The employment rate in the United Kingdom reached a new record high in the 3 months ending December 2016. Meanwhile, rising prices have eroded real earnings growth to the lowest it has been in nearly 2 years, says the Office for National Statistics (ONS).

The latest figures from the ONS show that the number of people employed in the UK continued to grow in the final quarter of 2016. It increased by 37,000 over the quarter to 31.84 million – 302,000 more than a year earlier.

Although UK employment rate has hit record high, real earnings growth remains subdued, says the ONS.

Although UK employment rate has hit record high, real earnings growth remains subdued, says the ONS.

The UK employment rate (proportion of people aged 16-64 years in work) reached 74.6 percent, the highest level since comparable records began in 1971, says the ONS.

Also, at 1.6 million, the number of unemployed in the UK (people not in work but seeking and ready to work) remained much the same as the previous quarter, although this is 97,000 lower than a year earlier.

Down 0.3 percent from a year earlier, the unemployment rate finished 2016 at 4.8 percent – the lowest it has been since the third quarter of 2005. This figure reflects the jobless proportion of the labour force, which comprises those in work plus those seeking and available for work but not in work.

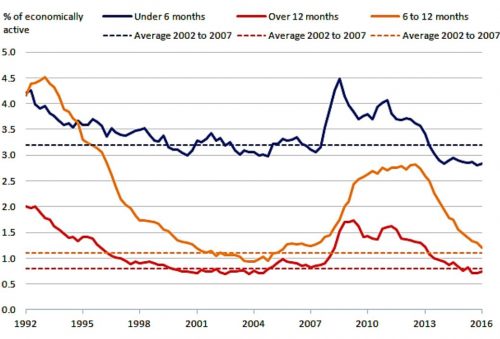

The unemployment rate is the lowest it has been since 2005. This graph from the ONS shows unemployment as a proportion of economically active people, by duration, seasonally adjusted from Q4 1992 to Q4 2016.

The unemployment rate is the lowest it has been since 2005. This graph from the ONS shows unemployment as a proportion of economically active people, by duration, seasonally adjusted from Q4 1992 to Q4 2016.

The ONS figures also show a decrease in economically inactive people – the number of people aged 16-64 not working and not seeking or available for work. This fell to 8.86 million people over the final quarter of 2016 – down by 31,000 on the previous quarter and 61,000 fewer than a year earlier.

The inactivity rate, however, remained rather flat. 21.6 percent of people aged 16-64 years were economically inactive during October-December 2016, only slightly less than in the previous quarter (21.7 percent) and lower than the same time the previous year (21.8 percent).

Meanwhile, the number of job vacancies also remained largely flat, falling by 9,000 from the previous quarter to finish the 3 months ending in January 2017 at 751,000. This is some 13,000 fewer than a year earlier.

Is UK labour market edging toward full capacity?

In comments accompanying the figures, the ONS notes that they would suggest the UK labour market is edging towards “full capacity.”

However, other figures from the ONS also reveal that real pay growth fell to 1.4 percent in December 2016 – the lowest it has been since January 2015, and the ONS comments that:

“The unemployment rate is now at its lowest in over a decade but wage growth remains subdued by historical standards, raising questions about the degree of spare capacity in the UK’s labour market.”

The ONS also examines a range of measures that might be used to judge the degree of spare capacity and concludes they raise questions about structural changes in the UK labour market.

Several variables relating to part-time work show how the pattern of UK employment is shifting, for example:

– the proportion of UK employment comprising part-time workers is rising

– there is a persistent and increasing pool of part-time workers who cannot find full-time work

– the underemployment rate at 8.1 percent remains higher than its pre-crisis average of 6.7 percent

Underemployment reflects potential spare capacity in the employed workforce – it is the percentage of employees who are available and want to work more hours.

The ONS says the picture these variables portray about UK employment “suggests that there may be resources in the labour market that firms can mobilize to increase output.”

Too early to see Brexit effects?

Nigel Meager, director of the Institute for Employment Studies, says the ONS figures show that the “anticipated employer nervousness about Brexit has yet to show up.”

He says the UK labour market appears to have been almost “entirely resilient to any uncertainty following the referendum vote,” and if anything, it has received a short term boost – especially given the fall in Sterling.

However, he says it is too early to conclude there will be no substantive impact as rules concerning migration, trade, and employment regulation become clearer in the run-up to Brexit.

Rachel Smith, principal labour market economist at the CBI says the fact pay growth “remains stubbornly sluggish” is a cause for concern with inflation rising.