Rising oil production in North America and Brazil is reducing the role of OPEC in the global oil market, a situation that will continue until the middle of the next decade, according to World Energy Outlook 2013, a study published by the International Energy Agency (IEA).

The study adds, however, that the Middle East will regain its dominant role as the main source of oil production growth around the middle of the 2020s.

According to the report, global energy demand will increase by approximately one third by 2035.

Global energy demand is shifting to Asia, with China being the main driver. However, by the mid 2020s India and other Southeast Asian countries will will become the new major contributors to energy demand growth.

By 2020, the Middle East is expected not only to have recouped its global oil production dominance, it will most likely become the second-largest gas consumer in the world, and by 2030 the third largest oil consumer.

Despite accelerating oil production during the rest of this decade and 80% higher energy use by 2035, Brazil will continue to be one of the least carbon-intensive energy countries worldwide.

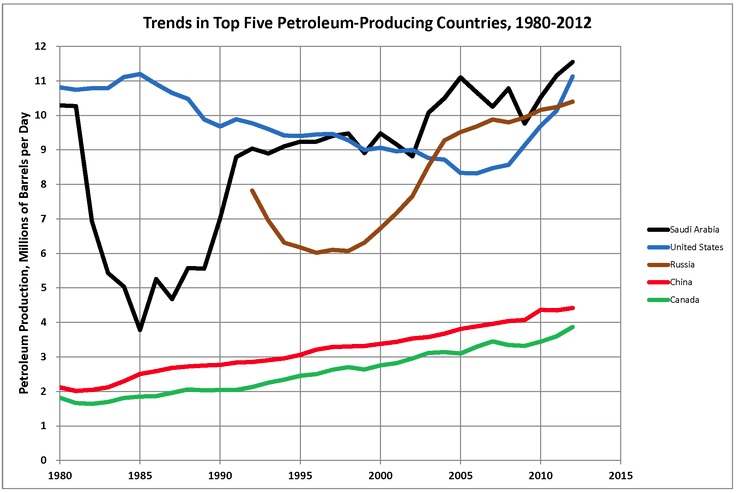

US oil production is expected to overtake Saudi Arabia’s in 2015. (Source: IEA)

OECD’s share of energy demand progressively falling

Energy demand by OECD member countries will remain virtually the same by 2035; by then non-OECD nations will be consuming twice as much energy as OECD countries.

By 2035, the report estimates that approximately 40% of the growth in worldwide energy demand will be met by low-carbon sources. In some parts of the world “rapid expansion of wind and solar PV raises fundamental questions about the design of power markets and their ability to ensure adequate investment and long-term reliability,” the IEA writes.

Maria van der Hoeven, IEA Executive Director, said:

“Major changes are emerging in the energy world in response to shifts in economic growth, efforts at decarbonisation and technological breakthroughs. We have the tools to deal with such profound market change. Those that anticipate global energy developments successfully can derive an advantage, while those that do not risk taking poor policy and investment decisions.”

Energy – a strategic industry

Having available and affordable energy is a vital, strategic element for a country’s economic well-being, and for many nations it is also important for industrial competitiveness.

US natural gas trades at ⅕ of import prices to Japan and ⅓ to Europe. Electricity prices cost consumers at least twice as much in Japan or Europe as it does in the United States; even Chinese industry is paying at double US prices.

According to World Energy Outlook 2013, energy price variations will persist up to 2035 – this will impact on corporate strategies and investment plans in energy-intensive industries.

By 2035, the US will have a slightly greater share of global exports of energy-intensive goods, which clearly demonstrates the close link between comparatively low energy prices and industrial expectations.

European nations and Japan, on the other hand, will see declining shares of global exports, possibly (combined) one-third less than today.

IEA Chief Economist, Dr. Fatih Birol, said “Lower energy prices in the United States mean that it is well-placed to reap an economic advantage, while higher costs for energy-intensive industries in Europe and Japan are set to be a heavy burden.”

Energy subsidies

The report says that policy makers may minimize the impact of high energy prices by focusing on energy efficiency, which is being currently undermined because of market barriers.

Fossil-fuel subsidies, which the authors describe as “pervasive”, encourage wasteful consumption, estimated to cost $544 billion last year.

Regional price differentials could be significantly reduced if countries moved more rapidly towards a global gas market. The IEA writes “Gas market and pricing reforms in the Asia-Pacific region and LNG exports from North America can spur a loosening of the current contractual rigidity of internationally traded gas and its indexation to high oil prices.”

Reducing energy prices and climate change

Taking measures to reduce the effects of expensive energy prices does not have to mean abandoning climate-change efforts. CO2 emissions linked to energy production/consumption are forecast to increase by 20% by 2035, which most likely means a future global temperature rise of 3.6 °C – overshooting the 2 °C internationally-agreed target.

The authors stress the importance of switching the subsidies over to renewables, which should ideally increase from $101 billion in 2012 to $220 billion by 2035.

Oil production boosted by new technology

The report discusses how new technology is making other types of resources available, including light tight oil and ultra-deepwater fields, options that used to be considered too expensive or difficult to access.

National governments and state-owned oil companies still control four-fifths of global proven-plus-probable oil reserves, despite new resources becoming available.

The IEA added “The pace of oil demand growth slows steadily, from an average of 1 mb/d per year to 2020 to just 400 kb/d thereafter, as high prices encourage efficiency and fuel switching, and the decline in OECD oil use accelerates.”

Not only is the oil consumption balance shifting eastwards, but so too is refining capacity in the Middle East and Asia. However, in several OECD nations declining demand is placing growing pressure on the refining industry. By 2035 nearly 10 mb/d of worldwide refinery capacity will face closure or low utilization rates. The report sees Europe as being “particularly vulnerable”.