The European Commission has imposed fines totaling €1,712,468,000 on eight international financial institutions for taking part in illegal cartels in markets for financial derivative in Europe.

The Commission says four banks were involved in interest rate rigging involving the euro currency and six in at least one bilateral cartel involving interest rate derivatives denominated in Japanese yen.

According to Article 53 of the EEA (European Economic Area) Agreement and Article 101 of TFEU (Treaty on the Functioning of the European Union), such collusion is illegal.

The Commission initially imposed a higher fine, which was reduced by 10% when the institutions agreed to settle.

Commission Vice-President in charge of competition policy, Joaquín Almunia, said:

“What is shocking about the LIBOR and EURIBOR scandals is not only the manipulation of benchmarks, which is being tackled by financial regulators worldwide, but also the collusion between banks who are supposed to be competing with each other.

Today’s decision sends a clear message that the Commission is determined to fight and sanction these cartels in the financial sector. Healthy competition and transparency are crucial for financial markets to work properly, at the service of the real economy rather than the interests of a few.”

Banks and companies use interest rate derivatives for managing interest rate fluctuation risks, examples include futures, swaps, and forward rate agreements. They are traded globally and play a key role in the worldwide economy

Interest rate derivatives are called “derivatives” because their value is derived from the level of a benchmark interest rate, such as LIBOR (London interbank offered rate) or EURIBOR (Euro interbank offered rate). LIBOR is used for a wide range of currencies, including the Japanese yen.

The benchmarks (interest rates) reflect an average of quotes that are submitted daily by panel banks (member of a panel). They serve as a reference for calculating the cost of interbank lending in a specific currency, and are also used as a basis for a range of financial derivatives.

Financial institutions are supposed to compete with one another for the trading of these derivatives. These benchmark levels may affect how much money a bank receives from a counterparty or how much cash it needs to pay to the counterparty according to the interest rate derivatives contracts.

Rate rigging in Euro interest rate derivatives (EIRD)

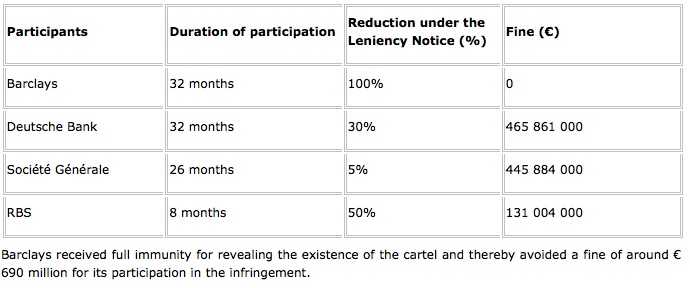

According to the Commission, “The EIRD cartel operated between September 2005 and May 2008. The settling parties are Barclays, Deutsche Bank, RBS and Société Générale.”

Rather than compete against each other, the cartel aimed at distorting the normal course of pricing components of these derivatives. “Traders of different banks discussed their bank’s submissions for the calculation of the EURIBOR as well as their trading and pricing strategies.”

The Commission started its investigation in October 2011 with surprise inspections and opened proceedings in March 2013. Barclays escaped a fine because it revealed the existence of the cartel to the Commission, which granted it immunity under the 2006 Leniency Notice.

Société Générale, Deutsche Bank and RBS (Royal Bank of Scotland) received two reductions in their fines, one for cooperating in the investigation and another for agreeing to settle the case with the Commission.

The Commission added “In the context of the same investigation, proceedings were opened against Crédit Agricole, HSBC and JPMorgan and the investigation will continue under the standard (non-settlement) cartel procedure.”

The EIRD cartel fines are as follows:

(Source: European Commission)

Rate rigging in Yen interest rate derivatives (YIRD)

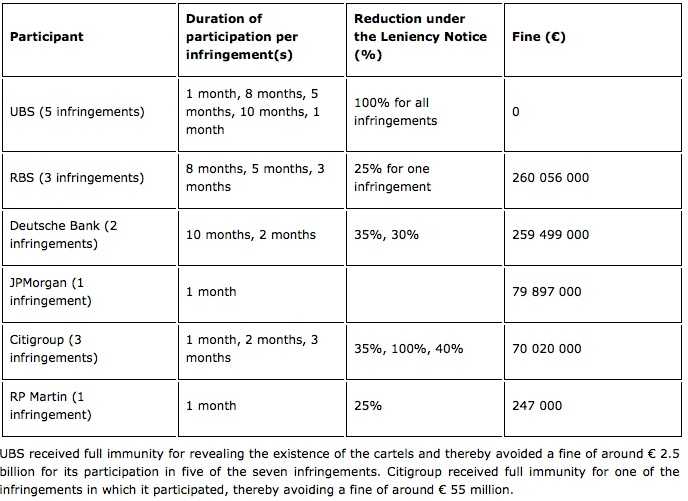

Seven distinct bilateral infringements were uncovered by the Commission in the YIRD sector, lasting from 1 to 10 months over the 2007 to 2010 period.

Traders working at participating banks colluded over certain Japanese yen LIBOR submissions. The traders also revealed commercially sensitive information to each other regarding either their trading positions or future Japanese yen LIBOR and Euroyen TIBOR submissions.

The following banks were involved in at least one of the YIRD illegal activities: JPMorgan, Citigroup, Deutsche Bank, RBS, and UBS. The Commission added “The broker RP Martin facilitated one of the infringements by using its contacts with a number of JPY LIBOR panel banks that did not participate in the infringement, with the aim of influencing their JPY LIBOR submissions.”

Proceedings opened in February 2013. UBS was granted full immunity for disclosing to the Commission the extent of the infringements. Citigroup was granted immunity for one infringement.

RP Martin, RBS, Deutsche Bank and Citigroup received two reductions in their fines, one under the Commission’s leniency program and the other for agreeing to settle the case.

The YIRD cartel fines are as follows:

(Source: European Commission)

Further penalties possible

The European Commission says it is pursuing cartel proceedings against a number of major financial institutions, including JP Morgan, Credito Agricole and HSBC Holdings.