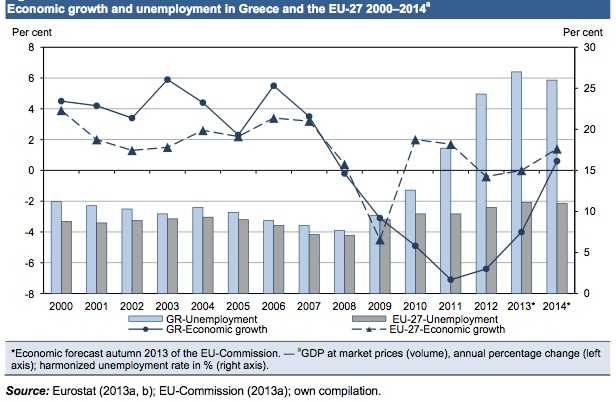

Extremely high unemployment at 27.6% looks set to stay. The authors describe young Greeks’ employment prospects as “more than dim”.

Greece’s unemployment is much higher than the European average.

Greek recovery needs a new business model

The report sees no sign of a new business model for Greece that might put an end to the long-term slack in growth and prevent a deterioration in people’s standard of living.

Greece urgently needs structural change, something the country has neglected for decades, otherwise the Greek recovery will be short-lived.

The authors wrote:

“There will be no more growth from the cheap credits that have allowed public and private consumption to get out of hand in the past. But it will also be impossible to simply flip the switch: Current economic structures will not allow Greece to outgrow the crisis with the help of exports in the short term.”

“Strong value-adding industrial firms and service providers like those that justify the raised standard of living that Greece has allowed itself thus far, have to first be established on a larger scale in Greece.”

The country will not be able to recover by depending purely on exporting raw-materials, labor-intensive goods and services in the low-income sector.

Greek recovery will depend on outside help

Laaser, Benček and Schrader doubt Greece will be able to manage its gigantic debt mountain without outside help.

Those who helped out Greece financially say the country has to maintain a primary surplus in the national budget of 4.5% in order to service its debt. With its current slow growth, the authors believe this is going to be impossible, in spite of the debt buyback and debt cuts that have already taken place.

The report acknowledges and praises the reforms that have taken place so far, but urge Greece “not let up on the pressure on Greek policy to finally resolve reform matters.”

They warn against overly high expectations which may undermine the Greek recovery. Reforms take time to bear fruit.

Put simply, the authors believe additional measures are needed to facilitate crisis management and improve the country’s economic prospects.

The Greek government needs to consult domestic and foreign expects regarding the design and implementation of the reform measures so that things move forward more quickly than they have done in the past.

They added “Moreover, another debt cut is deemed to be necessary to achieve a situation that is sustainable for Greece. Such a debt cut, which would directly affect the taxpayers of Euro countries, would require strict terms. National fiscal sovereignty would have to be limited for the period of further consolidation. Ongoing rescue with a succession of bail-out packages is not recommended though because such a transfer mechanism would also be attractive for other crisis-ridden countries.”