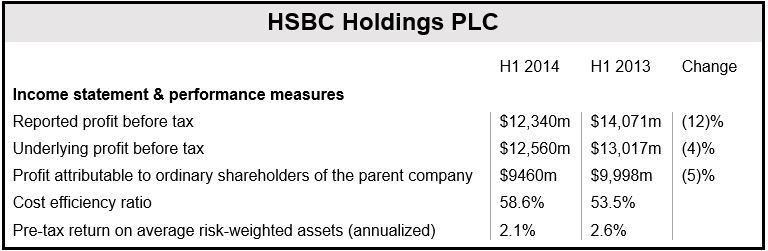

HSBC H1 profit fell 12% to $12.34 billion compared to $14.071 billion in H1 2013. During the first six months of this year the British financial institution put aside about $234 million to cover mis-selling PPI (Payment Protection Insurance) and other potential settlements.

The steeper-than-expected decline in profit was the first such fall in five years, as investment banking weakened further.

Underlying revenue during the first half of this year slid to $31,359 from $32,720 for the same period last year.

Stuart Gulliver, who has been HSBC’s CEO since 2011, has overseen the divestment of 68 businesses as he strives to focus the bank’s activities on its most profitable markets in an environment of increased compliance costs and more stringent regulations.

Mr. Gulliver said:

“Whilst regulatory uncertainty persists, our balance sheet remains strong. Our ability to generate capital continues to support our progressive dividend policy. We remain well-placed to meet expected future capital requirements, to continue to deliver an attractive total shareholder return and to establish HSBC as the world’s leading international bank.”

HSBC’s Common Equity Tier 1 Ratio, which measures an institution’s financial strength, rose to 11.3% at the end of June from 10.8% in December 2013.

(Data source: HSBC Holdings)

Outlook

Mr. Gulliver says he is broadly positive about the economic outlook for most of the bank’s home and priority markets. The UK’s GDP is growing rapidly.

HSBC has marginally increased its forecast for mainland China’s economic growth in 2014 to 7.5%, and expects Hong Kong will benefit from increased exports during the second half of 2014.

While growth in Latin America remains sluggish, the bank’s Middle East business continues performing well, “albeit overshadowed by regional uncertainties.”

Some indicators point to an interest rate rise in the UK as early as Q4 2014 and H1 2015 in the United States, which will have a positive impact on the company’s revenues, Mr. Gulliver added.

Many shareholders unhappy with pay policy

In May, more than one fifth of HSBC shareholders voted against the bank’s pay policy, reflecting rising anger among investors globally at how financial institutions continue raising bonuses while their profits fall. Even loss-making banks are raising executive bonuses.

The opposition was not enough, however, and the bonus policy, which includes bonuses up to 200% of salaries, was approved.

HSBC Holdings PLC is based in London, England. The company employs nearly one-quarter of a million people worldwide.