The UK economy is forecast to suffer a significant slowdown in growth after a robust second quarter following its decision to vote in favour of a Brexit, warns the National Institute of Economic and Social Research (NIESR).

NIESR expects the UK economy to be around 2.5% smaller 2 years after its decision to leave the EU when compared to the counterfactual remaining in the political union.

The result of the EU referendum has created a heightened feeling of uncertainty for many UK businesses and consumers.

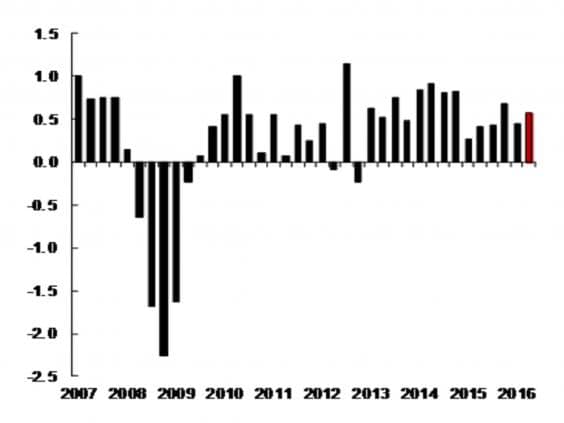

The British economy grew 0.6 percent in the second quarter of 2016, up from a 0.4 percent expansion in the first quarter, NIESR said.

However, the think tank said that the increase was mainly due to a surge in activity in April, while GDP likely stagnated the following month and contracted in June.

Jack Meaning, Research Fellow at NIESR said:

“At first glance this represents a robust rate of quarterly growth for the UK economy. However, the quarterly figure masks an important within-quarter pattern.

Our monthly estimates suggest that April saw a large expansion in GDP, which then stagnated in May. The estimate for June is one of an intensifying contraction across the board, but this is not enough to offset the very strong April numbers.

What it does suggest is that when April drops out of the 3 month calculation we should see a quick deterioration of growth, especially if the estimated contraction in June persists or accelerates into July and beyond.”

Monetary stimulus and a lower capital buffer rate – efforts by the Bank of England to mitigate damage to the economy

The UK central bank has already said that it expects to pump more monetary stimulus into Britain’s economy over the next few months.

The BoE also recently announced that the Financial Policy Committee lowered the UK countercyclical capital buffer rate from 0.5% to 0% of banks’ UK exposures, freeing up £150 billion for lending.

Businesses are more pessimistic about the UK economic outlook following Brexit vote

According to YouGov and the Centre for Economics and Business Research, the number of British businesses feeling pessimistic about the British economy doubled in the week after the referendum vote.