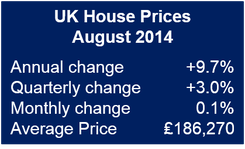

UK August house prices slowed down, rising by just 3% over the 3-month period to August compared to 3-months to May, says the Halifax House Price Index August 2014.

Annually, in the 3-months to August, property prices increased by 9.7%. Both the annual and quarterly increases were lower than July’s 10.2% and 3.5%.

Halifax housing economist, Martin Ellis, commented that housing demand is supported by the ongoing economic rebound, employment growth, strengthening consumer confidence and low mortgage rates. Many say it is also driven by a chronic housing shortage.

Earnings growth low, interest rate hike looms

Mr. Ellis added:

“Nonetheless, earnings growth that remains below consumer price inflation, and the prospect of an interest rate rise at some point over the coming months, are likely to curb demand.”

“There are some signs of an improvement in housing supply, both in terms of more second-hand properties coming onto the market and increased numbers of new homes. These trends, if sustained, should help to improve the balance between supply and demand, contributing to an easing in the pace of house price growth.

Below are some highlighted data from the Halifax House Price Index August 2014:

- Over a one-month period, house prices increased by just 0.1%,

- In the first eight months of 2014, monthly prices rose five times and fell three times (hence, quarterly calculations are more reliable indicators of price trends),

- Throughout 2014, the number of homes sold have remained between 101,000 and 104,000 units sold each month, with the exception of February (109,500),

- In July, the number of houses sold dropped to 101,190 (-1.3% decline), but over the 3-month period to July unit sales were 16% higher than during the same period in 2013,

- There are some tentative signs that a better balance between supply and demand may be emerging, which could help stabilize the pace of house price rises,

- There were slightly fewer buyers in July, the first drop in 20 months,

- The number of existing properties (second-hand homes) coming onto the market grew for the second month running,

- The number of new homes built in England grew by 6% between the 1st an 2nd quarters of this year, while the total for the 3-month period to June was 7% higher than during the same period in 2013. If the pace of new house-building is sustained, there will be a better balance between demand and supply. “There are, however, signs that material and labor shortages will constrain housebuilding activity, at least, in the short-term,” the authors wrote.

In late June, the Financial Policy Committee announced that lenders are to limit mortgage lending to 4.5 times income or 15% of their lending, and must test whether borrowers could afford their loans if interest rates were to go up by 3 percentage points during the first five years of the loan.

These measures are aimed at preventing a future accumulation of mortgage debt that has the potential to undermine financial stability, and should help temper house price growth over the medium- and long-term.

UK housing shortage costing buyers $4bn per year

The Confederation of British Industry (CBI) published a report – “Housing Britain – Building New Homes For Growth” – that found the housing shortage has created above-inflation house price increases, which is taking £3.2 billion in housing-related costs and £770 million in transport-related costs, i.e. a c. £4 billion bite out of consumer’s pockets annually.

This money could otherwise be spent in the wider economy or saved.

The housing shortage is holding millions of young people from getting onto the property ladder or renting a decent home, the report added.

CBI Deputy Director-General, Katja Hall, said:

“Housing is not just a social priority – it is a key business issue, We see the impact of too few homes being built not just on the front pages of our newspaper, but in the experience of our families, friends and colleagues.”

“Working people are being priced out of buying their first home and renters are not getting the quality they deserve for their money. Young people are living with their parents for longer because they cannot afford to get onto the housing ladder, and growing families are unable to buy the bigger homes they need.”

In May, Mark Carney, Governor of the Bank of England, said Canada builds twice as many houses as the UK does – and the UK has double the population.