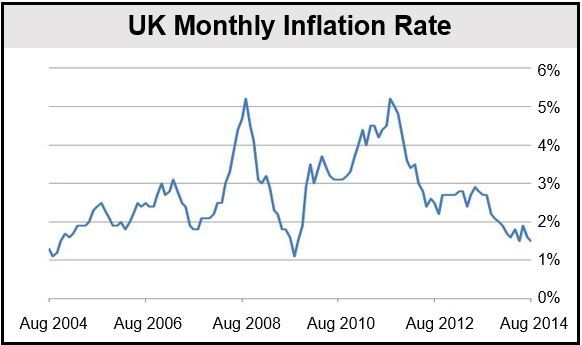

UK August inflation fell to 1.5% on an annual basis, from 1.6% in July, says the Office for National Statistics (ONS). Falling prices in non-alcoholic beverages, food and gasoline helped push down inflation. The decline was in line with what economists had expected.

Food and non-alcoholic drink prices dropped by -1.1%, the sharpest fall in over ten years.

The ONS wrote that the latest data continue the trend of inflation below the 2% target through this year. “Although there has been some volatility in the rate, fluctuating between 1.5% and 1.9% over recent months,” it added.

In order to achieve the 2% annual inflation goal, Mark Carney and colleagues at the Bank of England are likely to postpone considering raising interest rates.

In August, the Monetary Policy Committee of the Bank of England was split on interest rates for the first time since 2011.

Annual RPI (Retail Price Index) inflation also declined, from 2.4% in July to 2.5% in August.

Fierce competition among UK supermarket chains have driven down food and drink prices. Transport services, clothing, footwear and alcoholic-beverages, on the other hand, posted above-average increases.

Core inflation, which excludes energy, tobacco, alcoholic drinks and food, came in at 1.9%.

Factory gate prices also came in weak in August, the ONS reported, declining by 0.3% compared to August 2013. In the year to July, property prices increased by 11.7%, versus 10.2% in the year to June.

(Data source: Office for National Statistics)

In an interview with the BBC, Jeremy Cook, chief economist at World First, a currency exchange firm, said “For all the chatter, guesswork and prophecy around possible rate hikes in the UK, inflation is currently sat at a five-year low. Of course, the headline figure does not tell the full story. Core prices surprised higher by 1.9% in August; they were unaffected by the slips in oil prices or the 1.1% decline in food and booze through the past 12 months.”

British workers will welcome the weaker price increases. For the past few years wages have not kept up with inflation. However, even with August’s low 1.5% inflation rate, pay rises are still lower.

In the three-month period ending in June 2014, average wages increased by just 0.6% compared to the same period last year.

Three components set the pace

Since 2009, the three main contributors to the annual inflation rate have been:

- Gas & other fuels, electricity, and water,

- housing,

- restaurants & hotels, and transport (including vehicle fuels).

These three sectors combined have, on average, represented nearly half of the annual inflation rate each month.

Mr. Carney hinted last week that the benchmark rate may be increased in the first quarter of 2014. However, unless house prices start increasing too rapidly, most economists now are betting on interest rate hikes in the second half of next year.