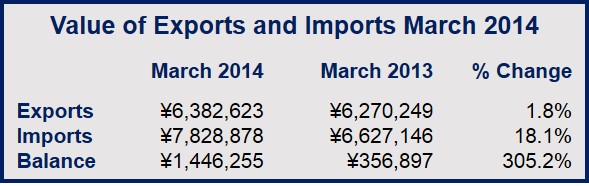

The Japanese trade deficit quadrupled in March to ¥1.446 billion ($14.1 billion) from ¥356.99 billion($3.48 billion) in March 2013, according to data published by the Ministry of Finance on Monday.

Exports for March 2014 were ¥6.383 trillion versus ¥6.270 billion in March 2013, while imports increased to ¥7.829 trillion compared to ¥6.627 trillion. The March trade deficit was the largest on record.

Year-on-year, exports in March grew by 1.8% while imports increased by 18.1%. A weak yen pushed up import costs, which also surged due to rising energy imports after Japan shut down virtually all its nuclear power stations in March 2013 following the 2011 Fukushima Daiichi nuclear disaster.

Japanese trade deficit quadrupled due to energy imports + weak yen

Liquefied Petroleum Gas (LPG) imports grew by 8.1% in March 2014 compared to March 2013, while Liquefied Natural Gas (LNG) imports rose by 4.1% over the same period. Petroleum imports increased by 14% and coal by 5.5%.

A series of aggressive policy measures aimed at boosting GDP (gross domestic product) growth, including a massive increase in Japan’s money supply, have reduced the value of the yen considerably, resulting in higher income costs.

Between March 2013 and March 2014, the yen dropped 10% against the US dollar and the euro. Although liquefied petroleum gas imports increased 8.1%, in value terms they actually grew by over 18%, and the LNG’s 4.1% increase was really 14%.

The Japanese trade deficit had shrunk in February to ¥800 billion ($7.9 billion), its lowest level in ten months.

(Source: Ministry of Finance)

Sales tax hike may have boosted trade deficit

In April 2014, sales tax (VAT), also called consumption tax, increased from 5% to 8%. Economists say greater consumer demand before the tax increase boosted imports.

Consumer demand should decline now that the sales tax increase has come into effect, resulting in lower imports.

There have been growing calls for Japan to restart some of its nuclear power stations. If this occurs energy imports will drop significantly as well as its expanding trade deficit.

In an interview with Bloomberg, Junko Nishioka, chief Japan economist at the Royal Bank of Scotland in Tokyo, said “In spite of the continued weaker yen, the performance of Japanese exporters is quite weak compared to competitors like Korea or Taiwan. (The trade deficit will worsen) unless the government decides to restart nuclear power plants.”

Bank of Japan likely to try to boost economy further

The Bank of Japan is expected to take further measures to steer inflation towards its 2% target as well as cushioning the economy from the sales tax hike. A majority of economists in Japan, the US and Western Europe believe the central bank will add stimulus within the next three months.

With domestic demand expected to be weak for the rest of this year, Japan is depending on strong exports, which so far have been elusive.