A Lindt Russel Stover takeover deal has been agreed by the two companies. The Swiss chocolate giant is to buy its American rival, creating North America’s third largest chocolate manufacturer behind Hershey and Mars.

The Ward family, which had acquired Russell Stover fifty-four years ago, hired Goldman Sachs earlier this year to put the company up for sale. The sale attracted interest from other chocolate giants, including Hershey and Godiva.

The Lindt & Sprüngli Group, famous for its gold-foil wrapped chocolate bunnies, said in a public statement today that the acquisition of the traditional Kansas City-based US family business Russell Stover Candies, Inc. will greatly complement its premium chocolate portfolio “in the world’s biggest chocolate marketplace.”

The combined firms are expected to exceed $1.5 billion in sales just in North America.

Both companies have agreed not to disclose how much money is changing hands, as well as other contractual deals. The Wall Street Journal quotes unnamed people who claim to be familiar with the business that the deal will be worth about $1.5 billion.

Expanding US presence

Lindt’s largest ever strategic acquisition will give the Swiss company an established presence throughout the United States with its Lindt, Russell Stover, Ghirardelli, and Whitman’s brands.

Lindt & Sprüngli chairman and CEO, Ernst Tanner, said:

“This biggest and most important strategic acquisition to date in Lindt & Sprüngli’s history is a unique opportunity for us to expand our North American chocolate business and will greatly enhance the group’s status in the world’s biggest overall chocolate marketplace.”

The Russell Stover Group has 2,700 workers and 2 manufacturing facilities in Kansas, one in Texas, and one in Colorado. It reports annual sales of c.$600 million and about $60 million in EBITDA (earnings before interest, tax, depreciation and amortization). It also has a chain of 35 proprietary retail outlets, mainly in the central US states.

Russell Stover’s products are sold in over 70,000 grocery stores, card and gift shops, department stores and drug stores across the US and in more than 20 other countries.

If Russell Stover does go for $1.5 billion, it would be a sizable multiple of 23.3 times EBITDA.

Perfect strategic fit?

Both Mr. Tanner and Russel Stover’s President and CEO Thomas S. Ward described the impending acquisition as a “perfect strategic fit”. Stover will maintain its headquarters in Kansas City.

Many analysts wonder about the so-called “perfect fit”, commenting that Lindt already has an established American presence through the Ghirardelli Chocolate Co., which it acquired in 1998. In 2013, Lindst sales in North America grew by 11.4% to $943.2 million.

Lindt, which counts tennis star Roger Federer as its ambassador, had previously said it planned to grow organically (without acquisitions) in North America. Most experts had expected the Swiss company to focus on other large markets, such as Russia, Brazil or China, where it does not have a large presence.

The takeover will be financed through a combination of cash resources and bank loans and should be completed by the end of this year, both companies said.

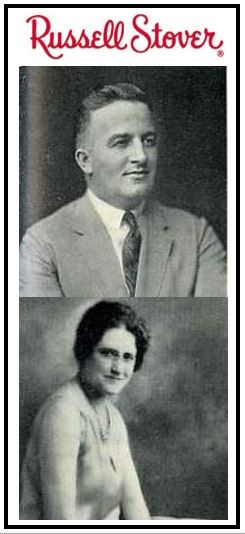

About Russell Stover

It all started with ice cream: In 1921, Russell Stover and Christian Nelson, an Iowa schoolteacher, created the world’s first chocolate-dipped ice-cream parlor. Russell’s wife Clara suggested at a dinner party they call it an Eskimo Pie. The product sold extremely well.

Several other companies soon caught on to the idea and started selling similar chocolate-dipped ice cream products, which nearly pushed Russell Stover out of business.

Russell and Clara sold their shares in the company, raising $25,000, and moved to Denver.

In 1923 they created “Mrs. Stover’s Bungalow Candies.” In 1943 the business was renamed Russell Stover Candies.

Twenty years later, Louis Ward bought the company and transformed it into a major global brand. At that time, the business boasted 35 retails stores and over 2,000 agencies selling its candies.

After Mr. Ward died in February 1996, the Ward family continued to own and run the business.

In 1998, the company launched a line of sugar-free chocolates and rapidly became the country’s leading producer of sugar-free confectionery.

In 2003, it launched a Net Carb line of reduced-carb chocolates to meet the needs of customers wanting to lead low-carb lifestyles.

The following year, it introduced two products designed specifically for consumers with diabetes.

Today, the company’s three brands – Russell Stover, Whitman’s and Pangburn’s – represent over 60% of the US boxed chocolates market.

Russell Stover manufactures almost 100m pounds of chocolate each year. It is the only major American-based confectionery business to avoid serious controversy over the use of genetically-modified ingredients, pesticides, and child slave labor.

About Lindt & Sprüngli

The company dates back to 1845 when David Sprüngli-Schwarz and Rudolf Sprüngli-Ammann (son) ran a small pastry shop in Zurich. Two years later they added an extension which became a factory producing chocolate in solid form.

When Mr. Sprüngli-Ammann retired in 1892, the expanded business was divided between his two sons. David Robert ran two confectionery stores that traded under the name Confiserie Sprüngli.

Johann Rudolf, the older brother, received the factory. In 1899, he converted his private business into Chocolat Sprüngli AG because he needed to raise finance to expand the business.

Lindt is famous for its chocolate bunnies.

Johann acquired a chocolate factory in Bern belonging to Rodolphe Lindt in the same year, and changed the business name to Aktiengesellschaft Vereinigte Berner und Züricher Chocoladefabriken Lindt & Sprüngli (United Bern and Zurich Lindt & Sprungli Chocolate Factory Ltd.). It was later renamed “Chocoladefabriken Lindt & Sprüngli AG”.

During the first two decades of the 20th century, the Swiss chocolate industry grew rapidly. By 1915, Lindt & Sprüngli exported about three-quarters of all its chocolate production to more than twenty countries.

The 1920-1945 period was much more difficult for the company. Increased protectionism worldwide plus the economic crises in the 1920s and 1930s virtually eliminated all its export markets. Lindt had to reorganize itself completely and focus on the slowly developing domestic market.

World War II brought tough import restrictions on cocoa and sugar, as well as rationing in 1943. Despite stagnant sales from 1919 to 1946, the business survived, thanks mainly to a strict adherence to the quality principle that if people are short of money and can hardly buy chocolate, they should at least have a tiny bit of the best.

Demand for chocolate rose rapidly after the Second World War both in Switzerland and abroad. In 1961, Lindt acquired Chocolat Grizon, and Nago Nährmittel AG plus Chocoladefabrik Gubor in 1971. They were all fully integrated into the company.

Lindt & Sprüngli acquired Hofbauer, an Austrian chocolatier in 1994. In 1997 it bought Caffarel, an Italian cholocatier, and then the American chocolate maker Ghirardelli. They all became fully-owned subsidiaries.

During the global financial crisis, Lindt closed fifty of its 80 retail outlets in the US.

The company has factories in Switzerland, Germany, France, Italy, Austria and the US.

Video – What is takeover?

This video explains what takeovers and acquisitions are, and how they are different from mergers.