UK construction activity accelerated in January after December’s low, according to Markit Economics. However, job creation fell to a 13-month **trough while construction companies’ assessment of business outlook deteriorated.

** Trough is the lowest point, on a graph it is between the declining line and rising line – the bottom of the ‘V’ shape.

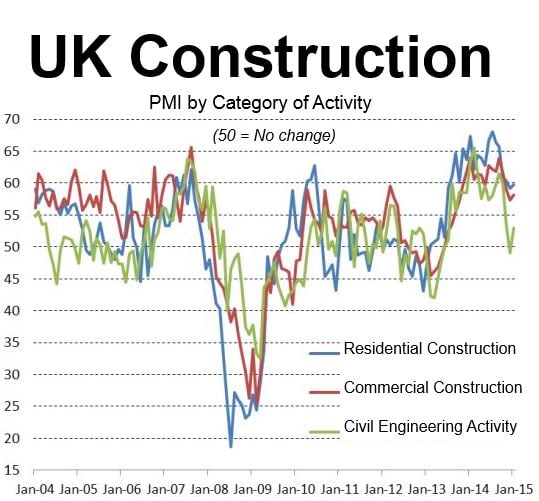

January’s Markit/CIPS UK Construction PMI (Purchasing Managers’ Index) was 59.1, compared to 57.6 in December.

Any reading above 50 indicates growing activity, while a reading below the 50-mark suggests contraction. January’s figure was the 21st successive month above the neutral 50. However, it was the second-lowest performance since September 2013.

So, while last month represented a rebound compared to December, it was much weaker than 2014’s average of 61.8.

Source: Markit Economics Limited.

While all three broad areas of construction – residential building, commercial construction and civil engineering – all picked up from December, in each case the rate of growth was weaker than their 2014 peaks.

In January, residential building performed best out of the three sub-categories, with January’s survey reporting two years of continuous growth.

Volumes of new work increased robustly in January – the fastest month-on-month upturn for three months.

Job creation weak in January

The rate of job creation, however, fell for the second successive month to its weakest since December 2013.

Several builders said softer new business gains in recent months contributed to their sluggish employment growth.

Supply-chain pressures, which were prevalent in December, persisted in January, as highlighted by a steep deterioration in vendor performance.

According to anecdotal evidence, strong demand for construction materials and spare capacity shortages among suppliers had contributed to longer delivery times at the beginning of this year.

Regarding sub-contractors, Markit Economics wrote:

“The availability of sub-contractors decreased sharply during January, while the latest rise in subcontractor charges was close to the survey-record high recorded in November 2014. Overall input cost inflation nonetheless eased to its weakest since April 2013, helped by falling energy and fuel prices.”

Nearly half of all companies in January’s survey forecast an increase in business activity over the next twelve months, with less than 10% predicting a reduction. Even so, the degree of business optimism was the second-lowest in 15 months, with some respondents citing growing uncertainty about the overall economic outlook.

Tim Moore, Senior Economist at Markit Economics, said:

“UK construction companies have found their feet again after a protracted slowdown in output growth at the end of 2014. Stronger trends were recorded across housing, commercial and civil engineering, although each category of activity still experienced much slower growth than the high-water marks achieved last year.”

“In short, the peak speed of the construction recovery seems to be over, but reports of its death have been greatly exaggerated.”

“Expectations in relation to output growth over the next 12 months remained close to December’s low, contributing to a further slowdown in construction sector job creation during January. However, skill shortages persisted at the start of the year, with construction companies indicating that subcontractor charges increased at a near survey record pace.”

“Strong demand for construction materials resulted in upward pressure on costs and lengthening delivery times from suppliers in January. That said, the latest survey highlighted that lower fuel and energy prices helped drive down overall cost inflation to its lowest for just under two years.”