Private landlords got £9.3bn from the tax payer in Housing Benefit in 2015, which is more than twice as much as the £4.6bn received ten years ago, says a new report published by the National Housing Federation (NHF).

According to the NHF, there are two reasons for this huge increase:

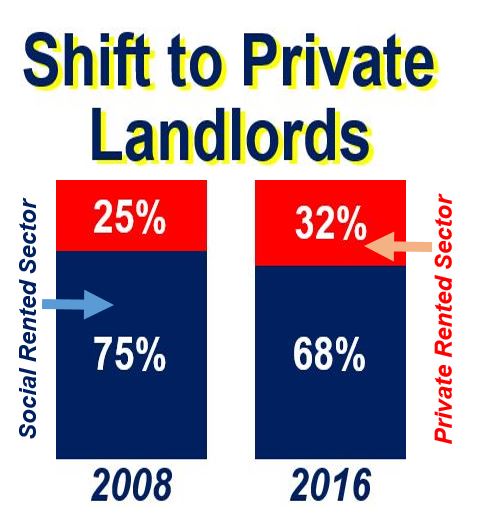

1. Since 2008, the overall number of private renters who receive Housing Benefit has risen by 42%.

2. The total claimed in Housing Benefit in the private rented sector (PRS) is considerably higher than in the non-profit housing association sector.

Housing Benefit: changing tenure distribution in UK. This shift towards the private rented sector is costly for the taxpayer, because private landlord rents are more expensive than those of social housing. (Data Source: pub.housing.org.uk)

Housing Benefit: changing tenure distribution in UK. This shift towards the private rented sector is costly for the taxpayer, because private landlord rents are more expensive than those of social housing. (Data Source: pub.housing.org.uk)

Costs: private landlords vs. housing associations

Housing a family in a PRS costs £21 per week more than in a social home, i.e. £110 overall versus £89.

The amount per year being spent per family in the PRS (£5,705) is more than £1,000 greater compared to a family in the social rented sector (£4,638). In London, the difference is £64 per week (£3,000 per year).

There is a growing shortage of affordable housing in the UK, which means that more people and a wider group of individuals need Housing Benefit.

Forty-seven percent of all families that claim Housing Benefit in the PRS have jobs – this is nearly twice the percentage recorded in 2008 (26%). Recipients of Housing Benefit who pay rent to private landlords now earn an average $4,000 more than in 2008.

While the size of Housing Benefit awards in the PRS is greater across all the country’s regions, the biggest difference between PRS and social renter sector spend is in London and the South East. (Data Source: pub.housing.org.uk)

While the size of Housing Benefit awards in the PRS is greater across all the country’s regions, the biggest difference between PRS and social renter sector spend is in London and the South East. (Data Source: pub.housing.org.uk)

Using private landlords costs £1.5bn more

If all the PRS tenants who receive Housing Benefit lived in affordable housing, the taxpayer would save £1.5 billion each year, which would have amounted to £15.6 billion over the past seven years.

Not only are homes in PRS expensive, they are also of lower quality compared to non-profit housing association homes. One in every three homes in the PRS fails to meet the English Housing Survey’s decent homes standard.

David Orr, National Housing Federation’s CEO said regarding the amount spent by taxpayers:

“It is madness to spend £9 billion of taxpayers’ money lining the pockets of private landlords, rather than investing in affordable homes.”

“Housing associations want to build the homes nation needs. By loosening restrictions on existing funding, the Government can free up housing associations to build more affordable housing at better value to the taxpayer and directly address the housing crisis.”

Housing benefit to private landlords has doubled.Housing associations ready to build more affordable homes @SkyNews pic.twitter.com/MK4cA11VYE

— National Housing Fed (@natfednews) 20 August 2016

As a proportion of overall benefit expenditure, Housing Benefit expenditure has been progressively increasing. Today it accounts for 14% of the total benefit bill.

This growth is mainly due to the increasing number of private renters – many of them in full-time jobs – receiving Housing Benefit.

The amount spent on Housing Benefit in the private sector has increased particularly fast in the aftermath of the 2008 financial crisis, reaching its peak in 2011/2012, after which it started to decline.

According to a Department of Work and Pension forecast, the amount spent in the private sector is expected to stabilise at approximately £9 billion per year over the next five years.

Video – Private Landords getting billions

This Sky News video reports on how taxpayers are giving more than twice as much to private landlords today in Housing Benefits compared to ten years ago.