The UK economic forecast for 2014 by the Confederation of British Industry (CBI) has increased to 2.6% GDP (gross domestic product) growth for the year, after receiving better-than-expected Q4 2013 growth figures, annualized at 1.9%.

If 2.6% GDP growth is achieved in 2014, it will be the best performance since 2007, the CBI adds.

In its UK economic forecast, the CBI wrote:

“The UK economy now seems more firmly on the road to recovery and we forecast growth of 2.6% in 2014 and 2.5% in 2015.”

“We expect increasing support to growth from business investment over the next two years, and small contributions to growth from net trade.”

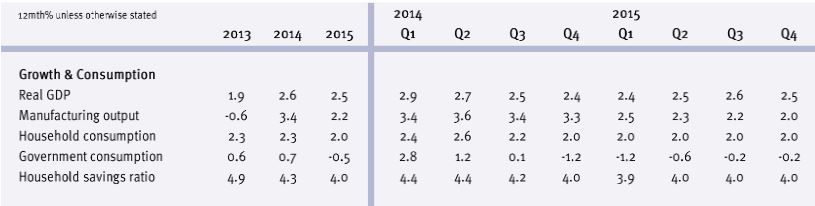

The data below is from the CBI UK economic forecast:

Risks to growth

However, the authors also added that there are still risks that could affect outcomes.

- The Eurozone has a long way to go before it is fully resolved

- Emerging markets have slowed down and are showing signs of volatility

- The tapering of the Fed’s stimulus program poses a risk to the stability of financial markets.

CPI inflation

In December 2013, consumer price index (CPI) inflation reached 2% for the first time in four years, partly reflecting base effects as 2013’s increase in food prices dropped out of the comparison, and compared to gasoline prices in 2012, fell back at a faster rate .

The CBI predicts that CPI inflation will go further down in the short term, before nearing 2% again in 2014, “with underlying inflationary pressures remaining soft.”

The Bank of England’s Monetary Policy Committee says the present benchmark interest rates can remain where it is for a considerable period without the risk of inflationary pressure building.

Even though the unemployment rate is expected to fall below the 7%, which the Bank of England sees as a prompt for raising interest rates, the CBI now assumes that the central bank rate will stay on hold for the whole of 2014, “reflecting the degree of spare capacity in the labor market and broader economy.”

Household spending and income

Personal spending (household spending) has been a major driver in boosting economic growth in 2013, with spending on durable goods, especially automobiles, strengthening significantly.

As real household disposable income has had weak growth over the last few years, higher personal spending has been accompanied by a drop in the saving ration which stood at 5.4% in Q3 2013, down from its recent peak of 8.6% in 2009.

Increased consumer spending reflects improvements in consumer confidence, which reduces people’s instinct to save more, as well as better credit availability.

The CBI sees a slowing down in consumer spending in 2014, with increased productivity and real wages boosting spending later on in 2015.

Investment

According to CBI business surveys, businesses have been reluctant to invest because of demand uncertainty. A recent survey suggests that demand uncertainty has started to diminish while investment intentions have improved, “with financial and service sector firms expecting to increase investment across all categories in investment in the year ahead.”

Information Technology (IT) is expected to see that greatest increase in investment. All current studies indicate that business spending will gradually begin to rise in the near term.

With demand uncertainty diminishing, investment is expected to grow.

However, despite better corporate cash balances, diminished demand uncertainty, and other positive signs, the CBI does not expect business investment to return to its pre-crisis peak over its forecast horizon.

UK trade

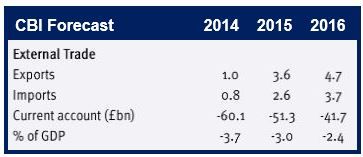

In Q3 2013 exports fell by 3%, after rising by 3.3% in Q2, i.e. trade data for 2013 has been “volatile”. A CBI survey found that sentiment about export prospects for 2014 has improved.

The CBI believes UK export performance will strengthen over the next few years, as economic growth globally picks up.

However, the Eurozone’s slow recovery will probably act as a restraint on British export growth.

Signs of right kind of growth

CBI Director-General, John Cridland, said:

“We are starting to see signs of the right kind of growth. In our view this is not a debt-fuelled, housing bubble-led recovery – our forecast shows encouraging signs that business investment and net trade are starting to play their part.”

“More businesses are feeling inclined to invest in new technology and advertising. We can also expect to see more companies coming to market to raise finance and an uptick in merger and acquisitions activity as animal spirits return.”

“But there is no doubt that business leaders are concerned about political uncertainty as we enter a lengthy election campaign. This could be a real mood killer when business leaders are faced with making big investment decisions in the months ahead.”