A second Pfizer AstraZeneca bid approach has been confirmed by the world’s largest pharmaceutical company. The first approach occurred in January 2014, and the second on Saturday, 26th April, 2014.

Pfizer said it had approached AstraZeneca in January with a bid worth £58.8 billion, which Britain’s second largest drugmaker turned down.

On January 5th, 2014, Pfizer had offered a combination of cash and shares, consisting of £46.61 ($76.62) per share and a considerable premium of about 30% to AZ’s closing share price of £35.86 on January 3rd.

On January 14th the initial talks “were discontinued and Pfizer then ceased to consider a possible transaction,” Pfizer wrote in a statement.

At the time AstraZeneca said the bid amount “significantly undervalued” the company, which employs 50,000 workers globally.

News that Pfizer had approached AZ during the weekend was reported by the Sunday Times, which quoted some merchant bankers who had asked to remain anonymous.

There is concern among British lawmakers that Pfizer will asset strip Astrazeneca, resulting in massive layoffs in the UK.

AstraZeneca says it can succeed alone

According to the British pharmaceutical firm, it was confident its strategy (turning Pfizer’s January bid down) was in the best interest of the company and that it could create “significant value” for shareholders without outside help. Today AZ stated “The Board remains confident in the ongoing execution of AstraZeneca’s strategy as an independent company.”

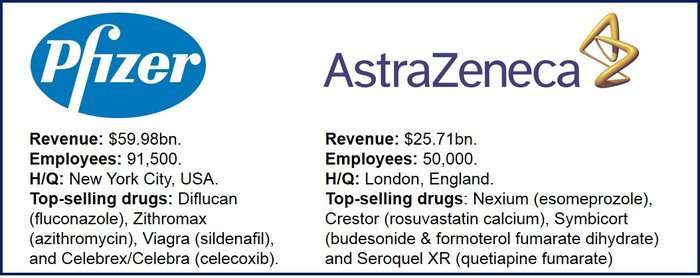

Pfizer is the largest drugmaker worldwide, and AstraZeneca the second biggest in the UK.

If this second Pfizer AstraZeneca bid approach is successful it will be the largest acquisition of a British company by a foreign firm.

According to AZ, Ian Read, Pfizer’s CEO and Chairman, contacted AZ’s Chairman Leif Johansson on April 26th, 2014. Mr. Read did not make any specific proposal regarding a bid for AZ. Even so, Pfizer requested that the two firms make a joint statement before markets opened on April 28th.

AZ wrote in a statement “The Board of AstraZeneca considered this request and concluded that, absent a specific and attractive proposal, it was not appropriate to engage in discussions with Pfizer.”

Pfizer said that if the acquisition is successful, the combined company would be listed on the New York Stock Exchange, and would have management in both the UK and US.

Read, who stressed a firm offer would only be made after a unanimous vote by AZ directors, said:

“We have great respect for AstraZeneca and its proud heritage. The strategic, business and financial rationale for a transaction is compelling.”

About AstraZeneca

AZ makes drugs in 16 nations around the world, concentrating on treatments for asthma, cancer, diabetes, and infections (antibiotics). In the United Kingdom it has 8 sites and employs 6,700 people.

In 2013 AZ reported sales of £25.7 billion and £3.3 billion in pre-tax profit. Patent expiries have led to a fall in sales of its blockbuster drugs. In order to reduce costs the company has laid off thousands of workers.

Q1 2014 profits were down, again because of patent expiries of its older drugs. At its annual general meeting, AZ faced shareholder protest at its executive remuneration package.

Is the Second Pfizer AstraZeneca bid approach a hostile move?

Acquiring AZ would give Pfizer access to a number of diabetes and cancer medications, as well as several pipeline (experimental) drugs.

However, for AZ’s board to vote unanimously in favor, Pfizer’s offer will need to be increased substantially.

In an interview with the BBC, Justin Urquhart Stewart, head of corporate development at Seven Investment Management, said regarding the bid value “It’s too close to what it is priced at in the market. They’ve tried to talk to the management and gain agreement but that’s not happened so they are considering now going directly to the shareholders”.

Rumors abound in US and UK media that an offer of about £49 per share would probably secure a deal. Most add that if AZ does not engage, the bid could turn hostile.