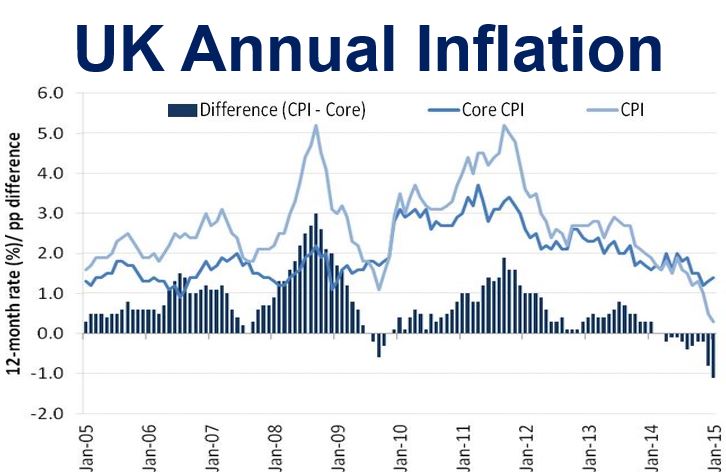

The UK’s annual inflation rate slid further to 0.3% in January from 0.5% in December and 1% in November, according to figures published by the Office for National Statistics on Tuesday.

Mark Carney, the Governor of the Bank of England, warned last week that consumer price inflation could fall into negative figures in the months to come before it starts to pick up again.

For the current government coalition led by the Conservatives, the easing on the squeeze on households just before May’s general election is good news.

Source: Office for National Statistics.

Inflation at record low

According to the Office for National Statistics (ONS), the UK’s rate of inflation has fallen to its lowest level since records began in 1960.

“With the rate of inflation slowing, commentators are considering the possibility of deflation – where prices, overall, become cheaper than they were previously. While some prices (such as motor fuels and food) are lower than they were a year ago, others (such as clothing and furniture) are rising.”

The annual rate of “core inflation” – price rises excluding certain goods with volatile price movements such as energy, alcohol, tobacco and food – stood at 1.4% in January, i.e. 1.1 percentage points higher than overall inflation.

Non-core goods driving inflation

Most of the downward pressure on inflation in recent months has come from non-core inflation goods, notably motor fuel, energy and food prices.

Most bets are on the Bank of England not considering raising interest rates until 2016. Just a few months ago, analysts were predicting a rate hike in 2015.

While negative inflation could place the country at risk of falling into a deflationary cycle of declining prices and recession (stagflation), most economists believe Britain, with strong consumer spending and recent wage hikes, is in a stronger position than the Eurozone nations and Japan.

The ONS also informed today that prices at the factory gate declined by 1.8% in January compared to January 2014, the sharpest fall since 1997 (when records began).

Just in December, British manufacturers paid 20.2% less for crude oil compared to the previous month, the steepest decline since December 2008.

Mr. Carney insists the plummeting of crude oil prices is good for the British economy.