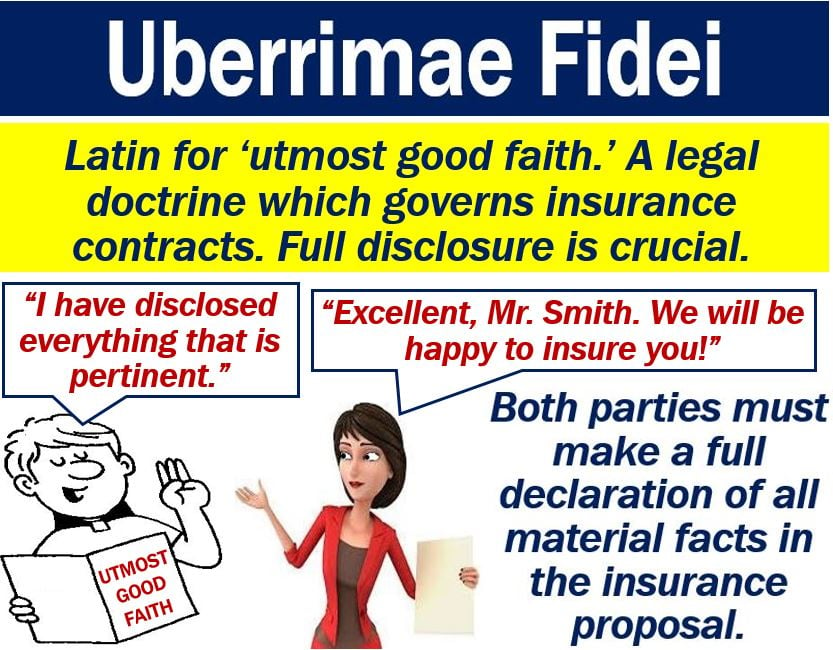

What is uberrimae fidei? Definition and examples

Uberrimae fidei or uberrima fides refers to insurance contracts. The policy applicant must disclose all material facts and surrounding circumstances. The applicant must be open about anything that could influence the decision of the insurance company. If the applicant does not disclose all material facts, the insurance contract becomes voidable.

Voidable means that it could be declared void, i.e., not valid. Uberrimae fidei is Latin for ‘utmost good faith’ (literally ‘most abundant faith’).

Put simply; the term means that every party in a contract must deal in good faith.

Uberrimae fidei contrasts with the term caveat emptor, which means ‘let the buyer beware.’ Caveat emptor is a contract law principle that governs, for example, the sale of real estate property. Caveat emptor is also a disclaimer

The International Risk Management Institute says that insurers execute documents in good faith. They presume full disclosure from both contracting parties. Specifically, full disclosure of all pertinent facts.

The Law Dictionary has the following definition of the term uberrimae fidei:

“Latin for in utmost good faith. It implies that the insured will disclose all relevant information to the insurer. The insured must also fulfill all obligations of the contract.”

Uberrimae fidei – insurance contracts

The insurance industry expects a higher duty from the parties in its contracts than from parties in most other contracts.

Lord Mansfield (1705-1793), a British politician and legal expert, first stated the principles underlying this rule. Lord Mansfield wrote:

“Insurance is a contract of speculation… The special facts, upon which the contingent chance is to be computed, lie most commonly in the knowledge of the insured only: the under-writer trusts to his representation, and proceeds upon confidence that he does not keep back any circumstances in his knowledge, to mislead the under-writer into a belief that the circumstance does not exist…”

“Good faith forbids either party by concealing what he privately knows, to draw the other into a bargain from his ignorance of that fact, and his believing the contrary.”

Uberrimae fidei – full disclosure

The insured, therefore, must disclose the exact nature and potential risks that the insurer will assume.

Risk refers to the probability or threat of injury, damage, loss, liability or any other undesirable occurrence.

Full disclosure is vital because the insured is transferring the risk and its financial consequences to the insurer.

Meanwhile, the insurer must also make sure that the potential contract matches the needs of the insured. The insurer must also ensure that the right benefits are in place for the insured.

Reinsurance contracts require the highest level of uberrimae fidei. In fact, reinsurance companies consider ‘utmost good faith’ as the foundation of their industry.

Reinsurers say it is an essential component of today’s marketplace. In this context, ‘marketplace’ means the same as the abstract meaning of ‘market.’