The pound sterling, which is worth 11% less now than before the Brexit vote on 23rd June, is set to plunge further during the coming week if the Bank of England (BoE) cuts interest rates – something everyone across the country is 99% sure will happen.

The pound has weakened considerably against all the thirty-one major currencies since Britons voted to leave the European Union.

During the referendum campaign, the Remain camp plus George Soros, who made billions in the 1990s when the UK left the European exchange rate mechanism, warned that the pound would take a beating. The Leave campaigners accused them of scaremongering. Clearly those who had predicted devaluation were right.

According to the Bank of England: “Interest rates are set by the Bank’s Monetary Policy Committee. The MPC sets an interest rate it judges will enable the inflation target to be met. It is made up of nine members – the Governor, the three Deputy Governors for Monetary Policy, Financial Stability and Markets & Banking, the Bank’s Chief Economist and four external members appointed directly by the Chancellor. (Image: Bank of England)

According to the Bank of England: “Interest rates are set by the Bank’s Monetary Policy Committee. The MPC sets an interest rate it judges will enable the inflation target to be met. It is made up of nine members – the Governor, the three Deputy Governors for Monetary Policy, Financial Stability and Markets & Banking, the Bank’s Chief Economist and four external members appointed directly by the Chancellor. (Image: Bank of England)

Emerging data suggests outlook for UK not good

A raft of business and economic data and statistics over the past four weeks points to a looming slowdown in the British economy. The Bank of England is aware of the signs pointing to threats to economic growth and employment, and is expected to take steps by reducing interest rates.

When interest rates in a country rise, its currency tends to increase in value, but when they fall, the currency typically drops too.

The BoE’s Monetary Policy Committee, which meets twelve times a year to decide the official interest rate, has its next meeting on 4th August. Most bets are on a loosening of monetary policy.

In a Bloomberg survey of forty-six economist, 44 predicted that the Monetary Policy Committee (MPC) will vote to reduce interest rates from a record-low 0.5%.

In an interview with Bloomberg Markets, Lee Hardman, a foreign exchange strategist at Bank of Tokyo-Mitsubishi UFJ Ltd. in London said:

“I think it’s a done deal that we’re going to get easing next week, but the question is just how aggressive. If we get a package of measures and not just a rate cut it will reinforce the weakening trend for the pound.”

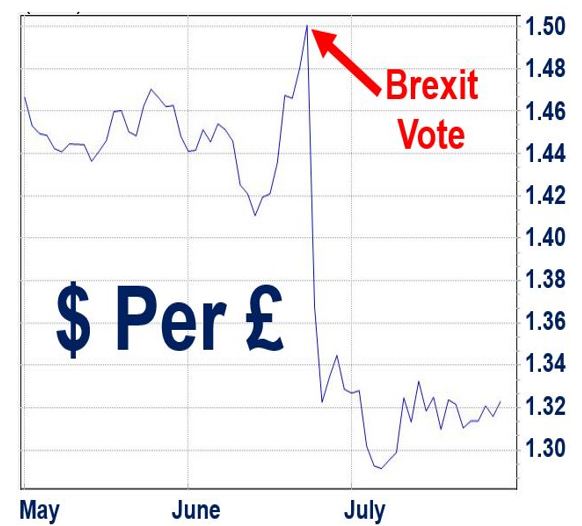

As the referendum date neared, the pound started to rise because everybody thought the electorate would vote to remain in the EU. When it became clear that Britons had voted for Brexit, the pound plummeted. (Image: adapted from moneyweek.com)

As the referendum date neared, the pound started to rise because everybody thought the electorate would vote to remain in the EU. When it became clear that Britons had voted for Brexit, the pound plummeted. (Image: adapted from moneyweek.com)

Hardman believes the pound will continue sliding during the rest of the year, ending 2016 at $1.24, which would be a 31-year low.

Hawk becomes dovish

BoE arch-hawk Martin Weale is now supporting immediate stimulus, which for some has turned the speculation of a cut in interest rates into a certainty. Swaps signaled a 100% likelihood of a rate cut on 4th August.

Will Peters, writing in Pound Sterling Live, believes that taking a big position on the pound would be foolish.

Britain’s central bank is currently the single most important factor for its currency’s outlook, because any policy measure taken (or not taken) will affect demand for UK assets directly, particularly bonds.

Should the MPC vote to cut interest rates, demand for UK debt should diminish as the yield offered to international investors would be cut.

Currency specialists expect the MPC to reduce the interest rate to 0.25% – anything more or less would probably trigger a currency reaction, they say.

BoE Governor Mark Carney may in a ‘whatever it takes’ moment encourage cutting interest rates while also ordering the central bank to purchase more government debt.

Writing in the Financial Times, Neil Collins believes that cutting the bank rate from 0.5% would be a ‘futile gesture’. The main banks have already inserted clauses warning their commercial customers that they may have to pay to hold their cash in the bank, provoking an understandable outcry – ‘You want me to pay you to hold my money?!’

Mr. Collins wrote:

“In the real world, halving the rate would make no difference to confidence or the plans of borrowers.”

The Bank of England, which already owns one third of Britain’s national debt, would drive down yields still further if it opted for additional quantitative easing, which would intensify the pain for pension funds. Rather than investing in productive assets, companies would be forced to compete with the Bank of England to purchase more ‘risk-free’ bonds.

Consumer confidence plummets

Earlier this week, GfK published its Consumer Confidence Index for July, which showed a nosedive of 11 points. Consumer confidence dropped steeply immediately after the Brexit vote, and then continued to slide through the whole of July.

British consumer confidence suffered its steepest decline in over twenty-six years.

The Index authors said that since the Brexit vote, British consumers have become increasingly concerned about their own personal finances, job prospects and their country’s economy.

Purchasing Manager’s Index

The Markit Purchasing Manager’s Index (PMI), a strong indicator of the health of a country’s economy, has deteriorated significantly since the electorate voted to leave the European Union.

The Markit PMI plunged to 47.7 points in July, its lowest level in more than seven years.

The PMI, which is based on five key indicators – the employment environment, supplier deliveries, new orders, inventory levels and production – tells us how an economy’s manufacturing and service sectors are doing.

Any reading above 50 means that business activity is growing, while one below fifty means it is shrinking. July’s PMI figures showed that both the manufacturing and service experienced a drop in orders and output.

In an interview with Reuters, Chris Turner, an ING currency strategist said:

“All the confidence surveys have been dire, but they’ve already been priced in. So we need something new now, and that is probably the Bank of England response,” said ING currency strategist Chris Turner.”

“We think they will go large and early, and sterling will weaken to $1.27-1.28 towards the end of next week on the back of that.”

Mr. Turner, like most analysts, believes the MPC will vote for a 25-basis-point rate cut (from 0.5% to 0.25%). He also thinks there will be a fresh round of asset purchases.

In a note to clients, a BNP Paribas currency strategist wrote:

“Our economists expect the BoE to cut rates by 25 basis points and announce 50 billion pounds of asset purchases.”

“While easing is now mostly priced into markets for next week’s meeting, markets could be underpricing easing further out the curve, as highlighted by comments from two former BoE policymakers this week that a UK slowdown could warrant a move to negative rates.”

Video – Brexit’s impact on the pound sterling

In this Fox Business video, Jane Foley, a senior currency strategist at Robobank International, talks about the British pound and the impact of Brexit. Brexit is a term that emerged when it became clear that there would be a referendum regarding staying or leaving the EU. It is a blend of the words Britain and Exit.