Low wages are more common today than before the global financial crisis and the Great Recession that followed. The jobs gained during the economic rebound in the United States pay on average 23% less than those lost during the recession, says a new report released during The U.S. Conference of Mayors (USCM).

The average annual salary of jobs lost during the Great Recession was $61,637, compared to $47,171 for the jobs gained, i.e. a $93 billion loss in wages, says the IHS report.

The new jobs created after the 2001-2002 recession paid 12% less than the lost jobs; a much smaller gap than the current 23%.

U.S. Conference of Mayors President, Sacramento Mayor Kevin Johnson, said:

“While the economy is picking up steam, income inequality and wage gaps are an alarming trend that must be addressed. This Task Force, led by New York City Mayor Bill de Blasio, will recommend both national and local policies that will help to give everyone opportunity.”

“We cannot put our heads in the sand on these issues,” he said. “The nation’s mayors have an obligation to do what we can to address issues of inequality in this country while Washington languishes in dysfunction.”

Income gap between households increasing

The gap between low- and higher-income households is also widening, the report showed, and is likely to continue growing.

In 2012, the last year for which figures are available, 73% (261) out of 357 metros had a higher proportion of households making less than $35,000 annually (poorer households) than households earning $75,000+ (upper-income households).

The authors of the report predict that middle-income households will continue losing out as higher-earning households grab a larger share of income gains.

Median household income is forecast to rise by 2.5% in nominal dollars in 2014, and then by 3.8% each year from 2015 to the end of 2017. But mean (average) income is expected to increase more rapidly, by 2.7% in 2014 and 4.1% through 2017. Faster mean income growth compared to median income growth means income inequality is increasing.

Median income fell

According to the report, median income declined by 5.5% (adjusted for inflation) from 2005 to 2012.

New York City Mayor and Chair of the Mayors’ Cities of Opportunity Task Force, Bill de Blasio, said:

“The inequality crisis facing our cities is a threat to our fundamental American values. Reducing income inequality and ensuring opportunity for all is nothing less than the challenge of our times. As mayors, we are on the front lines and we must act now. The Cities of Opportunity Task Force is bringing mayors from all corners of the country together to work together and leverage the power of municipal governments to advance a national, common equity agenda, and to also encourage action on a federal level.”

Martin Walsh, the Mayor of Boston and Vice Chair of the Mayors Task Force, said:

“Recognizing that each city has both universal and unique challenges, we identified three areas in which many of us believe there can be short-term, meaningful impact. In addition to this work we are committing to do together, we will all continue to work in our respective cities on disparity across all policy areas.”

“In our conversations to date, we have identified additional factors related to housing, transportation, financial empowerment and a whole host of other issues that we plan to address moving forward. This is a long-term commitment for all of us, to effect lasting change in the lives of real people in our cities.”

40 years of widening income gap

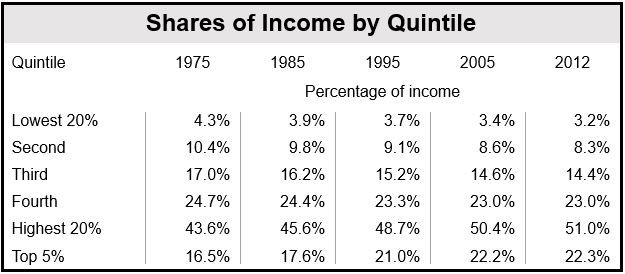

The authors pointed out that since 1975, the 20% of households with the highest incomes (highest quintile) have increased their share of income from 43.6% to 51% in 2012.

Most of the gain was captured by the highest 5% of incomes, which increased from 16.5% in 1975 to 22.3% in 2012, a gain of $490 billion in 2012 income.

(Data source: United States Conference of Mayors)

The 40% of households with the lowest incomes (lowest two quintiles) captured only 6.6% of income gains in the US since 2005, while the top 20% of earners grabbed 60.6% and the top 5% received 27.6%.

Director of US Regional Economics at IHS, Jim Diffley, who authored the report, said:

“Unless policies are developed to mitigate these trends, income inequality will only grow larger in the future.”

Growing inequality – not just in the United States

An OECD report published in July forecasts growing income inequality for the next three to five decades, plus a global economic slowdown.

In another report, the OECD said that inequality has persisted for the last thirty years in most member countries. The top 1% richest individuals have been capturing a progressively more disproportionate share of income growth.