Companies with the highest CEO pay give a worse shareholder return in the long term than companies with the lowest CEO pay.

So concluded investment analysts after comparing the CEO pay of 429 large US companies against total shareholder return during 2005-2015.

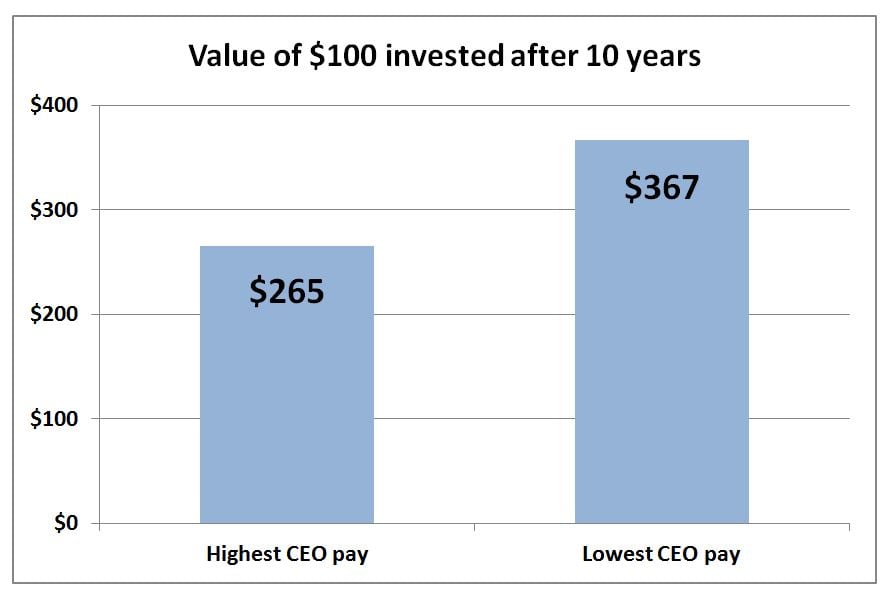

The MSCI ESG Research analysts calculated that $100 invested in the companies with the highest CEO pay grew to an average of $265 in 10 years, compared with $367 average from those with the lowest CEO pay.

They found this after ranking the companies according to how much they paid their CEOs and comparing the yield of the top 20 percent against the bottom 20 percent.

The analysis showed that $100 invested in the companies with the highest CEO pay grew to an average of $265 in 10 years, compared with $367 average from those with the lowest CEO pay. Data from MSCI ESG Research report ‘Are CEOs Paid for Performance?’

The analysis showed that $100 invested in the companies with the highest CEO pay grew to an average of $265 in 10 years, compared with $367 average from those with the lowest CEO pay. Data from MSCI ESG Research report ‘Are CEOs Paid for Performance?’

The researchers found a similar result when they compared companies within their own sector peer groups over the 10 years.

This showed that shareholder return of companies whose CEO pay was below the sector median was as much as 39 percent higher than that of companies whose CEO pay was above it.

For their calculations the researchers used “summary pay” as a measure of CEO pay. Summary pay is the level that must be disclosed in the “summary tables of proxy statements” that must be sent to shareholders before annual meetings. This disclosure rule is set by the U.S. Securities and Exchange Commission (SEC).

The researchers also found that equity incentive awards is the largest element of CEO pay, accounting for as much as 70 percent of the executive’s total compensation package in the U.S. This was the same for both summary pay and realized pay (which includes stock gains realized during the course of the year).

Mismatch between CEO and shareholder interests

The findings are important for long-term institutional investors, because they highlight a potential mismatch between CEO and shareholder interests.

The analysts note that while the SEC disclosure rules make companies give quite detailed information about CEO pay in their “annual proxies,” they rarely include “the sort of cumulative figures that long-term investors would find most helpful.”

“There is an “inherent over-emphasis on annual reporting rather than longer periods,” they note, which could be “a likely cause for much of the short-term orientation we encounter in tracking and analyzing U.S. CEO pay practices and reporting.”

The analysts suggest if companies had to disclose long-term data, such as comparison of cumulative CEO pay and company performance over the officer’s entire tenure, then it “could help better align the interests of CEOs and long-term investors.”

Also, giving investors more information on one-time benefits such as signing bonuses and severance agreements in the cumulative totals “would likely increase the focus on these often significant pay provisions.”