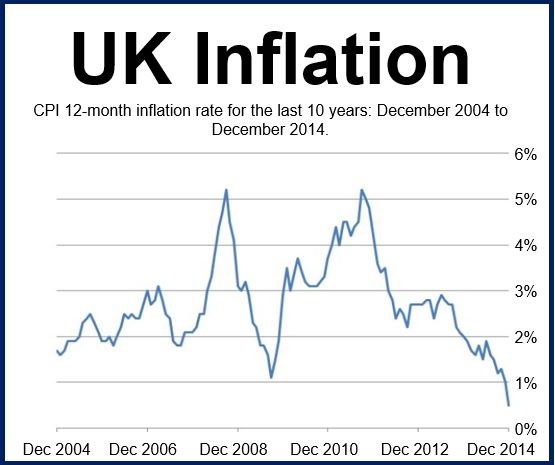

UK inflation in December halved to 0.5% (annualized) from 1% in November. Consumer price inflation fell to its lowest level in nearly 15 years (May 2000). The result, published by the Office for National Statistics (ONS) on Tuesday, makes it much less likely that the Bank of England will consider raising interest rates this year.

This is welcome news for consumers, whose wages have failed to keep up with inflation for the past four years.

“The rate of inflation faced by households is at the joint lowest level since records began in 1996. The Consumer Prices Index, which measures changes in the prices of the goods and services bought by households, increased by 0.5% in the year to December 2014, down from 1.0% in the year to November. The CPI was previously 0.5% in May 2000.”

Source: “Consumer Price Inflation, December 2014,” Office for National Statistics.

The main contributors to the inflation slowdown came from prices of electricity and natural gas. While most utility companies increased their prices in December 2013, none of them did so in December 2014.

The prices of petrol (gasoline) and diesel at filling stations continue to fall, which also contributed to the lower rate of inflation.

Compared to their peak prices in April 2012, petrol and diesel prices are now nearly 25p lower. With the price of Brent Crude and West Texas Intermediate dropping to their lowest levels in almost six years today, falling petrol and diesel prices look likely to continue this year.

While the Consumer Price Index fell, there was some upward pressure on alcohol prices – notably spirits and wine. In the run up to Christmas, prices of alcohol tend to fall. In 2014, most of the fall came in November, thus the ensuing December decline was smaller than usual.

Prices of goods declined by 1% in the year to December 2014, while those for services rose by 2.3%.

Mark Carney, the Governor of the Bank of England, who said in December that declining oil prices were an “unambiguously net positive” for the UK economy, will need to explain formally to Chancellor George Osborne in February why the annual inflation rate has veered by more than one percentage point from the 2% target.

Mr. Carney predicts that inflation will reach the central bank’s target towards the end of 2017.

A fierce supermarket war has pushed food prices down over the past few months. In December, food prices were 1.9% down compared to December 2013, the steepest fall since June 2002.