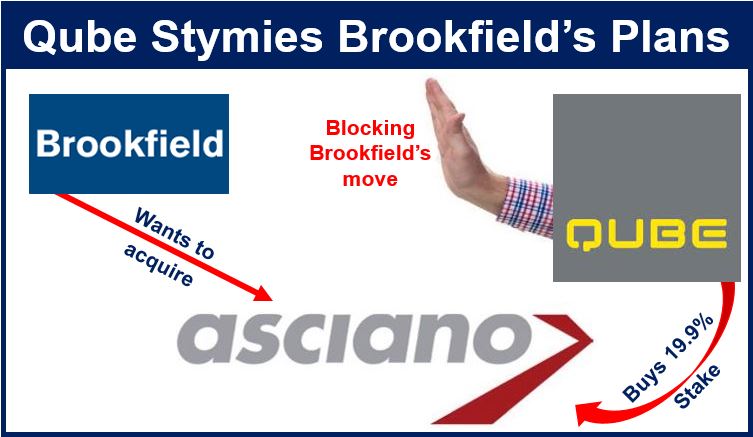

Sydney-based Qube Holdings Ltd., a diversified logistics and infrastructure company, has acquired an almost 20% stake in Melbourne-based Asciano Ltd., a freight logistics company, operating in railway freight and shipping.

The acquired stake could potentially block a bid from a large Canadian rival, Toronto-based Brookfield Asset Management, Inc., according to the media in both Australia and Canada.

Seventy-five percent of stockholders need to vote in favor for the takeover to go through.

According to the Sydney Morning Herald, Qube made an off-market raid for Asciano’s stocks at $8.80, with the help of two co-investors, through UBS. The co-investors are Canada’s Pension Plan Investment Board and Global Infrastructure Partners.

Qube’s move effectively puts an end to Brookfield’s plans.

Qube’s move effectively puts an end to Brookfield’s plans.

Reuters Canada quoted an unnamed source who said “(QUBE has) acquired just short of 20 percent of Asciano,” adding that the new shareholder aimed to vote against the proposed acquisition.

Brookfield Asset Management wanted to buy Asciano for $6.5 billion, which would have been Australia’s largest inbound deal since 2011 and the biggest buyout ever of an Australian company by a Canadian firm.

The Australian Competition and Consumer Commission (ACCC), the country’s competition regulator, had expressed antitrust concerns earlier in October, saying the deal would have given the merged entity rail network and train operations in two of Australia’s eight states.

A final ruling will be given by December 17th, 2015, the ACCC said.

Qube, which had considered taking over Asciano’s Patrick container ports a few months ago, would take the ports, while the co-investors would take its Pacific National rail haulage business.

This is bad news for Brookfield. Having been forced to pause by the competition regulator, it now faces a challenge by the owner of a blocking shareholding whose investment plan is built on the disintegration of Asciano.