Oil exploration in the UK Continental Shelf (UKCS) is at an all-time low ‘with no sign of improving’, according to the Oil & Gas UK’s 2016 Activity Survey.

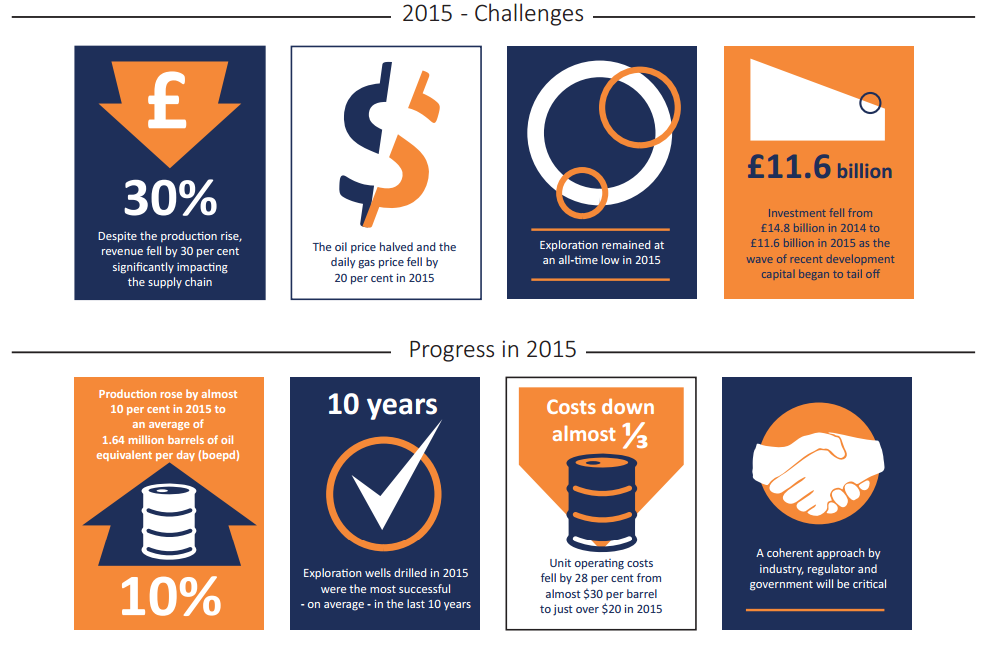

Production in the North Sea rose 9.7 percent in 2015 to 1.64 million barrels of oil equivalent per day (boepd). Despite the improvement in production, revenues dropped by 30 percent between 2014 and 2015 to 18.1 billion. The increase in production reflects the ‘significant expenditure’ of approximately £100 billion over the previous five years – before the price slump.

Exploration and appraisal remains at an all-time low

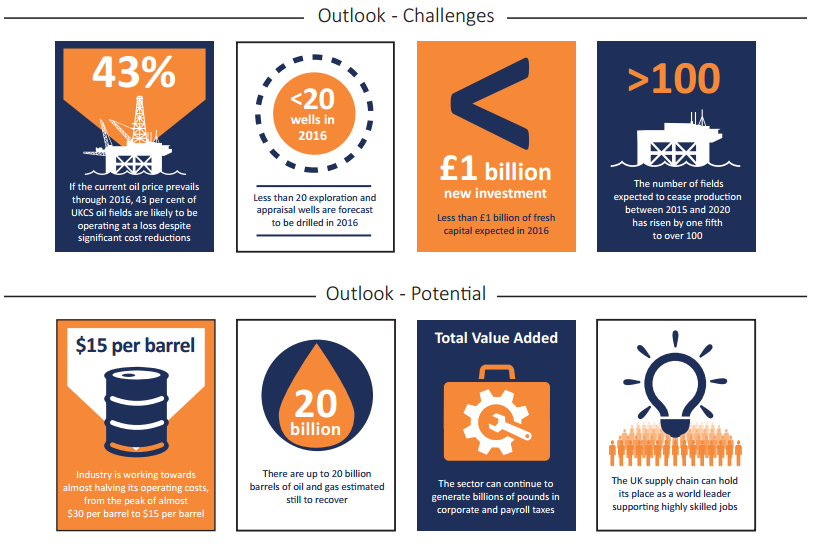

Exploration and appraisal activity fell to its lowest level in 45 years. Just 13 exploration wells and 13 appraisal wells were drilled, most of which were committed prior to 2015. The report says that as few as six to nine wells are currently forecast for 2016 – this drop is driven by budget constraints and a consequence of the recent low rate of exploration.

Less investment in new projects

Total capital expenditure dropped in 2015 from £14.8 billion in 2014 to £11.6 billion. Capital expenditure is forecast to drop even more this year down to around £9 billion.

According to the report, less than £1 billion of fresh capital in new projects is forecast to be sanctioned, down from an average of £8 billion per year over the last five years.

The UK Continental Shelf is entering a phase of ‘super maturity’

Oil & Gas UK’s chief executive, Deirdre Michie, said: “The UKCS is entering a phase of ‘super maturity’. While the industry’s decades of experience provide great depths of knowledge and expertise which can be applied to recover the still significant remaining resource, the report highlights the challenges that the falling oil price poses in our capability to maximise economic recovery of the UK’s offshore oil and gas.”

Deirdre Michie continued: “The basin has to compete fiercely in the global market to attract price-constrained capital to the UK. A coherent approach by the industry, regulator and Government will be critical to boost the industry’s competitiveness and its investors’ confidence.

“Together we need to transform the basin into a highly competitive, low tax, high activity province, which is attractive to a variety of operators and sustains and supports the important supply chain based here. It is absolutely crucial that the recently announced Aberdeen City Region Deal and funding for the Oil and Gas Technology Centre, which will help support the industry in the longer term, is accompanied by the right signals in relation to the tax regime.

“The industry currently pays special taxes at a headline rate of 50 per cent (67.5 per cent for fields paying PRT). A significant permanent reduction in those rates is now urgently needed, a move which would be consistent with HM Treasury’s ‘Driving Investment’ plan for fiscal reform. This should be combined with additional measures to help unlock the late-life asset market and encourage exploration by permanently removing the special taxes from all discoveries made over the next five years. Finally, improving the effectiveness of the Investment Allowance would stimulate activity in the short term and attract fresh investment.”

Deirdre Michie concluded: “We have a huge task ahead but the prize is worth fighting for. The UKCS still holds up to 20 billion boe which can continue to provide a secure supply of energy for the country, support hundreds of thousands of jobs, generate several billion pounds in corporate and payroll taxes from the supply chain and stimulate countless technological innovations.”