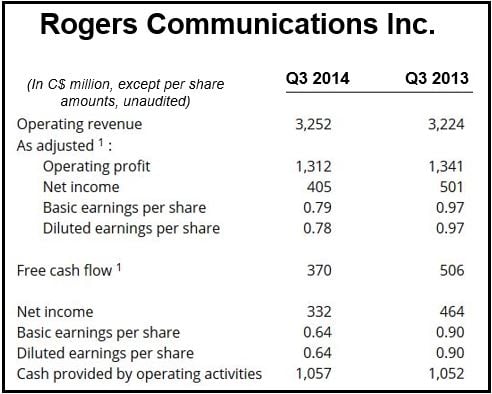

Canadian communications and media company Rogers Communications Inc. posted a 28% fall in profit for the third quarter. It reported net income of $332 million (64 cents per share), compared to $464 million (90 cents a share) in Q3 2013.

The company says it is pushing ahead with restructuring that is aimed at improving its long-term performance.

Adjusted profits, at 78 cents a share, were lower than analysts’ estimate of 84 cents. Revenue, however, at $3.25 billion, was more-or-less within expectations.

CEO Guy Laurence, who joined the firm in December 2013, said the last quarter’s results were within what the board of directors had been expecting. Mr. Laurence has been pursuing a long-term plan to improve the company’s results.

The Toronto-based business reiterated its guidance for 2014, adding that its adjusted operating profit and free cash flow will probably come in at the lower end of the range.

In the third quarter, Rogers added 17,000 new postpaid subscribers to its wireless division, which were fewer than last year. Wireless revenue increased by 2% to $1.88 billion.

(Source: Rogers Communications Inc.)

At $864 million, cable revenue was 1% below the figure in Q3 2014. The firm lost 30,000 TV subscribers and is facing mounting pricing competition.

Its media unit, which includes TV and radio stations, print & digital publications, as well as the Toronto Blue Jays, posted revenues of $440 million (about the same as in Q3 2013).

Regarding third quarter results, Mr. Laurence said:

“During the third quarter, we completed the customer-centric structural reorganization we announced in May under Rogers 3.0 and are now up and running. The business is gaining momentum with the recent unveiling of our awesome new NHL experiences and with the launch in the coming days of our shomi subscription video on-demand service.”

“While it will take time to fully execute on our multi-year plan, Q3 results are where we expected them to be. Wireless revenue and postpaid ARPU profiles improved again this quarter and we continue to generate strong margins and operating cash flow.”