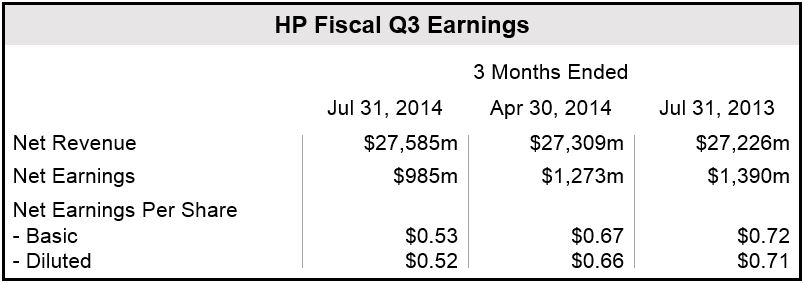

HP Q3 profit was markedly down to $985 billion compared to $1.39 billion in Q3 2013, but its sales increased by 1% to $27.6 billion, driven by an unexpected 12% jump in personal computer sales.

GAAP (general accepted accounting principles) earnings per share were $0.58. If it had not been for some one-time charges, HP says it would have earned $0.89 per share.

Chairman, President and CEO, Meg Whitman, said:

“Overall, I’m very pleased with the progress we’ve made. When I look at the way the business is performing, the pipeline of innovation and the daily feedback that I receive from our customers and partners, my confidence in the turnaround grows stronger.”

Q3 segment results:

- Personal Systems: revenue was 12% up on Q3 2013, with a 4% operating margin.

- Printing: revenue fell by 4% compared to Q3 2013, with an 18.4% operating margin.

- Enterprise Group: revenue increased by 2% on Q3 2013, with a 14% operating margin.

- Enterprise Services: revenue declined by 6% compared to Q3 2013, with a 4.1% operating margin.

- Software: revenue dropped by 5% on Q3 2013, with a 21.2% operating margin.

- HP Financial Services: sales were 3% down on Q3 2013, with an operating margin of 9.2%.

(Data source: HP)

HP in major overhaul

The multinational information technology company headquartered in Palo Alto, California, is undergoing a major restructuring program involving deep job cuts as it attempts to focus more on computing infrastructure.

In May, 2014, HP said another estimated 11,000 to 16,000 jobs had to be cut, on top of the previously-announced 34,000.

With shares rising by 25.5% since the beginning of the year, investors have shown confidence in Ms. Whitman’s ability to turn around the company, which has been far too dependent on progressively obsolete products such as desktop computers and printers.

She also managed to significantly increase HP’s cash flow, which is vital for new investment, while at the same time raising R&D spending by 11%.

However, it remains to be seen whether the “pillars of future growth” – security software, cloud computing and big data analysis – will yield strong revenue. So far, there are no signs of significant revenue growth.

Ms. Whitman said the company will soon unveil its plans for 3-dimensional printing, but also warned that it would take several years before that part of the business starts making money.

Acquisitions?

Ms. Whitman said HP, with its $4.9 billion in operating company net cash at the end of Q3, may make acquisitions. “We’re in a position to make acquisitions the way we weren’t over the past year,” she said.

While acknowledging that personal computer demand is “coming back some,” Ms. Whitman stressed that “(it is) a turnaround in a declining business.”

Several companies have reported an increase in personal computer sales, which are attributed to Microsoft’s discontinuation earlier this year of its older Windows operating systems, prompting several businesses to purchase new PCs.

Outlook

For Q4 2014, HP estimates non-GAAP diluted net EPS (earnings per share) of between $1.03 and $10.7 (GAAP $0.83 to $0.87).

For the whole year (fiscal 2014), the company estimates non-GAAP net EPS of between $3.70 and $3.74 (GAAP $2.75 to $2.79).

Video – Does HP need to be bolder?

In this video, Nathan Bachrach gives his opinion on CNBC’s Closing Bell.