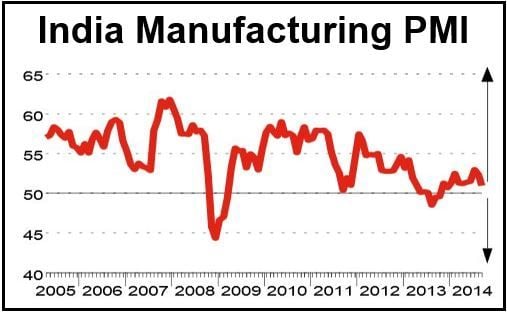

The India Manufacturing Purchasing Managers’ Index declined to a 9-month low of 51 in September from 52.4 in August, according to a report published by Markit Economics and HSBC on Wednesday.

Any reading above 50 suggests manufacturing activity is growing, while a posting below 50 points to lower output. Therefore, a reading of 51 points still means manufacturing activity in September grew, but the figure was much closer to fifty than in the previous nine months.

September’s output figure marks the eleventh successive month of growth.

According to Markit Economics, domestic orders in India expanded at a weaker pace, which encouraged manufacturers to meet demand by exhausting inventories. Growth in new orders from abroad accelerated in September.

India’s pro-business Prime Minister, Narendra Damodardas Modi, came into office in May 2014 after winning a landslide election victory. His administration has introduced much-needed policy changes, which have sparked growing optimism that the economy will rebound.

(Source: Markit Economics)

Inflation, which has been a problem for manufacturers in India, eased significantly in September. The authors of the report stressed, however, that it is still too high.

The Reserve Bank of India, the country’s central bank, is likely to continue trying to focus on keeping price rises under control, despite growing pressure to boost GDP (gross domestic product).

Frederic Neumann, Co-Head of Asian Research at HSBC, said:

“Manufacturing activity continues to slow amid weaker output and new order flows. Responding to the slowdown, firms lowered purchases and trimmed inventories. On the positive side, the rate of cost inflation decelerated sharply and output prices were unchanged.”

“The central bank is likely to look beyond the near term moderation and keep policy rates elevated so as to reign in entrenched inflation expectations. The RBI would rather see growth recover supported by supply side reforms than through monetary policy stimulus.”