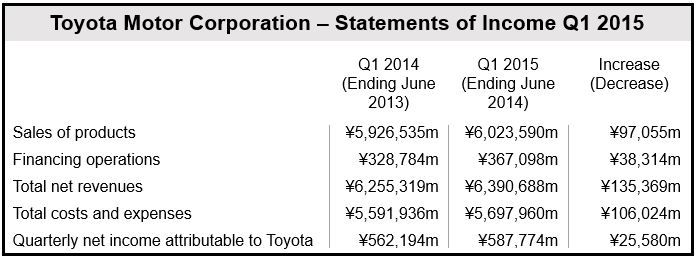

Japanese automaker Toyota Q1 group sales for 2015 increased by 2% to ¥6.39 trillion compared to Q1 2014, while net profit rose to ¥587 billion ($5.7 billion). Toyota’s fiscal year is from April 1 to March 30, hence last quarter (Apr-May-Jun) was Q1 2015.

First quarter sales in the Japanese market declined by almost 10%, reflecting lower consumer demand after the consumption tax hike on April 1.

Below is a breakdown of Q1 2015 sales compared to Q1 2014, according to region:

- North America: increased by 21,753 units to 710,409. Operating income (excl. gains/losses from interest rate swaps) rose by ¥46.1 billion to ¥149.7 billion. Sales of SUVs (sports utility vehicles) were especially strong.

- Europe: rose by 14,970 units to 207,481, i.e. 9.3% growth. Operating income reached ¥10.8 billion compared to ¥5.6 billion in Q1 2014.

- Asia: sales increased by 9,490 units to 385,376. Operating income rose by ¥6.2 billion to ¥110.3 billion.

- Rest of the world (excluding Japan): sales reached 432,192 units, a rise of 2,143. Operating income fell by ¥8.4 billion to ¥34 billion.

Vehicle recalls

In its earnings press release, Toyota did not mention whether the recent vehicle recalls might affect future finances. The world’s largest carmaker has recalled 2.79 million vehicles so far this year because of faulty airbags.

In March 2013, a $1.2 billion settlement was reached with US regulators after a criminal probe into the recall of over 10 million vehicles with several defects, including problems with floor mats, accelerator pedals and brakes.

(Data source: Toyota Motor Corporation)

Outlook

Toyota’s forecast for consolidated vehicle sales for the whole year is the same as March’s estimate of 9.1 million units.

The Tokyo-based carmaker predicts whole year consolidated net revenue and net income will reach ¥25.7 trillion and ¥1.78 trillion respectively, assuming an exchange rate of ¥101 per $1 and ¥136 per €1.

Toyota gave no indication of what its future investment plans are. It had previously said it will not be building any new plants until 2016. It has a global production capacity of approximately 9.8 million vehicles.

Weaker yen favored Toyota more than rivals

The declining yen benefitted Toyota more than its other Japanese rivals, because it moved less production abroad. As a comparatively higher proportion of the company’s total costs base was in yen, its bottom line received a greater boost when the currency fell. Approximately 49% of its worldwide vehicle production is based in Japan, compared to Nissan’s 27%.

As the yen’s slide has recently slowed down significantly, Toyota’s profits are expected to be fairly flat during the next couple of quarters.