Britain could suffer from a “severe loss of momentum” following the vote to leave the European Union, a prominent think tank has said.

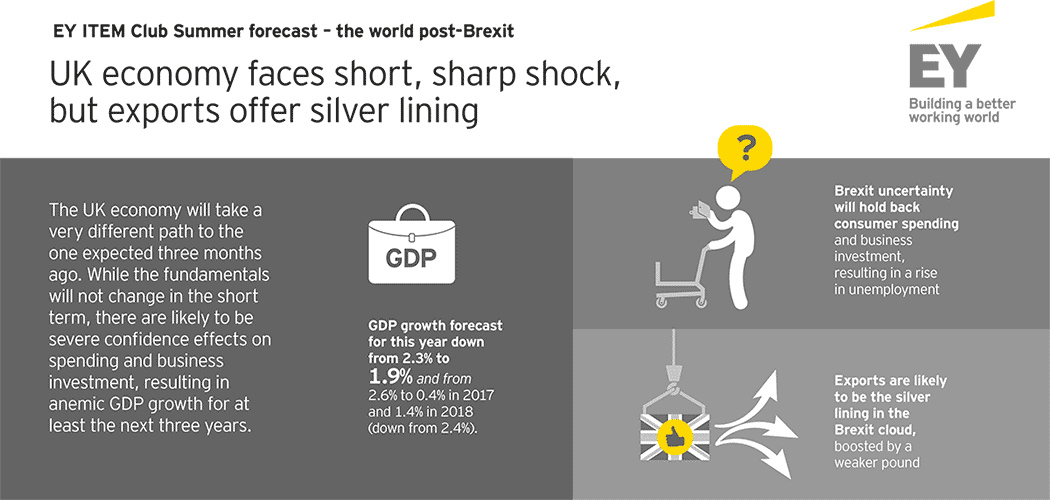

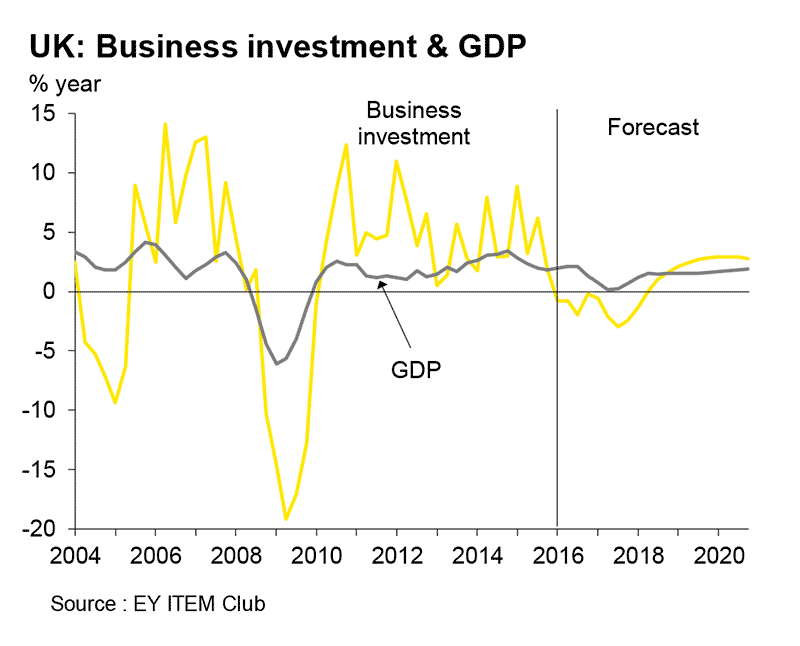

EY Item Club reduced its UK growth forecast for fiscal 2016 down to 1.9% from 2.3%, cut its growth forecast for 2017 down to only 0.4% from 2.6% and slashed its 2018 GDP growth forecast down to 1.4% from 2.4%.

The think tank said in a report that the vote to leave the EU would have “severe confidence effects on spending and business investment”, which may result in lacklustre GDP growth over the next few years.

It expects the downward pressure on the exchange rate to persist, “leaving the sterling exchange rate index in the last quarter of this year down 15% on a year earlier.”

Inflation is expected to be kept under control by the weakness of the company and the think tank expects the Monetary Policy Committee to have cut base rates from 0.5% to zero by the end of the year, with an average CPI inflation rate of 2.5% next year.

Peter Spencer, chief economic advisor to the EY Item Club, said:

“Heightened uncertainty is likely to hold back business investment, while consumer spending will be restrained by a weaker jobs market and higher inflation.

“Longer-term, the UK may have to adjust to a permanent reduction in the size of the economy, compared to the trend that seemed possible prior to the vote. But amongst the gloom, the weaker pound provides one silver lining to exporters, particularly those selling to the US and emerging markets.”

Steve Varley, Chairman and Managing Partner EY UK, said:

“Undoubtedly the next couple of years will be challenging for the UK economy. The UK government will need to quickly introduce measures to help offset Brexit blues, support the economy and continue to attract foreign investment.

“While investors value the UK’s access to the single market, we shouldn’t lose sight that they also rate the UK’s quality of life, diversity and culture, education, stability of social climate, telecommunications, and labour skills highly. These underlying fundamentals have not changed.

“The focus now needs to be on making sure that the UK negotiates the right trade deals that will allow access to key markets. There are numerous opportunities for the economy to remain not only open for business but also attractive, competitive and connected. As the world’s fifth largest economy, the UK will continue to be an integral piece of the global jigsaw.”

A survey by Deloitte of Britain’s largest companies, conducted between 28 June and 11 July, revealed that 82% of chief financial officers expect to cut capital spending over the next year, more than double the 34% recorded in the first quarter.

Ian Stewart, Deloitte’s chief economist, said: “Perceptions of uncertainty have soared to levels last associated with the euro crisis five years ago.”

Brexit vote “horrible for the economy”, says fund manager

Richard Buxton, chief executive of Old Mutual Global Investors, told the Guardian that the Brexit vote could have a “horrible” impact on the UK economy, which could “judder to a halt”.

“I think the economy is going to judder to a halt [or] have a mild recession, but I don’t think it is going to be as severe as some of these shares are pricing in… The real economy is only going to gradually emerge over the next three to six months,” he said.