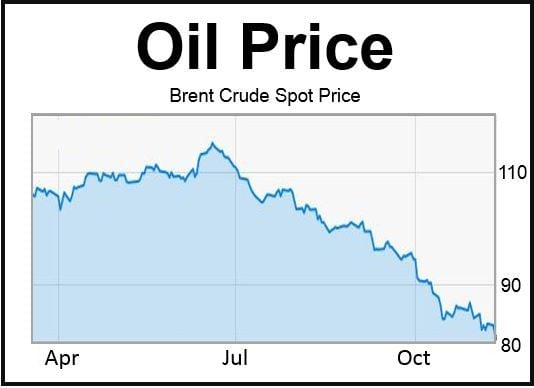

The oil price decline that started in June this year is set to continue, warns the Paris-based International Energy Agency (IEA), in its latest oil market report.

The energy watchdog said on Friday that according to supply and demand balances “the price rout has yet to run its course.” In fact, the IEA says that further downward pressure in the first half of 2015 is highly likely.

With China’s economic growth slowing down and US shale output rising, the oil market has entered a new era, the IEA wrote.

In its latest monthly report – “Oil Market Report” – the IEA informed that in October global oil supply increased by 350,000 barrels per day to 94.2 million barrels per day (mb/d). This was 2.7 mb/d higher than in October 2013, with non-OPEC production increasing 1.8 mb/d over the same period.

OPEC’s oil production in October was 30.6 mb/d, which was higher than its sixth-month supply target of 30 mb/d.

OPEC’s oil ministers next meet on November 27th. Since their last get-together in June, oil prices have plunged by 30%.

Since its June peak, the price of oil fell 30% and will continue declining, says the IEA (Source: YCharts)

OPEC will be under pressure to sharply reduce production when ministers meet. However, its main producers may not be so keen to do so for fear of losing market share to US shale oil drillers.

The IEA predicts that non-OPEC production increase will ease to 1.3 mb/d next year.

Estimates for 2014 oil demand at 92.4 mb/d and 93.6 mb/d in 2015 remain the same, says the IEA. “Projected growth will increase from a five‐year annual low of 680 kb/d in 2014 to an estimated 1.1 mb/d next year as the macroeconomic backdrop is expected to improve,” the IEA wrote on Friday.

The IEA informs that OECD industry oil stocks built counter-seasonally to 12.6 million barrels in September. Their deficit versus average levels, after rising rapidly earlier in 2014, declined to its narrowest in 18 months. The watchdog added “Preliminary data show that despite a 4.2 mb draw, stocks swung into a surplus to average levels in October for the first time since March 2013.”

The effects of high or low oil prices

Years of high oil prices have helped fuel R&D into new technology, which has resulted in more oil resources today being exploited, such as shale output.

At the same time, the US shale oil and gas boom has pushed down prices, which will eventually bite too hard into margins, forcing many businesses to close down. This will eventually result in reduced supply and higher oil prices again.